17311 Ruette Abeto Unit 55 San Diego, CA 92127

Rancho Bernardo NeighborhoodEstimated Value: $655,716 - $822,000

2

Beds

2

Baths

1,104

Sq Ft

$647/Sq Ft

Est. Value

About This Home

This home is located at 17311 Ruette Abeto Unit 55, San Diego, CA 92127 and is currently estimated at $714,429, approximately $647 per square foot. 17311 Ruette Abeto Unit 55 is a home located in San Diego County with nearby schools including Westwood Elementary School, Bernardo Heights Middle, and Rancho Bernardo High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2003

Sold by

Rumis Harry A and Rumis Edith J

Bought by

Rumis Harry A and Rumis Edith J

Current Estimated Value

Purchase Details

Closed on

Sep 27, 2002

Sold by

Macmacneil Valerie Mac

Bought by

Rumis Harry A and Rumis Edith J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,600

Interest Rate

6.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 11, 2000

Sold by

Louise Rogers E

Bought by

Macneil Valerie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,582

Interest Rate

8.24%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 8, 2000

Sold by

Quirk William

Bought by

Rogers E Louise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,582

Interest Rate

8.24%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 30, 1995

Sold by

Woodbury Kathleen L

Bought by

Rogers E Louise

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rumis Harry A | -- | -- | |

| Rumis Harry A | $242,000 | Commonwealth Land Title Co | |

| Macneil Valerie | $155,000 | Old Republic Title Company | |

| Rogers E Louise | -- | Old Republic Title Company | |

| Rogers E Louise | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rumis Harry A | $193,600 | |

| Previous Owner | Macneil Valerie | $150,582 | |

| Closed | Rumis Harry A | $24,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,106 | $367,860 | $202,758 | $165,102 |

| 2024 | $4,106 | $360,648 | $198,783 | $161,865 |

| 2023 | $4,019 | $353,578 | $194,886 | $158,692 |

| 2022 | $3,953 | $346,646 | $191,065 | $155,581 |

| 2021 | $3,902 | $339,850 | $187,319 | $152,531 |

| 2020 | $3,850 | $336,366 | $185,399 | $150,967 |

| 2019 | $3,750 | $329,771 | $181,764 | $148,007 |

| 2018 | $3,645 | $323,305 | $178,200 | $145,105 |

| 2017 | $83 | $316,966 | $174,706 | $142,260 |

| 2016 | $3,476 | $310,752 | $171,281 | $139,471 |

| 2015 | $3,425 | $306,086 | $168,709 | $137,377 |

| 2014 | $3,179 | $285,000 | $156,000 | $129,000 |

Source: Public Records

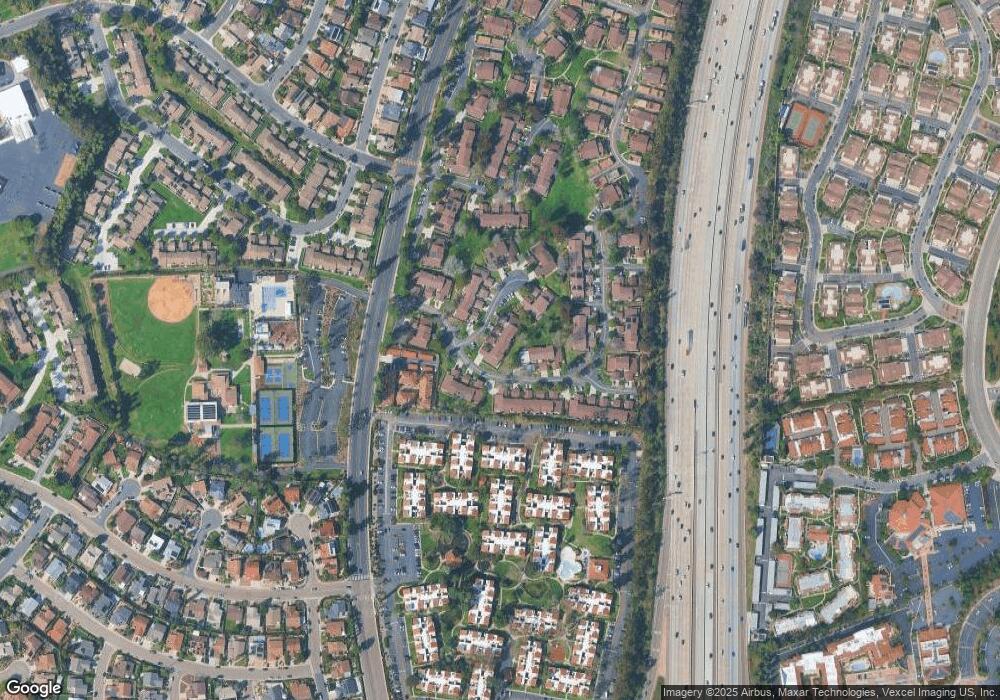

Map

Nearby Homes

- 17141 W Bernardo Dr Unit 203

- 17093 W Bernardo Dr Unit 106

- 17141 W Bernardo Dr Unit 204

- 17147 W Bernardo Dr Unit 103

- 17093 W Bernardo Dr Unit 202

- 17129 W Bernardo Dr Unit 208

- 17093 W Bernardo Dr Unit 205

- 17165 W Bernardo Dr Unit 205

- 17185 W Bernardo Dr Unit 203

- 17195 W Bernardo Dr Unit 206

- 17438 Ashburton Rd

- 11864 Bernardo Terrace Unit C

- 11872 Bernardo Terrace Unit E

- 17544 Ashburton Rd

- 17162 Poblado Ct

- 17408 Caminito Baya

- 11450 Cabela Place

- 11915 Fairhope Rd

- 11412 Lucera Place

- 11825 Caminito Ronaldo Unit 119

- 17326 Ruette Abeto Unit 94

- 17338 Ruette Abeto

- 17354 Ruette Abeto

- 17365 Ruette Abeto

- 17361 Ruette Abeto

- 17392 Caminito Canasto

- 17368 Caminito Canasto Unit 66

- 17364 Caminito Canasto

- 17349 Ruette Abeto

- 17212 Caminito Canasto

- 17310 Ruette Abeto Unit 98

- 17318 Ruette Abeto Unit 96

- 17224 Caminito Canasto

- 17369 Caminito Canasto

- 17365 Caminito Canasto

- 17396 Caminito Canasto

- 17384 Caminito Canasto

- 17216 Caminito Canasto

- 17353 Ruette Abeto

- 17350 Ruette Abeto