17366 Caminito Masada Unit 169 San Diego, CA 92127

Rancho Bernardo NeighborhoodEstimated Value: $780,004 - $803,000

4

Beds

3

Baths

1,578

Sq Ft

$504/Sq Ft

Est. Value

About This Home

This home is located at 17366 Caminito Masada Unit 169, San Diego, CA 92127 and is currently estimated at $795,251, approximately $503 per square foot. 17366 Caminito Masada Unit 169 is a home located in San Diego County with nearby schools including Westwood Elementary School, Bernardo Heights Middle, and Rancho Bernardo High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 29, 2003

Sold by

Pearson Therese M

Bought by

Leclerc Therese M and Pearson Therese M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Outstanding Balance

$56,058

Interest Rate

5.26%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$739,193

Purchase Details

Closed on

Mar 24, 1999

Sold by

Pearson Rickard C

Bought by

Pearson Therese M

Purchase Details

Closed on

Jan 4, 1996

Sold by

Jack Christine and Ehlert Christine C

Bought by

Pearson Rickard C and Pearson Therese M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,550

Interest Rate

6.99%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leclerc Therese M | -- | New Century Title Company | |

| Pearson Therese M | -- | -- | |

| Pearson Rickard C | $133,000 | American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Leclerc Therese M | $133,000 | |

| Closed | Pearson Rickard C | $128,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,406 | $220,916 | $63,350 | $157,566 |

| 2024 | $2,406 | $216,585 | $62,108 | $154,477 |

| 2023 | $2,354 | $212,340 | $60,891 | $151,449 |

| 2022 | $2,313 | $208,178 | $59,698 | $148,480 |

| 2021 | $2,282 | $204,097 | $58,528 | $145,569 |

| 2020 | $2,251 | $202,005 | $57,928 | $144,077 |

| 2019 | $2,192 | $198,045 | $56,793 | $141,252 |

| 2018 | $2,129 | $194,163 | $55,680 | $138,483 |

| 2017 | $2,072 | $190,357 | $54,589 | $135,768 |

| 2016 | $2,027 | $186,625 | $53,519 | $133,106 |

| 2015 | $1,997 | $183,823 | $52,716 | $131,107 |

| 2014 | $1,949 | $180,223 | $51,684 | $128,539 |

Source: Public Records

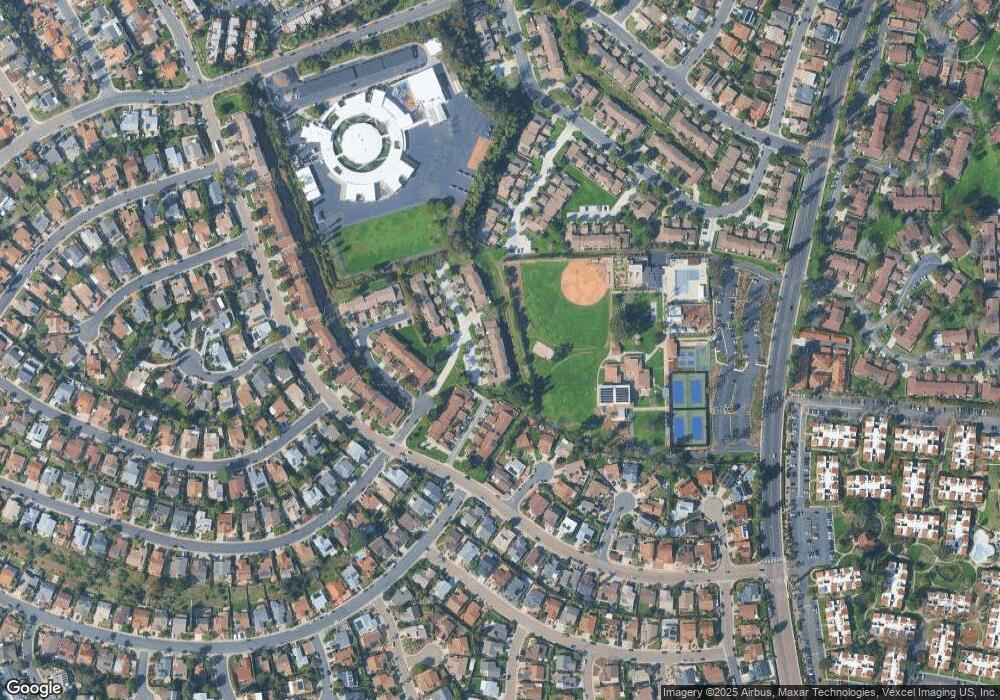

Map

Nearby Homes

- 17408 Caminito Baya

- 17162 Poblado Ct

- 11412 Lucera Place

- 11450 Cabela Place

- 17185 W Bernardo Dr Unit 203

- 17165 W Bernardo Dr Unit 205

- 17195 W Bernardo Dr Unit 206

- 17147 W Bernardo Dr Unit 103

- 17141 W Bernardo Dr Unit 204

- 17159 W Bernardo Dr Unit 202

- 17081 W Bernardo Dr Unit 203

- 17141 W Bernardo Dr Unit 203

- 17129 W Bernardo Dr Unit 208

- 17093 W Bernardo Dr Unit 205

- 17093 W Bernardo Dr Unit 106

- 11409 Duenda Rd

- 17636 Azucar Way

- 17078 Matinal Rd

- 17438 Ashburton Rd

- 11864 Bernardo Terrace Unit C

- 17429 Caminito Baya Unit 114

- 17408 Caminito Baya Unit 147

- 11303 Matinal Cir Unit 124

- 17355 Caminito Masada

- 17416 Caminito Baya Unit 145

- 17420 Caminito Baya

- 17430 Caminito Baya

- 17446 Caminito Baya Unit 138

- 17450 Caminito Baya Unit 137

- 17460 Caminito Baya

- 17468 Caminito Baya Unit 134

- 17386 Caminito Masada

- 17382 Caminito Masada

- 17362 Caminito Masada

- 11303 Matinal Cir

- 11301 Matinal Cir Unit 123

- 17445 Caminito Baya Unit 118

- 17433 Caminito Baya

- 17429 Caminito Baya

- 17341 Caminito Masada