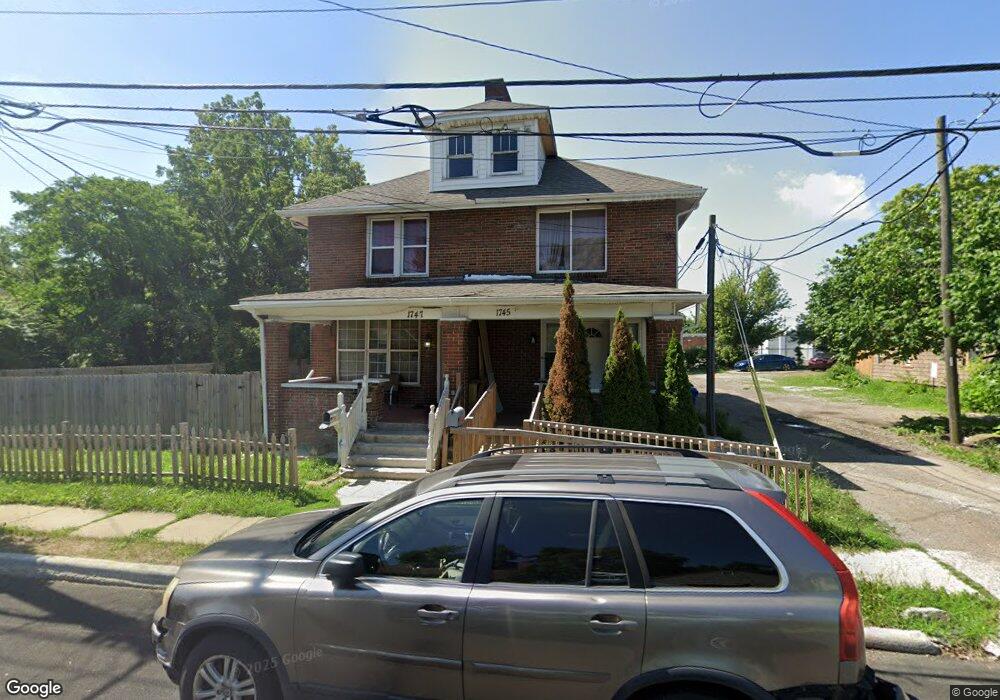

1745 Genessee Ave Unit 747 Columbus, OH 43211

North Linden NeighborhoodEstimated Value: $233,000 - $294,000

7

Beds

3

Baths

3,136

Sq Ft

$83/Sq Ft

Est. Value

About This Home

This home is located at 1745 Genessee Ave Unit 747, Columbus, OH 43211 and is currently estimated at $259,217, approximately $82 per square foot. 1745 Genessee Ave Unit 747 is a home located in Franklin County with nearby schools including Linden STEM Academy (K-6), Linden-Mckinley Stem School On Arcadia, and Focus Learning Academy of Central Columbus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 16, 2018

Sold by

Inacio Jooquin and Feenandes Anarin

Bought by

Jimale Dhihi Abakar and Soleman Abdi Amin

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2017

Sold by

Abdi Abdiaziz and Cruz Stephanie Abb

Bought by

Amonim Abdi Abdiaziz and Amonim Fernandez Inacio Jaoquinn

Purchase Details

Closed on

Nov 28, 2014

Sold by

Christinavera Kathymusic L

Bought by

Cruz Stephanie Ann

Purchase Details

Closed on

May 21, 2014

Sold by

Harbour Portfolio Vi Lp

Bought by

Vera Christina and Music Kathy L

Purchase Details

Closed on

Apr 7, 2011

Sold by

Fannie Mae

Bought by

Harbour Portfolio Vi Lp

Purchase Details

Closed on

Jun 30, 2010

Sold by

Price Rosalyn M and Countrywide Home Loans Inc

Bought by

Fanniemae and Federal National Mortgage Association

Purchase Details

Closed on

Feb 1, 2009

Sold by

Price Roslyn M

Bought by

Jackson Mario M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,400

Interest Rate

8%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 25, 2006

Sold by

Wilburn Felicia

Bought by

Price Rosalyn M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,600

Interest Rate

6.46%

Mortgage Type

Commercial

Purchase Details

Closed on

Jun 27, 2005

Sold by

Tanner Gregory L

Bought by

Wilburn Felicia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,950

Interest Rate

7.3%

Mortgage Type

Commercial

Purchase Details

Closed on

Sep 25, 2000

Sold by

Hines Wilma G and Hines David

Bought by

Tanner Gregory L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,170

Interest Rate

7.87%

Mortgage Type

Commercial

Purchase Details

Closed on

Dec 30, 1998

Sold by

Hines Wilma G and Hines David

Bought by

Tanner Gregory L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

9%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

May 5, 1992

Bought by

Hines David and Hines Wilma G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jimale Dhihi Abakar | $22,000 | None Available | |

