1666 Hidden Valley Rd Thousand Oaks, CA 91361

Estimated Value: $20,938,072

--

Bed

--

Bath

--

Sq Ft

26.29

Acres

About This Home

This home is located at 1666 Hidden Valley Rd, Thousand Oaks, CA 91361 and is currently estimated at $20,938,072. 1666 Hidden Valley Rd is a home located in Ventura County with nearby schools including Westlake Elementary School, Colina Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 9, 2013

Sold by

The Toucan Trust

Bought by

Karlin Michael and The Y Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,150,000

Outstanding Balance

$4,258,331

Interest Rate

2.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$16,679,741

Purchase Details

Closed on

Feb 25, 2013

Sold by

Salick Bernard and Salick Gloria

Bought by

Salick Bernard

Purchase Details

Closed on

May 26, 2009

Sold by

Sandstone Horse Sales Llc

Bought by

Neuman Harley J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Karlin Michael | $10,850,000 | Equity Title Company | |

| Salick Bernard | -- | None Available | |

| Salick Bernard | -- | None Available | |

| Neuman Harley J | -- | Equity Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Karlin Michael | $6,150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $66,631 | $6,386,200 | $4,653,400 | $1,732,800 |

| 2024 | $66,631 | $6,386,200 | $4,653,400 | $1,732,800 |

| 2023 | $66,484 | $6,386,200 | $4,653,400 | $1,732,800 |

| 2022 | $66,675 | $6,386,200 | $4,653,400 | $1,732,800 |

| 2021 | $66,911 | $6,386,200 | $4,653,400 | $1,732,800 |

| 2020 | $65,838 | $6,300,000 | $4,567,200 | $1,732,800 |

| 2019 | $120,627 | $11,630,330 | $10,299,164 | $1,331,166 |

| 2018 | $118,217 | $11,402,285 | $10,097,220 | $1,305,065 |

| 2017 | $115,934 | $11,178,712 | $9,899,236 | $1,279,476 |

| 2016 | $114,878 | $10,959,523 | $9,705,134 | $1,254,389 |

| 2015 | $111,707 | $10,684,289 | $9,559,354 | $1,124,935 |

| 2014 | $110,117 | $10,475,000 | $9,372,100 | $1,102,900 |

Source: Public Records

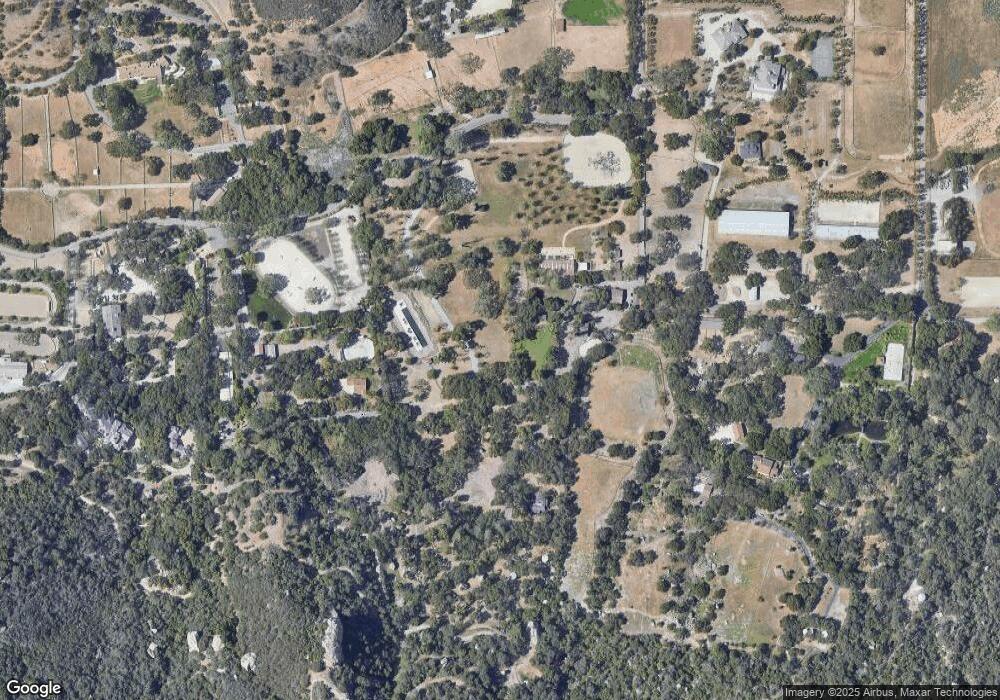

Map

Nearby Homes

- 2400 W Potrero Rd

- 2200 White Stallion Rd

- 1697 W Potrero Rd

- 2928 Cottonwood Ct

- 3184 Holloway Ct

- 947 Bearclaw Ct

- 872 La Grange Ave

- 650 S Ventu Park Rd

- 884 Boxthorn Ave

- 2775 Edgeview Ct

- 3738 Danmont Ct

- 779 La Grange Ave

- 265 W Kelly Rd

- 2219 Mapleleaf Ave

- 1995 Rudolph Dr

- 1124 Kathleen Dr

- 1826 Crystal View Cir

- 3964 Greenwood St

- 0 Rudolph Dr Unit 225005175

- 0 Rudolph Dr Lots 80 81

- 1666 Hidden Valley Rd

- 1644 Hidden Valley Rd

- 1688 Hidden Valley Rd

- 1688 Hidden Valley Rd

- 1516 Hidden Valley

- 1516 Hidden Valley Rd

- 1753 Hidden Valley Rd

- 1753 Hidden Valley Rd

- 1430 Hidden Valley Rd Unit Lot A

- 1430 Hidden Valley Rd

- 0 0 Hidden Valley Rd

- 1761 Hidden Valley Rd

- 1750 Hidden Valley Rd

- 1464 Hidden Valley Rd

- 1321 Hidden Valley Rd

- 1200 Hidden Valley Rd

- 1151 Hidden Valley Rd

- 2700 W Potrero Rd

- 2830 W Potrero Rd

- 2920 W Potrero Rd