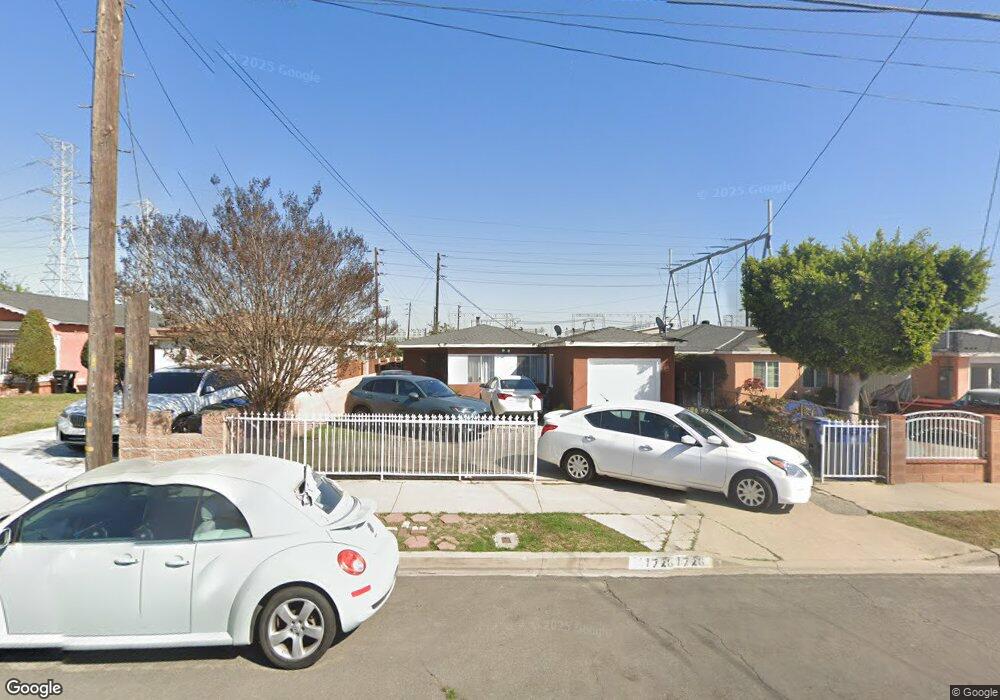

1726 N Banning Blvd Wilmington, CA 90744

Estimated Value: $705,613 - $865,000

4

Beds

2

Baths

1,392

Sq Ft

$547/Sq Ft

Est. Value

About This Home

This home is located at 1726 N Banning Blvd, Wilmington, CA 90744 and is currently estimated at $761,403, approximately $546 per square foot. 1726 N Banning Blvd is a home located in Los Angeles County with nearby schools including Broad Avenue Elementary School, Wilmington Middle School STEAM Magnet, and Phineas Banning Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 19, 2024

Sold by

Bermudez Francisco and Bermudez Elva Leticia

Bought by

Francisco Bermudez and Francisco Elva Leticia

Current Estimated Value

Purchase Details

Closed on

Jul 11, 2011

Sold by

The Bank Of New York Mellon

Bought by

Bermudez Francisco and Bermudez Elva L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,582

Interest Rate

4.46%

Mortgage Type

FHA

Purchase Details

Closed on

May 28, 2010

Sold by

Zamarripa Jesus M and Mora Glenda

Bought by

The Bank Of New York Mellon and The Bank Of New York

Purchase Details

Closed on

Jul 20, 2004

Sold by

Zamarripa Jesus M and Zamarripa Irelia N

Bought by

Zamarripa Jesus M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.24%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Francisco Bermudez | -- | None Listed On Document | |

| Bermudez Francisco | $257,500 | Landsafe Title Of Ca Inc | |

| The Bank Of New York Mellon | $243,000 | Landsafe Title | |

| The Bank Of New York Mellon | $243,000 | Landsafe Title | |

| Zamarripa Jesus M | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bermudez Francisco | $250,582 | |

| Previous Owner | Zamarripa Jesus M | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,110 | $322,920 | $178,480 | $144,440 |

| 2024 | $4,110 | $316,589 | $174,981 | $141,608 |

| 2023 | $4,035 | $310,382 | $171,550 | $138,832 |

| 2022 | $3,853 | $304,297 | $168,187 | $136,110 |

| 2021 | $3,802 | $298,332 | $164,890 | $133,442 |

| 2019 | $3,692 | $289,485 | $160,000 | $129,485 |

| 2018 | $3,607 | $283,810 | $156,863 | $126,947 |

| 2016 | $3,439 | $272,791 | $150,773 | $122,018 |

| 2015 | $3,390 | $268,695 | $148,509 | $120,186 |

| 2014 | $3,409 | $263,432 | $145,600 | $117,832 |

Source: Public Records

Map

Nearby Homes

- 1630 Lakme Ave

- 1627 Broad Ave

- 1610 Broad Ave

- 1526 Lakme Ave

- 890 Oceanside St

- 1610 N Fries Ave

- 810 Oceanside St

- 625 E Bonds St

- 835 E Bonds St

- 1603 Lagoon Ave

- 1607 Ravenna Ave

- 1353 Lakme Ave

- 24407 Island Ave

- 624 E Pacific St

- 24802 Petaluma Ln

- 639 E Pacific St

- 24613 Neptune Ave

- 914 E O St

- 1405 Lagoon Ave

- 1611 Bay View Ave

- 1730 N Banning Blvd

- 1722 N Banning Blvd

- 1734 N Banning Blvd

- 1718 N Banning Blvd

- 1738 N Banning Blvd

- 1714 N Banning Blvd

- 1742 N Banning Blvd

- 1710 N Banning Blvd

- 1725 N Banning Blvd

- 1721 N Banning Blvd

- 1729 N Banning Blvd

- 1746 N Banning Blvd

- 1706 N Banning Blvd

- 1719 N Banning Blvd

- 1733 N Banning Blvd

- 1737 N Banning Blvd

- 1715 N Banning Blvd

- 1702 N Banning Blvd

- 1750 N Banning Blvd

- 1741 N Banning Blvd