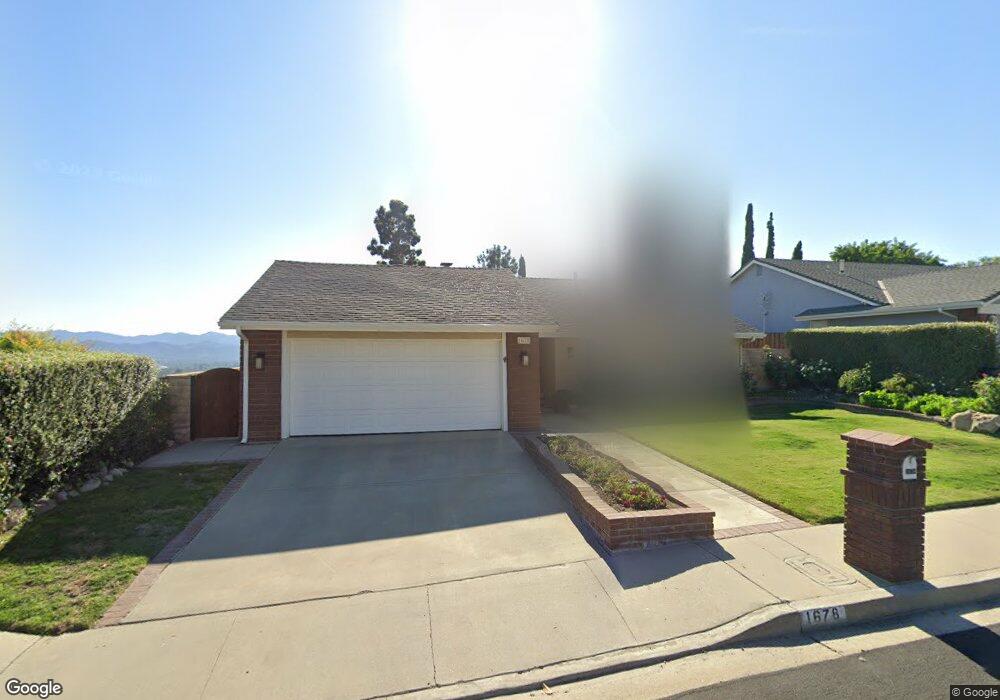

1678 Eveningside Dr Thousand Oaks, CA 91362

Estimated Value: $932,487 - $1,201,000

3

Beds

2

Baths

1,486

Sq Ft

$712/Sq Ft

Est. Value

About This Home

This home is located at 1678 Eveningside Dr, Thousand Oaks, CA 91362 and is currently estimated at $1,057,622, approximately $711 per square foot. 1678 Eveningside Dr is a home located in Ventura County with nearby schools including Ladera Stars Academy, Los Cerritos Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2021

Sold by

Hartman Trudy

Bought by

Hartman Trudy and The Trudy Hartman Revocable Tr

Current Estimated Value

Purchase Details

Closed on

Apr 18, 2016

Sold by

Hartman Bruce A

Bought by

Hartman Trudy

Purchase Details

Closed on

Sep 18, 2012

Sold by

Hayes Gordon R

Bought by

Hartman Bruce A and Hartman Trudy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$207,098

Interest Rate

3.52%

Mortgage Type

New Conventional

Estimated Equity

$850,524

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hartman Trudy | -- | None Available | |

| Hartman Trudy | -- | None Available | |

| Hartman Bruce A | $600,000 | Equity Title Los Angeles |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hartman Bruce A | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,070 | $642,597 | $257,033 | $385,564 |

| 2024 | $7,070 | $629,998 | $251,994 | $378,004 |

| 2023 | $6,861 | $617,646 | $247,053 | $370,593 |

| 2022 | $6,739 | $605,536 | $242,209 | $363,327 |

| 2021 | $6,697 | $593,663 | $237,460 | $356,203 |

| 2020 | $6,256 | $587,577 | $235,026 | $352,551 |

| 2019 | $6,092 | $576,057 | $230,418 | $345,639 |

| 2018 | $5,970 | $564,762 | $225,900 | $338,862 |

| 2017 | $5,855 | $553,689 | $221,471 | $332,218 |

| 2016 | $5,801 | $542,833 | $217,129 | $325,704 |

| 2015 | $5,700 | $534,680 | $213,868 | $320,812 |

| 2014 | $5,619 | $524,209 | $209,680 | $314,529 |

Source: Public Records

Map

Nearby Homes

- 2868 Amber Wood Place

- 2809 Shelter Wood Ct

- 3128 Casino Dr

- 2972 Morningside Dr

- 2749 Amber Wood Place

- 2965 Dogwood Cir

- 3011 Marigold Place

- 3063 Marigold Place Unit A

- 2162 Shady Brook Dr

- 1764 Shady Brook Dr

- 2596 Rikkard Dr

- 1322 E Avenida de Los Arboles

- 2906 Evesham Ave

- 1450 Corte de Primavera

- 2241 Olivewood Dr

- 2252 Northpark St

- 2848 Bayham Cir

- 3957 Corte Cancion

- 3249 Springbrook St

- 1791 E Avenida de Las Flores

- 1672 Eveningside Dr

- 1684 Eveningside Dr

- 1666 Eveningside Dr

- 1689 Alderwood Place

- 1697 Alderwood Place

- 1681 Alderwood Place

- 1705 Alderwood Place

- 1677 Eveningside Dr

- 1673 Alderwood Place

- 1689 Eveningside Dr

- 1660 Eveningside Dr

- 1683 Eveningside Dr

- 1671 Eveningside Dr

- 1719 Alderwood Place

- 1665 Eveningside Dr

- 1663 Alderwood Place

- 1654 Eveningside Dr

- 1716 Summer Cloud Dr

- 1715 Summer Cloud Dr

- 1653 Alderwood Place