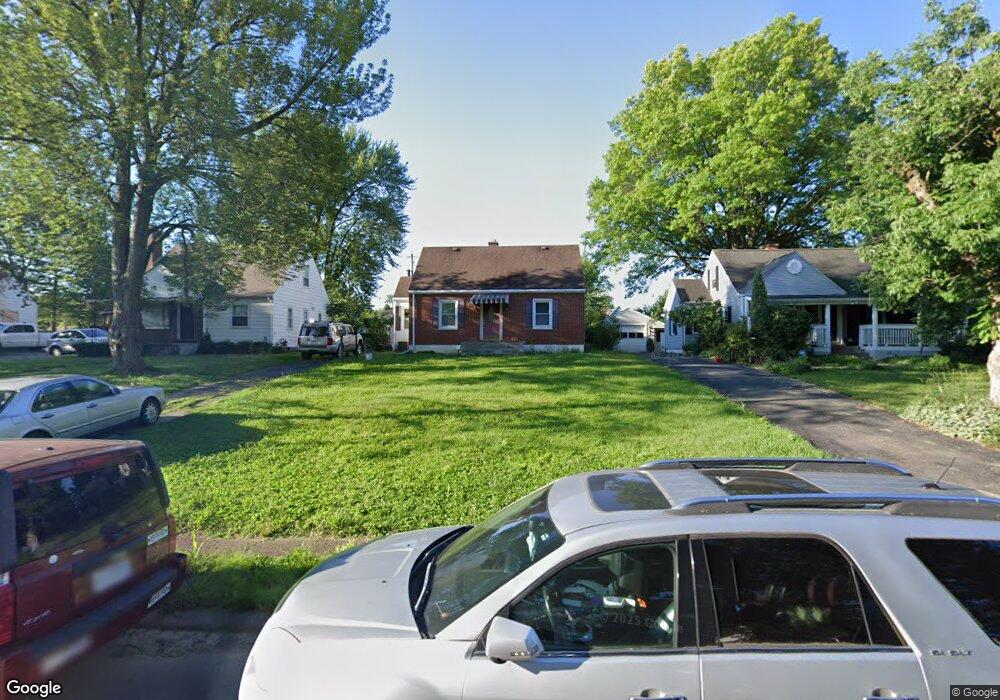

1723 E Dunedin Rd Columbus, OH 43224

North Linden NeighborhoodEstimated Value: $93,761 - $226,000

3

Beds

1

Bath

1,516

Sq Ft

$119/Sq Ft

Est. Value

About This Home

This home is located at 1723 E Dunedin Rd, Columbus, OH 43224 and is currently estimated at $180,190, approximately $118 per square foot. 1723 E Dunedin Rd is a home located in Franklin County with nearby schools including Huy Elementary School, Medina Middle School, and Mifflin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2001

Sold by

Cannon Sean J and Cannon Robert L

Bought by

Cason Mark E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,301

Outstanding Balance

$32,490

Interest Rate

7.16%

Mortgage Type

FHA

Estimated Equity

$147,700

Purchase Details

Closed on

Apr 28, 2000

Sold by

Kemmerling Adam F and Kemmerling Angela R

Bought by

Cannon Sean J and Hart Robert L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,301

Interest Rate

8.26%

Mortgage Type

FHA

Purchase Details

Closed on

May 30, 1996

Sold by

Stiles Kenneth L

Bought by

Kemmerling Adam F and Kemmerling Angela R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,495

Interest Rate

7.99%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 1, 1987

Purchase Details

Closed on

Jun 1, 1978

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cason Mark E | $89,000 | -- | |

| Cannon Sean J | $84,000 | Chicago Title West | |

| Kemmerling Adam F | $71,900 | -- | |

| -- | $50,000 | -- | |

| -- | $35,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cason Mark E | $88,301 | |

| Previous Owner | Cannon Sean J | $77,301 | |

| Previous Owner | Kemmerling Adam F | $71,495 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $515 | $11,240 | $10,430 | $810 |

| 2024 | $515 | $11,240 | $10,430 | $810 |

| 2023 | $509 | $11,240 | $10,430 | $810 |

| 2022 | $84 | $1,580 | $1,300 | $280 |

| 2021 | $84 | $1,580 | $1,300 | $280 |

Source: Public Records

Map

Nearby Homes

- 1711 Piedmont Rd

- 3281 Oaklawn St

- 3086 Bremen St

- 1812 Audrey Rd

- 3109 Bremen St

- 3034 Kenlawn St

- 3049 Cleveland Ave

- 3005 Kenlawn St

- 1841 E North Broadway St

- 1671 E Brighton Rd

- 1884 E North Broadway St

- 3134 Medina Ave

- 3426 Oaklawn St

- 1980 Oakland Park Ave

- 3056 Medina Ave

- 3508 Kenlawn St

- 1877 Robert St

- 3137 Westerville Rd Unit 4

- 3137 Westerville Rd Unit 91

- 2890 Medina Ave

- 1723 E Dunedin Rd

- 1731 E Dunedin Rd

- 1731 E Dunedin Rd

- 1726 Oakland Park Ave

- 1730 Oakland Park Ave

- 1718 Oakland Park Ave

- 1707 E Dunedin Rd

- 1710 Oakland Park Ave

- 1738 Oakland Park Ave

- 1701 E Dunedin Rd

- 1704 Oakland Park Ave

- 1744 Oakland Park Ave

- 1751 E Dunedin Rd

- 1693 E Dunedin Rd

- 1696 Oakland Park Ave

- 1724 E Dunedin Rd

- 1732 E Dunedin Rd

- 1716 E Dunedin Rd

- 1757 E Dunedin Rd

- 1754 Oakland Park Ave

Your Personal Tour Guide

Ask me questions while you tour the home.