| Amonim Abdi Abdiaziz | $47,500 | None Available | |

| Cruz Stephanie Ann | $10,000 | None Available | |

| Vera Christina | $15,500 | None Available | |

| Harbour Portfolio Vi Lp | $5,400 | Attorney | |

| Fanniemae | $28,000 | Attorney | |

| Jackson Mario M | $122,900 | Ticor Title Insurance Co | |

| Price Rosalyn M | $137,000 | Vta Title | |

| Wilburn Felicia | $107,000 | -- | |

| Tanner Gregory L | $52,000 | -- | |

| Tanner Gregory L | $55,000 | Chicago Title West | |

| Hines David | $35,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jackson Mario M | $122,400 | |

| Previous Owner | Price Rosalyn M | $109,600 | |

| Previous Owner | Wilburn Felicia | $90,950 | |

| Previous Owner | Tanner Gregory L | $82,170 | |

| Previous Owner | Tanner Gregory L | $52,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,792 | $83,620 | $13,410 | $70,210 |

| 2024 | $3,792 | $83,620 | $13,410 | $70,210 |

| 2023 | $3,895 | $83,620 | $13,410 | $70,210 |

| 2022 | $2,688 | $48,340 | $7,110 | $41,230 |

| 2021 | $2,543 | $48,340 | $7,110 | $41,230 |

| 2020 | $2,696 | $48,340 | $7,110 | $41,230 |

| 2019 | $2,952 | $42,000 | $6,160 | $35,840 |

| 2018 | $3,067 | $42,000 | $6,160 | $35,840 |

| 2017 | $3,182 | $42,010 | $7,110 | $34,900 |

| 2016 | $3,911 | $33,260 | $7,110 | $26,150 |

| 2015 | $3,560 | $33,260 | $7,110 | $26,150 |

| 2014 | $2,686 | $33,260 | $7,110 | $26,150 |

| 2013 | $1,331 | $33,250 | $7,105 | $26,145 |

Source: Public Records

Map

Nearby Homes

- 1326 Minnesota Ave

- 0 Aberdeen Ave Unit 226000728

- 0 Aberdeen Ave Unit 226002456

- 0 Aberdeen Ave Unit 226002459

- 0 Aberdeen Ave Unit 226002457

- 0 Aberdeen Ave Unit 226002458

- 1827 Aberdeen Ave

- 1799 Harold Place

- 1884 Aberdeen Ave

- 1545 Arlington Ave

- 1691 E Weber Rd

- 1544 Briarwood Ave

- 1938 Myrtle Ave

- 1525 Aberdeen Ave

- 2305 Cleveland Ave

- 1591-1593 E Weber Rd

- 1450 Briarwood Ave

- 1509 Loretta Ave

- 2475 Parkwood Ave

- 1864 E Hudson St

- 1745 Genessee Ave

- 1737 Genessee Ave

- 1755 Genessee Ave

- 1767 Genessee Ave

- 1748 Genessee Ave

- 1752 Genessee Ave

- 1744 Genessee Ave

- 1738-1740 Genessee Ave Unit 740

- 1758 Genessee Ave

- 1738 Genessee Ave Unit 740

- 2514 Cleveland Ave

- 2490 Cleveland Ave

- 2546 Cleveland Ave

- 0 Genessee Ave Unit 225001668

- 0 Genessee Ave Unit 2553938

- 0 Genessee Ave Unit 224027897

- 0 Genessee Ave Unit 223023005

- 0 Genessee Ave Unit 223023003

- 0 Genessee Ave Unit 223017548

- 0 Genessee Ave Unit 223012674

Your Personal Tour Guide

Ask me questions while you tour the home.