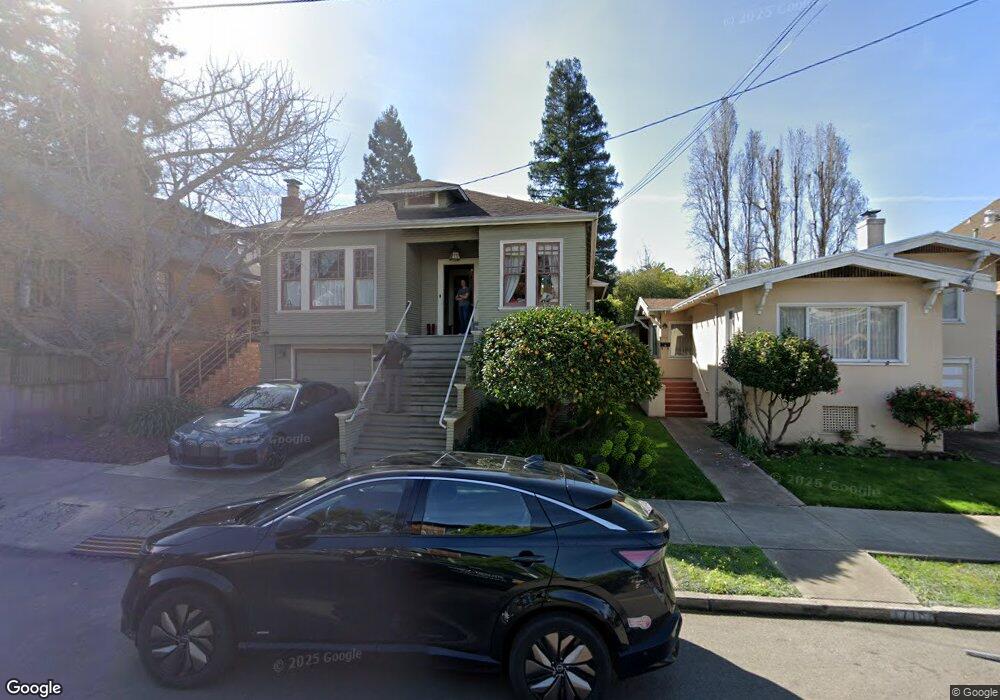

1718 Jaynes St Berkeley, CA 94703

North Berkeley NeighborhoodEstimated Value: $1,982,000 - $3,133,000

4

Beds

3

Baths

3,136

Sq Ft

$745/Sq Ft

Est. Value

About This Home

This home is located at 1718 Jaynes St, Berkeley, CA 94703 and is currently estimated at $2,337,542, approximately $745 per square foot. 1718 Jaynes St is a home located in Alameda County with nearby schools including Berkeley Arts Magnet at Whittier School, Ruth Acty Elementary, and Thousand Oaks Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2006

Sold by

Kratzer Valerie J and Wiener Erik

Bought by

Wiener Erik and Kratzer Valerie J

Current Estimated Value

Purchase Details

Closed on

Jul 24, 2000

Sold by

Crown Robert I & Luban Suzanne A

Bought by

Wiener Erik and Kratzer Valerie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$413,000

Outstanding Balance

$147,471

Interest Rate

8.2%

Estimated Equity

$2,190,071

Purchase Details

Closed on

Sep 28, 1998

Sold by

Crown Robert I & Luban Suzanne A

Bought by

Crown Robert I and Luban Suzanne A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

6.88%

Purchase Details

Closed on

Sep 17, 1998

Sold by

Crown Robert I & Luban Suzanne A

Bought by

Crown Robert I and Luban Suzanne A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

6.88%

Purchase Details

Closed on

Mar 4, 1996

Sold by

Crown Robert I and Luban Suzanne A

Bought by

Crown Robert I and Luban Suzanne A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wiener Erik | -- | None Available | |

| Wiener Erik | $763,000 | Placer Title Company | |

| Crown Robert I | -- | -- | |

| Crown Robert I | -- | Fidelity National Title Ins | |

| Crown Robert I | -- | -- | |

| Crown Robert I | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wiener Erik | $413,000 | |

| Previous Owner | Crown Robert I | $150,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,028 | $1,202,699 | $344,890 | $864,809 |

| 2024 | $19,028 | $1,178,982 | $338,128 | $847,854 |

| 2023 | $18,625 | $1,162,731 | $331,499 | $831,232 |

| 2022 | $18,273 | $1,132,938 | $325,001 | $814,937 |

| 2021 | $18,309 | $1,110,586 | $318,628 | $798,958 |

| 2020 | $17,269 | $1,106,130 | $315,362 | $790,768 |

| 2019 | $16,533 | $1,084,444 | $309,179 | $775,265 |

| 2018 | $16,245 | $1,063,185 | $303,118 | $760,067 |

| 2017 | $15,693 | $1,042,343 | $297,176 | $745,167 |

| 2016 | $15,159 | $1,021,909 | $291,350 | $730,559 |

| 2015 | $14,951 | $1,006,566 | $286,976 | $719,590 |

| 2014 | $14,783 | $986,856 | $281,357 | $705,499 |

Source: Public Records

Map

Nearby Homes

- 1564 Sacramento St

- 1482 Lincoln St

- 1425 Martin Luther King jr Way

- 1609 Bonita Ave Unit 3

- 1609 Bonita Ave Unit 5

- 1610 Milvia St

- 1813 Sacramento St

- 1512 Hearst Ave Unit 1512

- 1436 Delaware St

- 1929 California St

- 1360 Acton St

- 2012 Rose St

- 2015 Delaware St

- 2015 Delaware St Unit A

- 1809 Hopkins St

- 1411 Hearst Ave Unit 2

- 1322 Virginia St

- 1444 Walnut St

- 1546 Beverly Place

- 1923 Yolo Ave