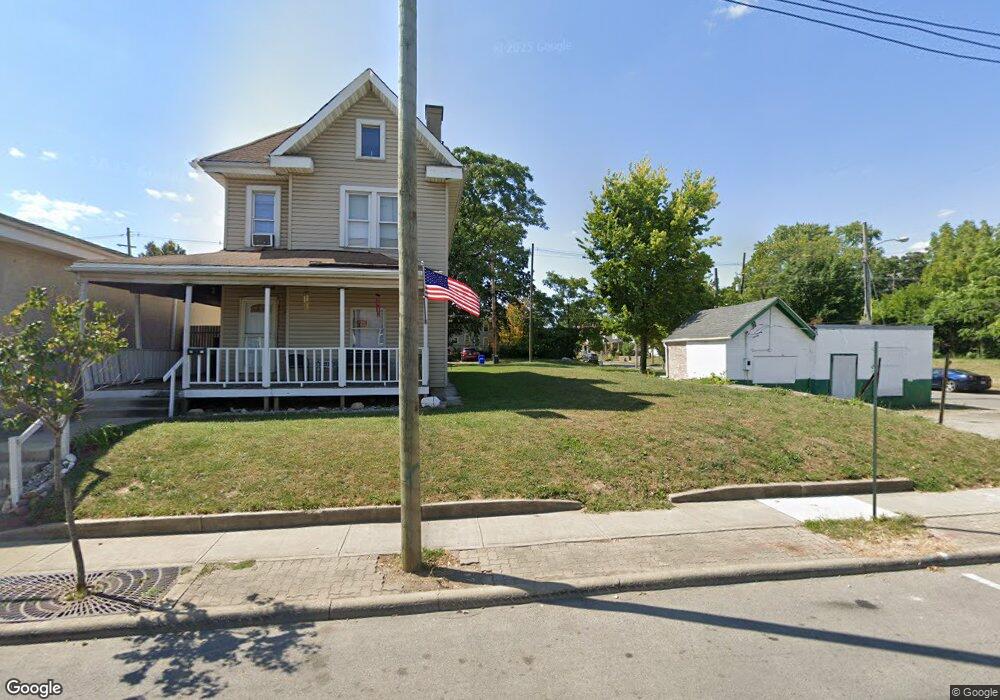

1729 Parsons Ave Unit 731 Columbus, OH 43207

Reeb-Hosack/Hungarian Village NeighborhoodEstimated Value: $137,325

6

Beds

3

Baths

2,464

Sq Ft

$56/Sq Ft

Est. Value

About This Home

This home is located at 1729 Parsons Ave Unit 731, Columbus, OH 43207 and is currently estimated at $137,325, approximately $55 per square foot. 1729 Parsons Ave Unit 731 is a home located in Franklin County with nearby schools including Southwood Elementary School, South High School, and South Columbus Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2019

Sold by

Central Ohio Community Improvement Corp

Bought by

City Of Columbus

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2019

Sold by

Municipal Tax Property Llc

Bought by

Central Ohio Community Improvement Corp

Purchase Details

Closed on

Oct 15, 2012

Sold by

Bailey Thomas A

Bought by

Minicipal Tax Property Llc

Purchase Details

Closed on

Nov 20, 2001

Sold by

American General Finance Inc

Bought by

Bailey Thomas A and Bailey Trixie Ann

Purchase Details

Closed on

Jan 2, 2001

Sold by

Young Bruce D

Bought by

American General Finance Inc

Purchase Details

Closed on

Mar 30, 2000

Sold by

Smith Danny L

Bought by

Young Bruce D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

8.31%

Mortgage Type

Balloon

Purchase Details

Closed on

Aug 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| City Of Columbus | -- | None Available | |

| Central Ohio Community Improvement Corp | -- | None Available | |

| Minicipal Tax Property Llc | $14,169 | None Available | |

| Bailey Thomas A | $18,000 | Amerititle Agency Inc | |

| American General Finance Inc | -- | -- | |

| Young Bruce D | $50,000 | Capcity Title | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Young Bruce D | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $7,070 | $7,070 | -- |

| 2023 | -- | $7,070 | $7,070 | $0 |

| 2022 | $0 | $5,710 | $5,710 | $0 |

| 2021 | $0 | $5,710 | $5,710 | $0 |

| 2020 | $0 | $5,710 | $5,710 | $0 |

| 2019 | $29,626 | $4,970 | $4,970 | $0 |

| 2018 | $742 | $4,970 | $4,970 | $0 |

| 2017 | $12,383 | $4,970 | $4,970 | $0 |

| 2016 | $564 | $8,300 | $4,970 | $3,330 |

| 2015 | $1,176 | $18,200 | $4,970 | $13,230 |

| 2014 | $1,128 | $18,200 | $4,970 | $13,230 |

| 2013 | $557 | $18,200 | $4,970 | $13,230 |

Source: Public Records

Map

Nearby Homes

- 332 E Hinman Ave

- 1696 Parsons Ave

- 1692 Parsons Ave

- 1676 Parsons Ave

- 314 E Woodrow Ave

- 464 E Hinman Ave

- 472 E Hinman Ave

- 457 E Woodrow Ave Unit 459

- 386 E Welch Ave

- 466 E Morrill Ave

- 480-482 E Morrill Ave

- 1613 S 8th St

- 255 E Woodrow Ave

- 495 E Welch Ave

- 524 E Hinman Ave

- 1657 Ann St

- 1756 Bruck St

- 391 Southwood Ave

- 361-363 Southwood Ave

- 323 Southwood Ave

- 1735 Parsons Ave

- 1725 Parsons Ave

- 1743 Parsons Ave

- 397 E Hinman Ave

- 1717 Parsons Ave

- 381 E Hinman Ave Unit 383

- 1709 Parsons Ave

- 1738 Parsons Ave

- 1742 Parsons Ave

- 1740 Parsons Ave

- 1755 Parsons Ave

- 1736 Parsons Ave

- 394-400 E Hinman Ave

- 1730 Parsons Ave

- 1732 Parsons Ave

- 394 E Woodrow Ave

- 1726 Parsons Ave

- 381-383 E Hinman Ave

- 1705 Parsons Ave

- 1724 Parsons Ave