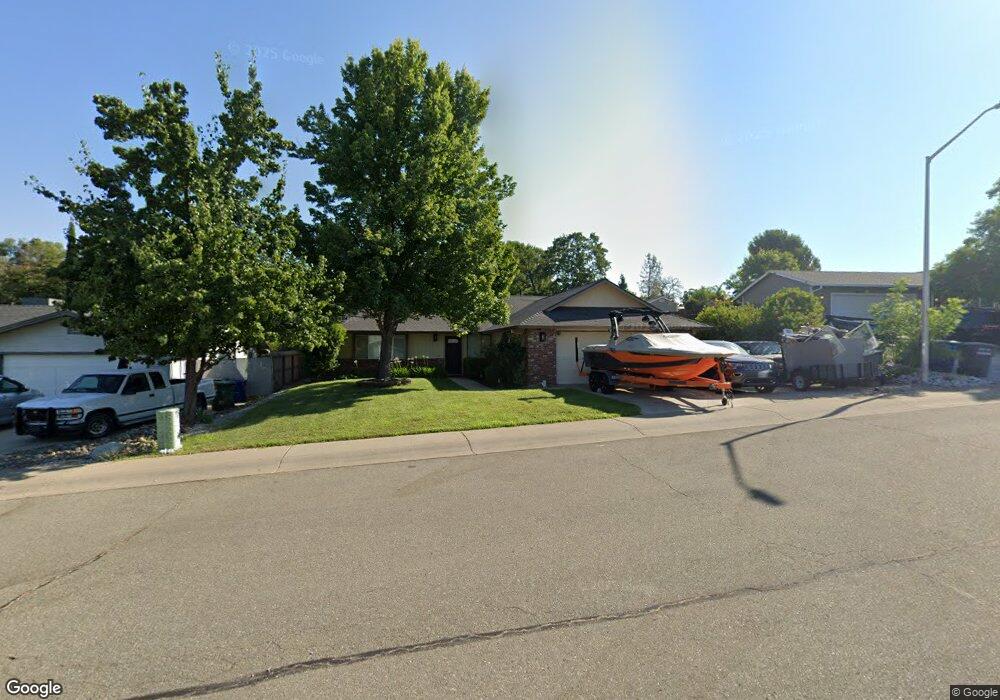

1728 Almaden(3 New Homes) Redding, CA 96001

Mary Lake NeighborhoodEstimated Value: $439,000 - $449,000

3

Beds

2

Baths

1,460

Sq Ft

$304/Sq Ft

Est. Value

About This Home

This home is located at 1728 Almaden(3 New Homes), Redding, CA 96001 and is currently estimated at $444,117, approximately $304 per square foot. 1728 Almaden(3 New Homes) is a home located in Shasta County with nearby schools including Manzanita Elementary School, Sequoia Middle School, and Shasta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2025

Sold by

Pabis John A and Pabis Kimberley A

Bought by

Schaller Janet A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,500

Outstanding Balance

$322,500

Interest Rate

6.26%

Mortgage Type

New Conventional

Estimated Equity

$121,617

Purchase Details

Closed on

Jun 6, 2002

Sold by

Colbert Travis R and Colbert Andrea

Bought by

Pabis John A and Pabis Kimberley A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,800

Interest Rate

6.74%

Purchase Details

Closed on

May 20, 1997

Sold by

Hernacki Teresa and Kopiej Anna

Bought by

Colbert Travis R and Colbert Andrea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,060

Interest Rate

8.14%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schaller Janet A | $430,000 | First American Title | |

| Pabis John A | $160,000 | Chicago Title Co | |

| Colbert Travis R | $103,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schaller Janet A | $322,500 | |

| Previous Owner | Pabis John A | $94,800 | |

| Previous Owner | Colbert Travis R | $105,060 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,455 | $236,343 | $44,305 | $192,038 |

| 2024 | $2,417 | $231,710 | $43,437 | $188,273 |

| 2023 | $2,417 | $227,168 | $42,586 | $184,582 |

| 2022 | $2,376 | $222,714 | $41,751 | $180,963 |

| 2021 | $2,364 | $218,348 | $40,933 | $177,415 |

| 2020 | $2,393 | $216,110 | $40,514 | $175,596 |

| 2019 | $2,274 | $211,873 | $39,720 | $172,153 |

| 2018 | $2,293 | $207,720 | $38,942 | $168,778 |

| 2017 | $2,279 | $203,648 | $38,179 | $165,469 |

| 2016 | $2,208 | $199,656 | $37,431 | $162,225 |

| 2015 | $2,179 | $196,658 | $36,869 | $159,789 |

| 2014 | $2,066 | $184,000 | $50,000 | $134,000 |

Source: Public Records

Map

Nearby Homes

- 3380 Placer St

- 3357 Oakwood Place

- 1474 Gladstone Ct

- 1355 Bambury Ct

- 1605 Wisconsin Ave

- 4160 Travona Ct

- 3135 Stratford Ave

- 1640 Wisconsin Ave

- 4125 Oro St

- 3811 Andes Dr

- 3060 Monte Bello Dr

- 1430 Ridge Dr

- 3036 Monte Bello Dr

- 1756 Mary Lake Dr

- 1783 Record Ln

- 2166 Wicklow St

- 2760 Shasta St

- 1191 Hillcrest Place

- 1575 Fig Ave

- 4648 Kilkee Dr

- 1726 Almaden Dr

- 1734 Almaden Dr

- 1724 Almaden Dr

- 1738 Almaden Dr

- 1729 Almaden Dr

- 1749 Almaden Dr

- 1722 Almaden Dr

- 3613 Rosita Dr

- 1744 Almaden Dr

- 1725 Almaden Dr

- 1754 Almaden Dr

- 1727 Almaden Dr

- 3610 Rosita Dr

- 1767 Almaden Dr

- 1758 Almaden Dr

- 3647 Rosita Dr

- 1762 Almaden Dr

- 3634 Rosita Dr

- 1494 Lear Way Unit Lot 12

- 1494 Lear Way