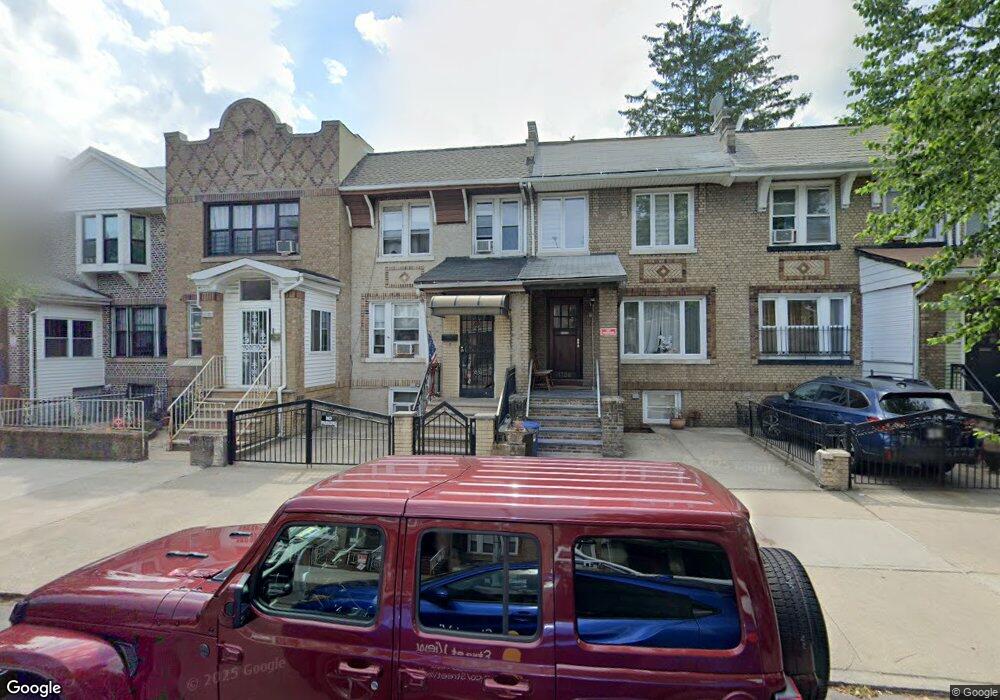

1728 W 10th St Brooklyn, NY 11223

Gravesend NeighborhoodEstimated Value: $904,036 - $1,106,000

--

Bed

--

Bath

1,368

Sq Ft

$764/Sq Ft

Est. Value

About This Home

This home is located at 1728 W 10th St, Brooklyn, NY 11223 and is currently estimated at $1,044,759, approximately $763 per square foot. 1728 W 10th St is a home located in Kings County with nearby schools including P.S. 97 - The Highlawn, Seth Low Intermediate School 96, and Success Academy Charter School - Bensonhurst.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 1998

Sold by

Esposito Rosa

Bought by

Esposito Rosa and Esposito Michelle

Current Estimated Value

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Esposito Rosa | -- | -- | |

| Esposito Rosa | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,231 | $47,460 | $11,520 | $35,940 |

| 2024 | $7,231 | $54,120 | $11,520 | $42,600 |

| 2023 | $6,963 | $60,960 | $11,520 | $49,440 |

| 2022 | $6,131 | $56,280 | $11,520 | $44,760 |

| 2021 | $6,812 | $49,560 | $11,520 | $38,040 |

| 2020 | $2,712 | $55,020 | $11,520 | $43,500 |

| 2019 | $6,228 | $55,020 | $11,520 | $43,500 |

| 2018 | $5,764 | $29,738 | $6,773 | $22,965 |

| 2017 | $5,470 | $28,305 | $6,994 | $21,311 |

| 2016 | $5,349 | $28,305 | $7,910 | $20,395 |

| 2015 | $3,001 | $27,519 | $8,350 | $19,169 |

| 2014 | $3,001 | $25,975 | $9,457 | $16,518 |

Source: Public Records

Map

Nearby Homes

- 86 Quentin Rd

- 74 Quentin Rd

- 226 Kings Hwy

- 60 Quentin Rd

- 103 Quentin Rd Unit B503

- 1720 W 12th St

- 1708 W 12th St

- 44 Quentin Rd

- 133 Quentin Rd

- 1664 W 8th St

- 25 Quentin Rd

- 104 Highlawn Ave

- 1639 W 9th St

- 1801 W 8th St

- 290 Kings Hwy

- 1683 W 7th St Unit 2B

- 1683 W 7th St Unit 3A

- 1683 W 7th St Unit 3B

- 1683 W 7th St Unit 4B

- 1683 W 7th St Unit 5-B