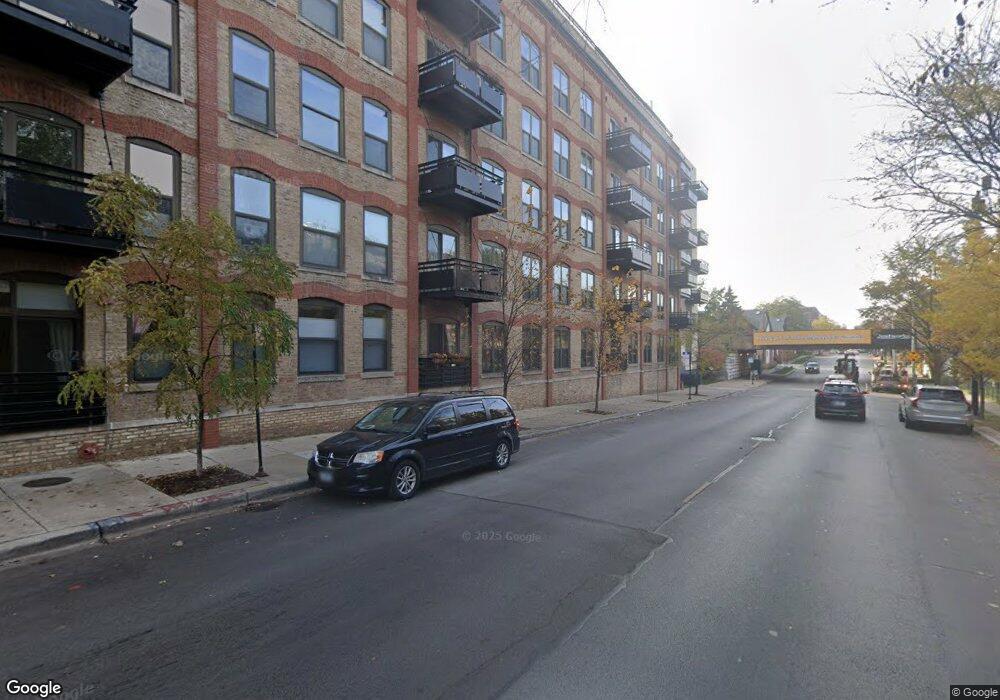

Regal Loft Condos 1735 W Diversey Pkwy Unit 603 Chicago, IL 60614

West DePaul NeighborhoodEstimated Value: $488,764 - $550,000

2

Beds

2

Baths

--

Sq Ft

1.93

Acres

About This Home

This home is located at 1735 W Diversey Pkwy Unit 603, Chicago, IL 60614 and is currently estimated at $527,255. 1735 W Diversey Pkwy Unit 603 is a home located in Cook County with nearby schools including Prescott Elementary School, Lincoln Park High School, and Alphonsus Academy & Center For The Arts.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 13, 2009

Sold by

Cucinella Craig R

Bought by

Babkes Jason

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Outstanding Balance

$203,479

Interest Rate

5.06%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$323,776

Purchase Details

Closed on

Dec 19, 2006

Sold by

Gorecki Anne L

Bought by

Cucinella Craig R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$302,400

Interest Rate

6.24%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 20, 2000

Sold by

1735 W Diversey Llc

Bought by

Gorecki Anne L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Babkes Jason | $360,000 | Stewart Title Company | |

| Cucinella Craig R | $378,000 | Chicago Title Insurance Co | |

| Gorecki Anne L | $252,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Babkes Jason | $324,000 | |

| Previous Owner | Cucinella Craig R | $302,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,843 | $44,146 | $19,275 | $24,871 |

| 2023 | $8,620 | $41,910 | $15,546 | $26,364 |

| 2022 | $8,620 | $41,910 | $15,546 | $26,364 |

| 2021 | $8,428 | $41,910 | $15,546 | $26,364 |

| 2020 | $7,195 | $32,296 | $7,638 | $24,658 |

| 2019 | $7,110 | $35,388 | $7,638 | $27,750 |

| 2018 | $6,990 | $35,388 | $7,638 | $27,750 |

| 2017 | $6,311 | $29,315 | $6,750 | $22,565 |

| 2016 | $5,871 | $29,315 | $6,750 | $22,565 |

| 2015 | $5,372 | $29,315 | $6,750 | $22,565 |

| 2014 | $5,275 | $28,432 | $5,884 | $22,548 |

| 2013 | $4,693 | $28,432 | $5,884 | $22,548 |

Source: Public Records

About Regal Loft Condos

Map

Nearby Homes

- 1735 W Diversey Pkwy Unit 208

- 1735 W Diversey Pkwy Unit 402

- 2754 N Paulina St Unit 2754

- 1800 W Diversey Pkwy Unit D

- 2701 N Hermitage Ave

- 1710 W Surf St Unit 41

- 1712 W Surf St Unit 40

- 2809 N Wolcott Ave Unit 2809C

- 1720 W Surf St Unit 36

- 1808 W Diversey Pkwy Unit E

- 2903 N Wolcott Ave Unit A

- 1924 W Diversey Pkwy Unit 3E

- 1760 W Wrightwood Ave Unit 204

- 1718 W Wrightwood Ave

- 2616 N Marshfield Ave

- 2642 N Ashland Ave

- 2851 N Ashland Ave Unit 1S

- 1656 W Wrightwood Ave Unit 3

- 1759 W Wellington Ave

- 2953 N Honore St

- 1735 W Diversey Pkwy Unit 520

- 1735 W Diversey Pkwy Unit PU49

- 1735 W Diversey Pkwy Unit PU55

- 1735 W Diversey Pkwy Unit GU3

- 1735 W Diversey Pkwy Unit PU57

- 1735 W Diversey Pkwy Unit 320

- 1735 W Diversey Pkwy Unit 115

- 1735 W Diversey Pkwy Unit PU16

- 1735 W Diversey Pkwy Unit PU15

- 1735 W Diversey Pkwy Unit 118

- 1735 W Diversey Pkwy Unit GU8

- 1735 W Diversey Pkwy Unit 201

- 1735 W Diversey Pkwy Unit GU43

- 1735 W Diversey Pkwy Unit 608

- 1735 W Diversey Pkwy Unit 406

- 1735 W Diversey Pkwy Unit 209

- 1735 W Diversey Pkwy Unit 121

- 1735 W Diversey Pkwy Unit 611

- 1735 W Diversey Pkwy Unit TPU21

- 1735 W Diversey Pkwy Unit 221