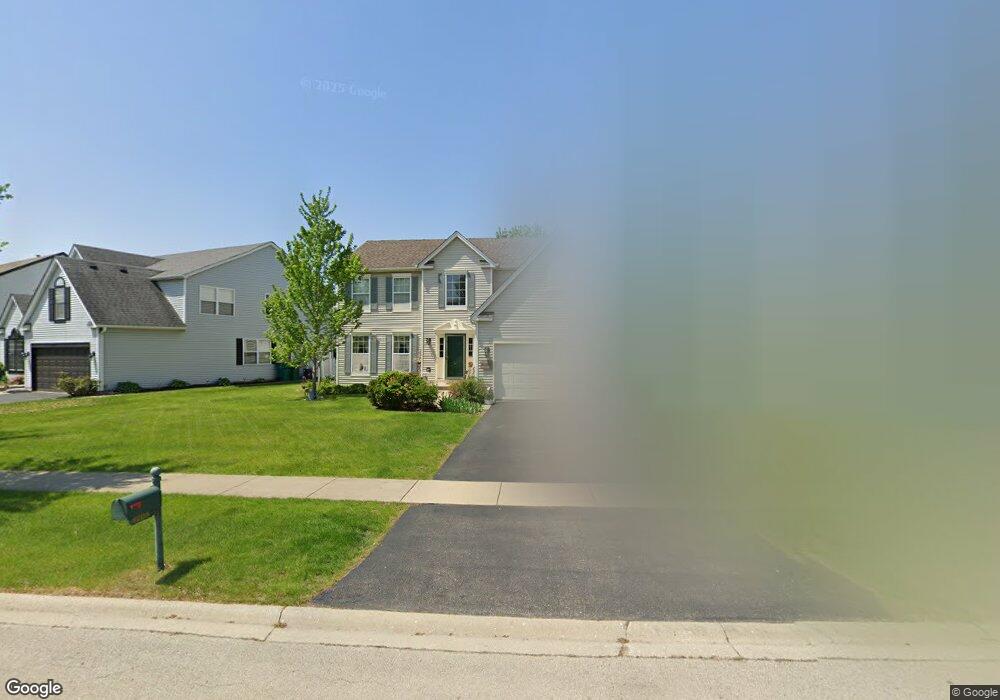

1701 Grand Highlands Dr Unit 2B Plainfield, IL 60586

Fall Creek NeighborhoodEstimated Value: $394,939 - $421,000

--

Bed

1

Bath

2,430

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 1701 Grand Highlands Dr Unit 2B, Plainfield, IL 60586 and is currently estimated at $411,235, approximately $169 per square foot. 1701 Grand Highlands Dr Unit 2B is a home located in Will County with nearby schools including Wesmere Elementary School, Drauden Point Middle School, and Plainfield South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2002

Sold by

Barber Paul R

Bought by

Iovino Mark A and Iovino Melissa E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,000

Outstanding Balance

$63,762

Interest Rate

6.93%

Estimated Equity

$347,473

Purchase Details

Closed on

Nov 14, 2001

Sold by

Barber Paula L

Bought by

Barber Paul R

Purchase Details

Closed on

Feb 28, 2000

Sold by

Neumann Homes Inc

Bought by

Barber Paul R and Barber Paula L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,350

Interest Rate

8.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Iovino Mark A | $211,000 | -- | |

| Barber Paul R | -- | -- | |

| Barber Paul R | $185,500 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Iovino Mark A | $151,000 | |

| Previous Owner | Barber Paul R | $148,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,311 | $124,047 | $22,816 | $101,231 |

| 2023 | $8,311 | $112,037 | $20,607 | $91,430 |

| 2022 | $7,954 | $100,624 | $18,508 | $82,116 |

| 2021 | $7,046 | $94,041 | $17,297 | $76,744 |

| 2020 | $6,941 | $91,373 | $16,806 | $74,567 |

| 2019 | $6,699 | $87,063 | $16,013 | $71,050 |

| 2018 | $6,413 | $81,801 | $15,045 | $66,756 |

| 2017 | $6,222 | $77,735 | $14,297 | $63,438 |

| 2016 | $6,097 | $74,140 | $13,636 | $60,504 |

| 2015 | $5,690 | $69,452 | $12,774 | $56,678 |

| 2014 | $5,690 | $67,000 | $12,323 | $54,677 |

| 2013 | $5,690 | $67,000 | $12,323 | $54,677 |

Source: Public Records

Map

Nearby Homes

- 1891 Westmore Grove Dr

- 1504 Lasser Dr

- 1905 Chestnut Grove Dr Unit 1

- 1910 Arbor Fields Dr

- 5302 Meadowbrook St

- 1314 Martin Ct Unit 2

- 0 Theodore St

- 2045 Winding Lakes Dr

- 1715 Pembrook Ct

- 5214 Riviera Blvd

- 1707 Chestnut Hill Rd

- 2108 Brookshire Estates Ct Unit 1

- 1710 Chestnut Hill Rd

- 1120 Trillium Ln

- 5307 Brindlewood Dr

- 1903 Brighton Ln

- 1213 Bridgehampton Dr

- 5117 Edgewater Ct Unit 1

- 5302 Foxwood Ct

- 1107 Shorewood Dr Unit 3

- 1617 Grand Highlands Dr

- 1703 Grand Highlands Dr

- 1615 Grand Highlands Dr

- 1705 Grand Highlands Dr

- 1706 Sierra Highlands Ct

- 1704 Sierra Highlands Ct

- 1613 Grand Highlands Dr

- 1707 Grand Highlands Dr

- 1708 Sierra Highlands Ct

- 1620 Grand Highlands Dr

- 1700 Grand Highlands Dr

- 1618 Grand Highlands Dr Unit 2B

- 1702 Grand Highlands Dr Unit 2B

- 1704 Grand Highlands Dr

- 1702 Sierra Highlands Ct

- 1616 Grand Highlands Dr

- 1706 Grand Highlands Dr

- 1611 Grand Highlands Dr

- 1709 Grand Highlands Dr

- 1710 Sierra Highlands Ct Unit 2A