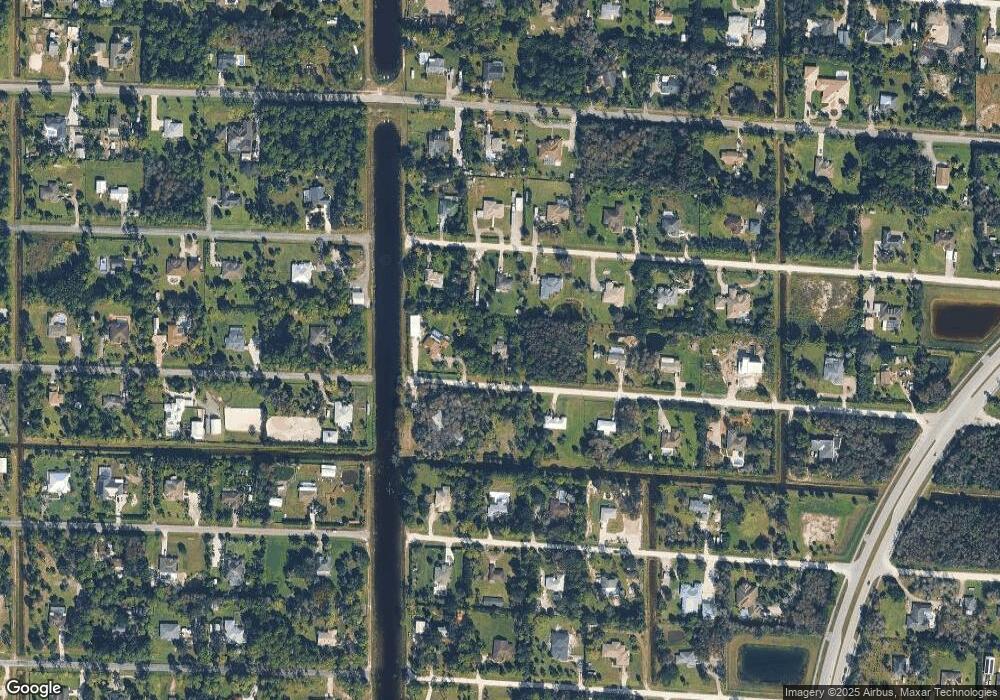

16875 63rd Rd N Unit N Loxahatchee, FL 33470

Estimated Value: $548,236 - $642,000

3

Beds

2

Baths

1,500

Sq Ft

$406/Sq Ft

Est. Value

About This Home

This home is located at 16875 63rd Rd N Unit N, Loxahatchee, FL 33470 and is currently estimated at $608,309, approximately $405 per square foot. 16875 63rd Rd N Unit N is a home located in Palm Beach County with nearby schools including Frontier Elementary School, Osceola Creek Middle School, and Seminole Ridge Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2022

Sold by

Zepeda and Bobbi

Bought by

Klein Justin

Current Estimated Value

Purchase Details

Closed on

Jun 8, 2020

Sold by

Fleming Christopher and Fleming Kristina

Bought by

Zepeda Juan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$342,705

Interest Rate

3.2%

Mortgage Type

VA

Purchase Details

Closed on

Nov 18, 2019

Sold by

Fleming Kristina and Fleming Christopher

Bought by

Fleming Christopher and Fleming Kristina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

3.6%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jun 22, 2012

Sold by

Higginbotham Paul and Higginbotham Lana

Bought by

Caruso Kristina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,750

Interest Rate

3.83%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 12, 1997

Sold by

Desena Henry A and Desena Stella C

Bought by

Higginbotham Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$14,619

Interest Rate

7.98%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Klein Justin | $525,000 | Zing Title | |

| Zepeda Juan | $335,000 | Florida Title Advisors Inc | |

| Fleming Christopher | -- | Attorney | |

| Caruso Kristina | $145,000 | None Available | |

| Higginbotham Paul | $16,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Zepeda Juan | $342,705 | |

| Previous Owner | Fleming Christopher | $164,000 | |

| Previous Owner | Caruso Kristina | $137,750 | |

| Previous Owner | Higginbotham Paul | $5,000 | |

| Previous Owner | Higginbotham Paul | $14,619 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,096 | $444,495 | -- | -- |

| 2024 | $8,096 | $432,801 | -- | -- |

| 2023 | $8,659 | $424,684 | $136,800 | $287,884 |

| 2022 | $4,937 | $244,074 | $0 | $0 |

| 2021 | $4,689 | $236,965 | $0 | $0 |

| 2020 | $2,609 | $120,480 | $0 | $0 |

| 2019 | $2,586 | $117,771 | $0 | $0 |

| 2018 | $2,402 | $115,575 | $0 | $0 |

| 2017 | $2,241 | $112,463 | $0 | $0 |

| 2016 | $2,249 | $110,150 | $0 | $0 |

| 2015 | $2,247 | $109,384 | $0 | $0 |

| 2014 | $2,222 | $108,516 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 16911 Tangerine Blvd

- 17038 61st Place N

- 17181 61st Place N

- 16645 66th Ct N

- 8601 Seminole Pratt Whitney Rd

- 16875 68th St N

- 16799 69th St N

- 16570 Orange Blvd

- 16575 Orange Blvd

- 17563 67th Ct N

- 17315 Orange Blvd

- 16380 Orange Blvd

- 17477 69th St N

- 5975 Kingfisher Blvd

- 17853 60

- 17889 62nd Rd N

- 17436 71st Ln N

- 17812 68th St N

- 16053 Rain Lilly Way

- 0 Orange Blvd Unit R11130992

- 16875 63rd Rd N

- 16915 63rd Rd N

- 16874 64th Place N

- 16838 64th Place N

- 17180 63rd Rd N

- 17428 63rd Rd N

- 16914 63rd Rd N

- 16836 63rd Rd N

- 16912 64th Place N

- 16795 63rd Rd N

- 16802 64th Place N

- 16873 64th Place N

- 16796 63rd Rd N

- 16837 64th Place N

- 16873 63rd Rd N

- 16915 64th Place N

- 16915 62nd Rd N

- 16835 62nd Rd N

- 17043 63rd Rd N

- 16801 64th Place N