1730 Red Fox Rd Placerville, CA 95667

Estimated Value: $571,721 - $937,000

3

Beds

2

Baths

1,795

Sq Ft

$380/Sq Ft

Est. Value

About This Home

This home is located at 1730 Red Fox Rd, Placerville, CA 95667 and is currently estimated at $682,180, approximately $380 per square foot. 1730 Red Fox Rd is a home located in El Dorado County with nearby schools including Sutter's Mill Elementary School, Gold Trail School, and El Dorado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 5, 2011

Sold by

Keith Lauren

Bought by

Keith Lauren

Current Estimated Value

Purchase Details

Closed on

May 8, 2006

Sold by

Keith Marc S and Keith Lauren

Bought by

Keith Marc S and Keith Lauren

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Outstanding Balance

$287,920

Interest Rate

6.3%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$394,260

Purchase Details

Closed on

Jun 9, 1999

Sold by

Lynn Bevers Terance and Lynn Ellen Bevers

Bought by

Keith Marc S and Keith Lauren A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

7.01%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Keith Lauren | -- | None Available | |

| Keith Marc S | -- | First American Title Co | |

| Keith Marc S | $255,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Keith Marc S | $500,000 | |

| Closed | Keith Marc S | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,127 | $391,898 | $117,563 | $274,335 |

| 2024 | $4,127 | $384,214 | $115,258 | $268,956 |

| 2023 | $4,045 | $376,682 | $112,999 | $263,683 |

| 2022 | $3,986 | $369,297 | $110,784 | $258,513 |

| 2021 | $3,931 | $362,057 | $108,612 | $253,445 |

| 2020 | $3,877 | $358,346 | $107,499 | $250,847 |

| 2019 | $3,818 | $351,321 | $105,392 | $245,929 |

| 2018 | $3,713 | $344,433 | $103,326 | $241,107 |

| 2017 | $3,649 | $337,680 | $101,300 | $236,380 |

| 2016 | $3,595 | $331,060 | $99,314 | $231,746 |

| 2015 | $3,475 | $326,089 | $97,823 | $228,266 |

| 2014 | $3,475 | $319,703 | $95,907 | $223,796 |

Source: Public Records

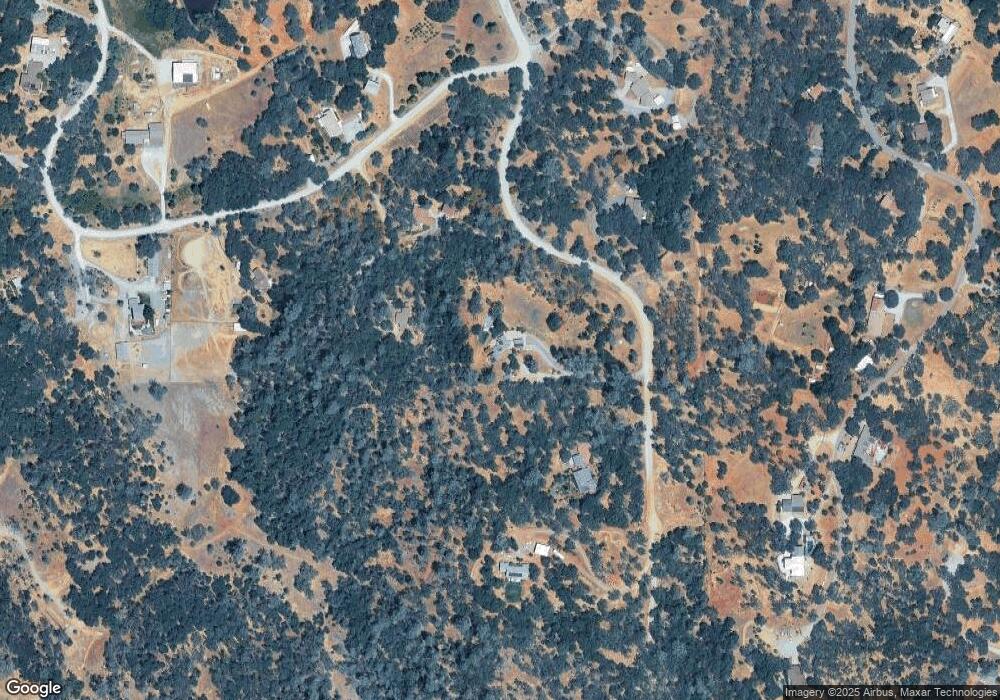

Map

Nearby Homes

- 4540 Meadow Creek Rd

- 3815 Lakeview Dr

- 0 Rossler Rd

- 4371 Luneman Rd

- 1363 Crooked Mile Ct

- 4740 Glory View Dr

- 4890 Thompson Hill Rd

- 4950 Thompson Hill Rd

- 5080 Thompson Hill Rd

- 5105 Glory View Dr

- 4644 Bakers Mountain Rd

- 3891 Chariot Cir

- 5661 Thompson Hill Rd

- 1261 Jurgens Rd

- 5 Jurgens Rd

- 7 Jurgens Rd

- 8 Jurgens Rd

- 6 Jurgens Rd

- 4640 Motto Ln

- 710 Cold Springs Rd

- 1760 Red Fox Rd

- 1680 Red Fox Rd

- 1721 Red Fox Rd

- 1794 Red Fox Rd

- 4631 Meadow Creek Rd

- 1671 Red Fox Rd

- 1820 Red Fox Rd

- 4681 Meadow Creek Rd

- 1680 Shadydale Ln

- 4590 Meadow Creek Rd

- 1660 Shadydale Ln

- 1681 Shadydale Ln

- 1622 Shadydale Ln

- 1840 Red Fox Rd

- 1620 Red Fox Rd

- 1831 Red Fox Rd

- 4601 Meadow Creek Rd

- 1650 Shadydale Ln

- 1641 Red Fox Rd

- 1700 Shadydale Ln