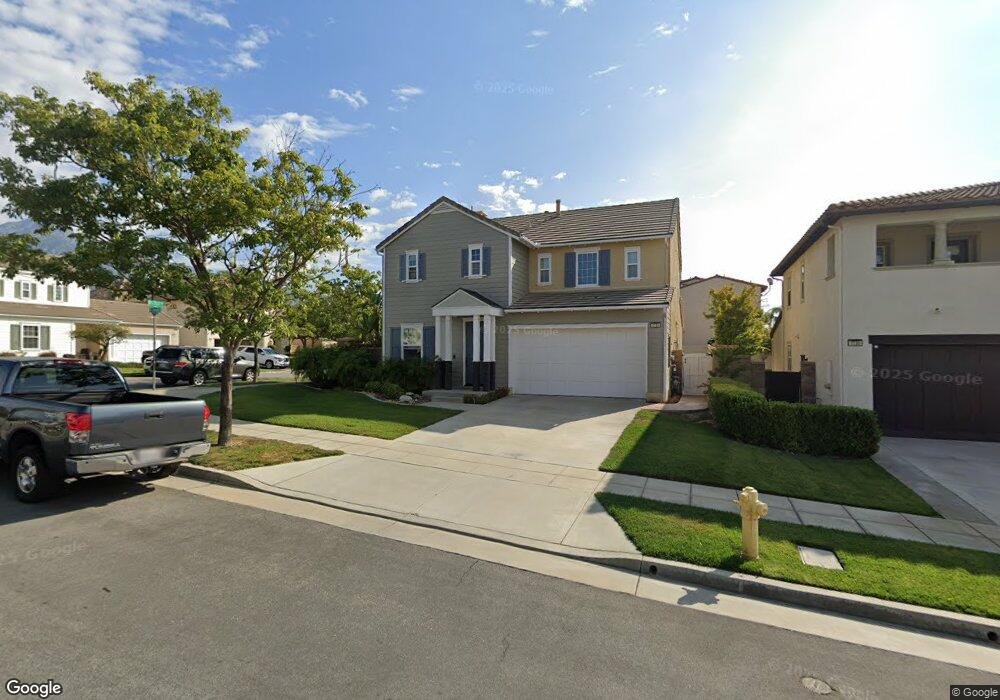

1734 Swan Loop W Upland, CA 91784

Estimated Value: $933,000 - $1,014,000

4

Beds

3

Baths

2,422

Sq Ft

$402/Sq Ft

Est. Value

About This Home

This home is located at 1734 Swan Loop W, Upland, CA 91784 and is currently estimated at $973,707, approximately $402 per square foot. 1734 Swan Loop W is a home located in San Bernardino County with nearby schools including Foothill Knolls STEM Academy of Innovation, Upland High School, and St. Joseph Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2013

Sold by

Ruelas Marlin J

Bought by

Ruelas Family Trust

Current Estimated Value

Purchase Details

Closed on

Nov 10, 2008

Sold by

Dela Cruz Eldridge Dizon

Bought by

Ruelas Marlin J and Ruelas Tracy M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$409,594

Outstanding Balance

$266,464

Interest Rate

5.9%

Mortgage Type

FHA

Estimated Equity

$707,243

Purchase Details

Closed on

Oct 20, 2006

Sold by

Taylor Woodrow Homes Inc

Bought by

Delacruz Eldridge D and Delacruz Javina May

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$507,376

Interest Rate

7.25%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ruelas Family Trust | -- | None Available | |

| Ruelas Marlin J | $415,000 | Southland Title Co | |

| Delacruz Eldridge D | $634,500 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ruelas Marlin J | $409,594 | |

| Previous Owner | Delacruz Eldridge D | $507,376 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,986 | $534,425 | $187,049 | $347,376 |

| 2024 | $8,687 | $523,946 | $183,381 | $340,565 |

| 2023 | $8,518 | $513,672 | $179,785 | $333,887 |

| 2022 | $8,902 | $503,600 | $176,260 | $327,340 |

| 2021 | $8,733 | $493,726 | $172,804 | $320,922 |

| 2020 | $8,405 | $488,663 | $171,032 | $317,631 |

| 2019 | $8,376 | $479,081 | $167,678 | $311,403 |

| 2018 | $8,140 | $469,687 | $164,390 | $305,297 |

| 2017 | $7,741 | $460,478 | $161,167 | $299,311 |

| 2016 | $7,527 | $451,449 | $158,007 | $293,442 |

| 2015 | $7,417 | $444,668 | $155,634 | $289,034 |

| 2014 | $7,295 | $435,957 | $152,585 | $283,372 |

Source: Public Records

Map

Nearby Homes

- 1248 Leggio Ln

- 1238 Leggio Ln

- 1737 Partridge Ave

- 1526 Cole Ln

- 1267 Kendra Ln

- 1060 Pebble Beach Dr Unit 58

- 1708 Old Baldy Way

- 1631 Quail St

- 1535 Upland Hills Dr S

- 1568 N La Quinta Dr

- 1405 E 15th St

- 8337 Jade Dr

- 1499 Alta Ave

- 7041 Cameo St

- 7247 Linden Ln

- 1475 Grove Ave

- 8682 La Grande St

- 689 E Cumberland St

- 1382 Crawford Ave

- 8715 Lurline St