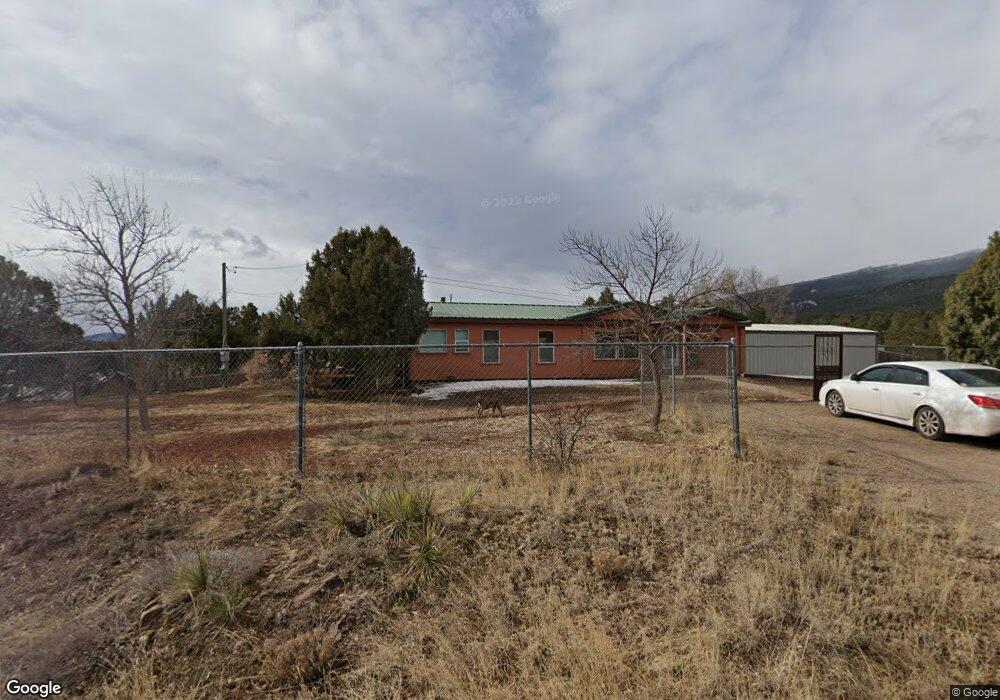

17 Corte de Canoncito Cedar Crest, NM 87008

Estimated Value: $378,476 - $429,000

3

Beds

2

Baths

1,596

Sq Ft

$254/Sq Ft

Est. Value

About This Home

This home is located at 17 Corte de Canoncito, Cedar Crest, NM 87008 and is currently estimated at $405,369, approximately $253 per square foot. 17 Corte de Canoncito is a home located in Bernalillo County with nearby schools including San Antonito Elementary School, Roosevelt Middle School, and Manzano High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2019

Sold by

Ousley D Hal and Ousley Lynnette R

Bought by

Butler Michal and Butler Shelly

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,150

Outstanding Balance

$163,960

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$241,409

Purchase Details

Closed on

Sep 20, 2007

Sold by

Willis Jimmie D and Janet Willis K

Bought by

Ousley D Hal and Ousley Lynnette R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 18, 2000

Sold by

Willis Kelly W and Willis Stephanie K

Bought by

Willis Jim D and Janet Willis K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Butler Michal | -- | Fidelity National Ttl Ins Co | |

| Ousley D Hal | -- | First American Title Ins Co | |

| Willis Jim D | -- | Southwestern Title & Escrow |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Butler Michal | $187,150 | |

| Previous Owner | Ousley D Hal | $175,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,530 | $50,495 | $11,599 | $38,896 |

| 2024 | $1,950 | $64,573 | $12,674 | $51,899 |

| 2023 | $1,920 | $62,693 | $12,305 | $50,388 |

| 2022 | $1,855 | $60,867 | $11,947 | $48,920 |

| 2021 | $1,793 | $59,094 | $11,599 | $47,495 |

| 2020 | $1,817 | $59,094 | $11,599 | $47,495 |

| 2019 | $1,351 | $43,929 | $11,599 | $32,330 |

| 2018 | $1,344 | $43,929 | $11,599 | $32,330 |

| 2017 | $1,313 | $44,029 | $11,599 | $32,430 |

| 2016 | $1,309 | $44,529 | $11,599 | $32,930 |

| 2015 | $44,482 | $44,482 | $14,740 | $29,742 |

| 2014 | $1,302 | $43,186 | $14,311 | $28,875 |

| 2013 | -- | $41,929 | $13,894 | $28,035 |

Source: Public Records

Map

Nearby Homes

- 7 Corte de Canoncito

- 10 Francisco Rd

- 31 & 37 Bilotto Dr

- 0 N 14 Hwy Unit 1096048

- 76 Canoncito

- 0 Melcor de Canoncito Unit 1098582

- 143 Sangre de Cristo

- 10 Vera Cruz

- 5 Sycamore Dr

- 12141 New Mexico 14

- 50 54 56 Juniper Hill Loop

- 27 Sycamore Dr

- 78 Sangre de Cristo

- 2 Cedar Hill Place

- 14 & 18 Aspen Loop

- 4 Juniper Ct NE

- 3 Oak Place

- 5 Pine Tree Ct

- 13 Pinon Ave

- 121 Rincon Loop Rd

- 13 Corte de Canoncito

- 16 Corte de Canoncito

- 18 Corte de Canoncito

- 14 Corte de Canoncito

- 19 Corte de Canoncito

- 22 Corte de Canoncito

- 4 Corte de Canoncito

- 9 Corte de Canoncito

- 23 Corte de Canoncito

- 24 Corte de Canoncito

- 3 Corte de Canoncito

- 3 Kennedy

- 15 Kennedy

- 5 Corte de Canoncito

- 29 Corte de Canoncito

- 5 Francisco Rd

- 28 Corte de Canoncito

- 21 Kennedy

- 6 Francisco Rd

- 8 Kennedy

Your Personal Tour Guide

Ask me questions while you tour the home.