1714 Treetop Trail Unit 4 Akron, OH 44313

Merriman Valley NeighborhoodEstimated Value: $70,000 - $94,710

2

Beds

2

Baths

756

Sq Ft

$104/Sq Ft

Est. Value

About This Home

This home is located at 1714 Treetop Trail Unit 4, Akron, OH 44313 and is currently estimated at $78,678, approximately $104 per square foot. 1714 Treetop Trail Unit 4 is a home located in Summit County with nearby schools including Woodridge High School, Immaculate Heart Of Mary School, and Redeemer Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2024

Sold by

Eddy Cynthia N and Foster Cynthia Nicole

Bought by

R & R Of Richfield Llc

Current Estimated Value

Purchase Details

Closed on

Apr 14, 2006

Sold by

Billington Charles F and Billington Melissa D

Bought by

Eddy Cynthia N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,900

Interest Rate

6.34%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 9, 2005

Sold by

Billington Charles F and Billington Tamara

Bought by

Billington Charles F and Billington Melissa D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$16,800

Interest Rate

5.66%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 27, 2002

Sold by

Darby Bethany L and Bethany

Bought by

Billington Charles F and Billington Charles F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,700

Interest Rate

6.64%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| R & R Of Richfield Llc | $67,000 | Chicago Title | |

| Eddy Cynthia N | $70,000 | Americas Choice Title Agency | |

| Billington Charles F | -- | First Security Title Corp | |

| Billington Charles F | $66,000 | Midland Commerce Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Eddy Cynthia N | $67,900 | |

| Previous Owner | Billington Charles F | $16,800 | |

| Previous Owner | Billington Charles F | $62,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,149 | $19,733 | $2,037 | $17,696 |

| 2024 | $1,149 | $19,733 | $2,037 | $17,696 |

| 2023 | $1,149 | $19,733 | $2,037 | $17,696 |

| 2022 | $990 | $15,156 | $1,523 | $13,633 |

| 2021 | $999 | $15,156 | $1,523 | $13,633 |

| 2020 | $986 | $15,150 | $1,520 | $13,630 |

| 2019 | $881 | $12,510 | $1,540 | $10,970 |

| 2018 | $897 | $12,510 | $1,540 | $10,970 |

| 2017 | $1,087 | $12,510 | $1,540 | $10,970 |

| 2016 | $1,082 | $15,890 | $2,050 | $13,840 |

| 2015 | $1,087 | $15,890 | $2,050 | $13,840 |

| 2014 | $1,023 | $15,890 | $2,050 | $13,840 |

| 2013 | $1,134 | $17,650 | $2,050 | $15,600 |

Source: Public Records

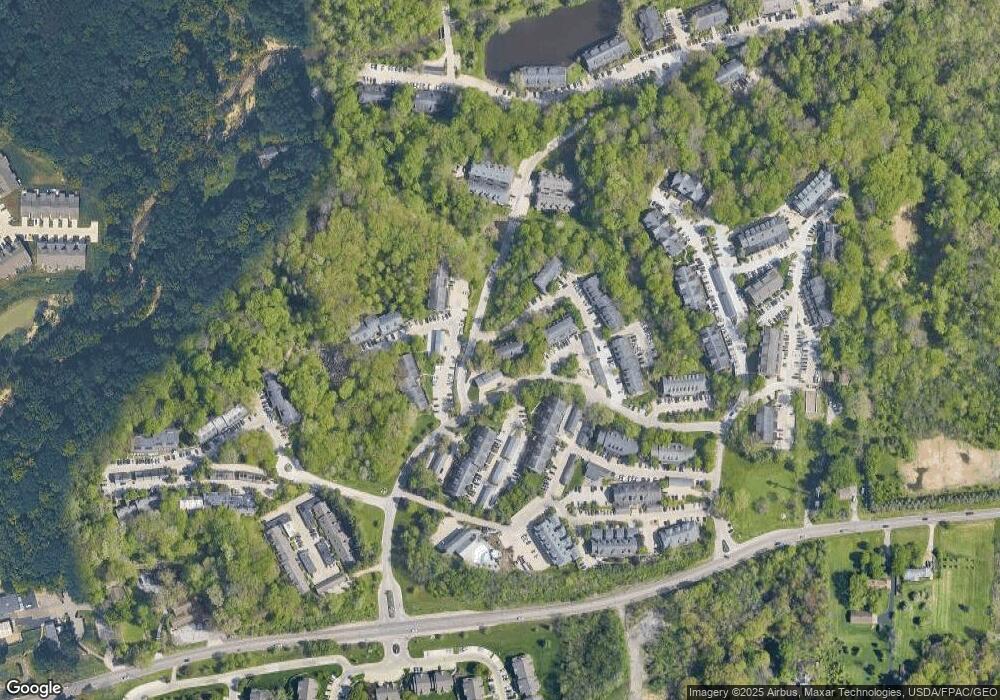

Map

Nearby Homes

- 1609 Treetop Trail Unit 39

- 1561 Treetop Trail Unit B

- 1541 Treetop Trail Unit B

- 896 Whitepine Dr Unit C

- 1113 Bean Ln

- 1134 Bean Ln

- 1484 Waters Edge Dr Unit 2A

- 1393 Waters Edge Dr Unit 26C

- 1173 Madrid Dr

- 532 Portage Trail Extension W

- 520 Meredith Ln Unit 104

- 558 Meredith Ln Unit 558

- 582 Meredith Ln Unit 582

- 546 Meredith Ln Unit 546

- Nassau Cove Plan at Riverwood Valley

- 652 Meredith Ln

- 2178 Pinebrook Trail Unit 2178

- 1431 Barcelona Dr

- 609 Meredith Ln

- 1047 Terrell Dr

- 1718 Treetop Trail

- 1718 Treetop Trail Unit 13

- 1714 Treetop Trail Unit 11

- 1714 Treetop Trail

- 1714 Treetop Trail Unit B

- 1718 Treetop Trail Unit A

- 1722 Treetop Trail Unit 11

- 1722 Treetop Trail Unit 15

- 1712 Treetop Trail

- 1722 Treetop Trail

- 1720 Treetop Trail

- 1716 Treetop Trail

- 1712 Treetop Trail

- 1722 Treetop Trail

- 1712 Treetop Trail Unit 1

- 1720 Treetop Trail

- 1716 Treetop Trail

- 1722 Treetop Trail

- 1712 Treetop Trail

- 1722 Treetop Trail Unit 2