1721 E Valley Rd Montecito, CA 93108

Estimated Value: $6,510,197 - $8,333,000

2

Beds

3

Baths

2,780

Sq Ft

$2,626/Sq Ft

Est. Value

About This Home

This home is located at 1721 E Valley Rd, Montecito, CA 93108 and is currently estimated at $7,301,299, approximately $2,626 per square foot. 1721 E Valley Rd is a home located in Santa Barbara County with nearby schools including Santa Barbara Junior High School, Santa Barbara Senior High School, and Our Lady of Mount Carmel School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2025

Sold by

Bianchi Family Trust and Bianchi Adam

Bought by

Bianchi Family Trust and Bianchi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$10,500,000

Outstanding Balance

$10,499,350

Interest Rate

6.77%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Estimated Equity

-$3,198,051

Purchase Details

Closed on

Jun 3, 1997

Sold by

Argyropoulos and Sarah

Bought by

Bianchi Adam and Bianchi Penelope W

Purchase Details

Closed on

Dec 24, 1993

Sold by

Devorzon Barry R and Devorzon Jelinda M

Bought by

Argyropoulos James and Argyropoulos Sarah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

7.09%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bianchi Family Trust | -- | Fnc Title | |

| Bianchi Adam | -- | Chicago Title Co | |

| Argyropoulos James | $280,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bianchi Family Trust | $10,500,000 | |

| Previous Owner | Argyropoulos James | $280,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $29,423 | $2,732,263 | $1,656,383 | $1,075,880 |

| 2023 | $29,423 | $2,626,167 | $1,592,064 | $1,034,103 |

| 2022 | $28,555 | $2,574,675 | $1,560,848 | $1,013,827 |

| 2021 | $27,984 | $2,524,193 | $1,530,244 | $993,949 |

| 2020 | $27,725 | $2,498,312 | $1,514,554 | $983,758 |

| 2019 | $20,463 | $1,833,660 | $1,147,512 | $686,148 |

| 2018 | $18,247 | $1,618,922 | $946,227 | $672,695 |

| 2017 | $25,796 | $2,354,226 | $1,427,208 | $927,018 |

| 2016 | $25,008 | $2,308,066 | $1,399,224 | $908,842 |

| 2015 | $24,501 | $2,273,398 | $1,378,207 | $895,191 |

| 2014 | -- | $2,228,866 | $1,351,210 | $877,656 |

Source: Public Records

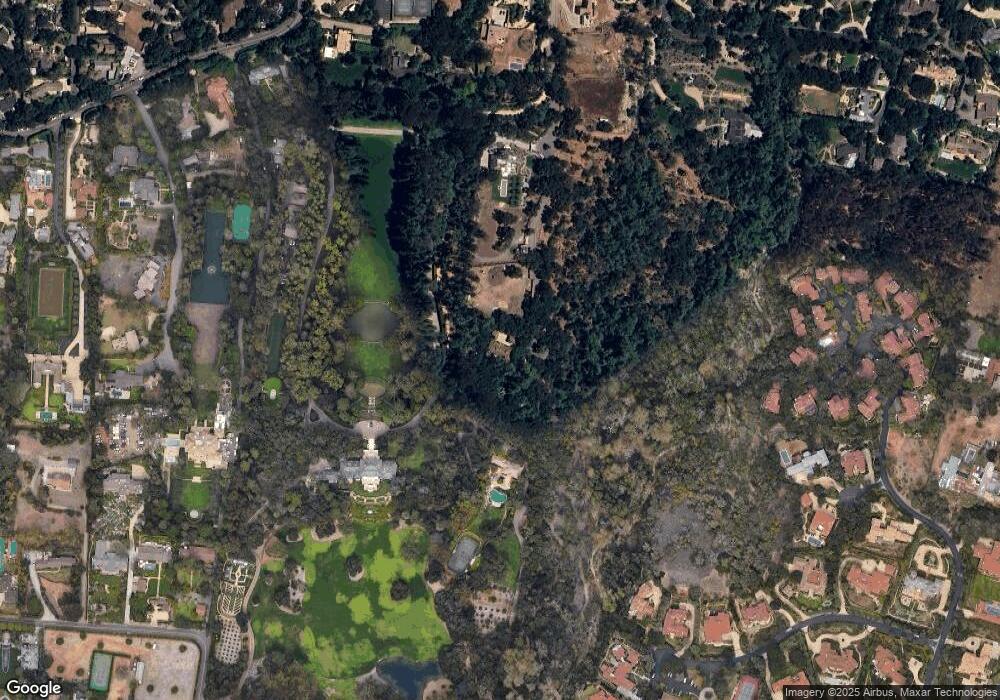

Map

Nearby Homes

- 485 Monarch Ln

- 1725 E Valley Rd

- 420 Seaview Rd

- 1850 Jelinda Dr

- 1988 Inverness Ln

- 526 Crocker Sperry Dr

- 240 Miramar Ave

- 650 San Ysidro Rd

- 2010 Birnam Wood Dr

- 1445 School House Rd

- 601 San Ysidro Rd

- 610 Olive Rd

- 2069 China Flat Rd

- 510 Mclean Ln

- 99 La Vuelta Rd

- 284 Gould Ln

- 1381 E Valley Rd

- 2125 Birnam Wood Dr

- 1932 N Jameson Ln Unit B

- 1940 N Jameson Ln Unit A

- 1721 E Valley Rd

- 1719 E Valley Rd

- 1719 E Valley Rd

- 1600-1700 East Valley

- 1715 E Valley Rd

- 1715 E Valley Rd

- 1715 E Valley Rd

- 1715 E Valley Rd

- 1633 E Valley Rd

- 1633 E Valley Rd

- 1711 E Valley Rd

- 1709 E Valley Rd

- 007 E Valley Ln

- 2790 E Valley Ln

- 2985 E Valley Ln

- 2876 E Valley Ln

- 1683 E Valley Rd

- 486 Monarch Ln

- 0000 Toro Canyon Area

- 400-500 Meadowbrook Dr

Your Personal Tour Guide

Ask me questions while you tour the home.