1743 W 7th St Red Wing, MN 55066

Estimated Value: $214,007 - $248,000

3

Beds

2

Baths

1,152

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 1743 W 7th St, Red Wing, MN 55066 and is currently estimated at $236,502, approximately $205 per square foot. 1743 W 7th St is a home located in Goodhue County with nearby schools including Sunnyside Elementary School, Burnside Elementary School, and Twin Bluff Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 2, 2015

Sold by

Demaster Wesley E and Demaster Lindsey

Bought by

Mahlum Joanna L

Current Estimated Value

Purchase Details

Closed on

Mar 4, 2010

Sold by

The Bank Of New York Mellon

Bought by

De Master Wesley E

Purchase Details

Closed on

May 14, 1999

Sold by

Trimble Kenyon Troy and Trimble Julie C

Bought by

Rapp Barry C and Rapp Rungrudee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mahlum Joanna L | -- | Goodhue County Abstract | |

| De Master Wesley E | $91,000 | -- | |

| Rapp Barry C | $84,500 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,166 | $188,800 | $36,000 | $152,800 |

| 2024 | $2,166 | $185,800 | $36,000 | $149,800 |

| 2023 | $1,095 | $174,900 | $36,000 | $138,900 |

| 2022 | $1,748 | $162,100 | $24,300 | $137,800 |

| 2021 | $1,610 | $137,900 | $24,300 | $113,600 |

| 2020 | $1,576 | $130,300 | $24,300 | $106,000 |

| 2019 | $1,590 | $121,200 | $24,300 | $96,900 |

| 2018 | $1,222 | $123,200 | $23,300 | $99,900 |

| 2017 | $1,182 | $107,300 | $23,300 | $84,000 |

| 2016 | $1,068 | $105,600 | $23,300 | $82,300 |

| 2015 | $1,012 | $101,600 | $23,300 | $78,300 |

| 2014 | -- | $97,300 | $23,300 | $74,000 |

Source: Public Records

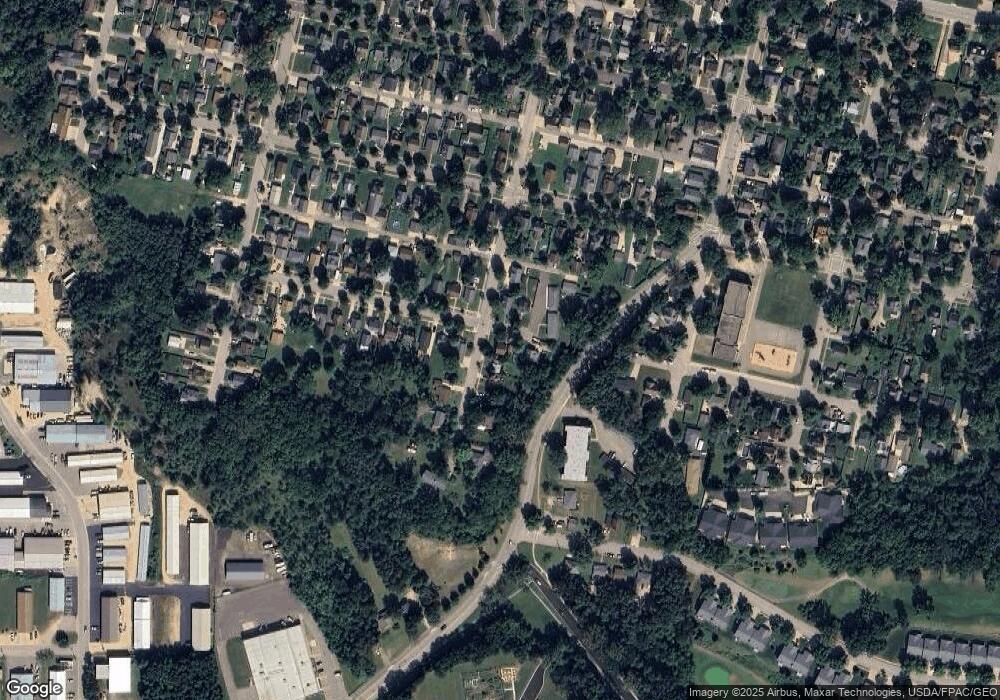

Map

Nearby Homes

- 717 Blaine St

- 1738 W 6th St

- 1715 W 5th St

- 504 Buchanan St Unit 506

- 1578 Alvina St

- 1130 W 4th St

- 1224 Tee Up Ln

- 1238 Foursome St

- 1108 Hawthorne St

- 1062 Putnam Ave

- 1828 Perlich Ave Unit 1A

- 815 W 4th St

- 1029 Putnam Ave

- 1012 West Ave

- 1606 Reichert Ave

- 802 West Ave

- 2114 Village Dr Unit 123

- 2762 Ridgeview Dr

- 2773 Ridgeview Dr

- 642 Grace St