Estimated Value: $293,194 - $359,000

--

Bed

2

Baths

2,120

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 175 Phillips Rd Unit CM, Jesup, GA 31545 and is currently estimated at $317,799, approximately $149 per square foot. 175 Phillips Rd Unit CM is a home located in Wayne County with nearby schools including Odum Elementary School, Martha Puckett Middle School, and Wayne County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2011

Sold by

Us Bank National Association

Bought by

Locke Jeremy R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,428

Outstanding Balance

$95,271

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$222,528

Purchase Details

Closed on

Nov 2, 2010

Sold by

Parker Myrtice A

Bought by

Us Bank National Association

Purchase Details

Closed on

May 1, 2004

Bought by

Parker Myrtice A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Locke Jeremy R | $142,000 | -- | |

| Us Bank National Association | $102,000 | -- | |

| Parker Myrtice A | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Locke Jeremy R | $139,428 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,786 | $95,440 | $4,501 | $90,939 |

| 2023 | $2,977 | $84,168 | $4,501 | $79,667 |

| 2022 | $1,996 | $68,387 | $4,501 | $63,886 |

| 2021 | $1,815 | $58,831 | $4,501 | $54,330 |

| 2020 | $1,878 | $58,831 | $4,501 | $54,330 |

| 2019 | $1,934 | $58,831 | $4,501 | $54,330 |

| 2018 | $1,934 | $58,831 | $4,501 | $54,330 |

| 2017 | $1,665 | $58,831 | $4,501 | $54,330 |

| 2016 | $1,611 | $58,831 | $4,501 | $54,330 |

| 2014 | $1,615 | $58,831 | $4,501 | $54,330 |

| 2013 | -- | $66,611 | $6,392 | $60,219 |

Source: Public Records

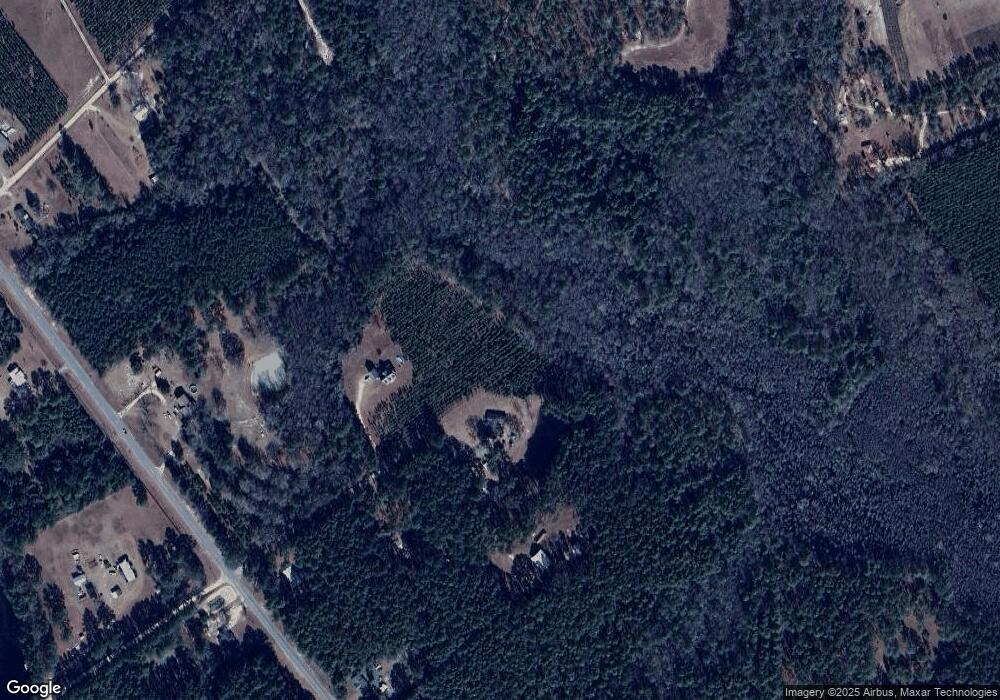

Map

Nearby Homes

- 2936 Madray Springs Rd

- 17380 Lanes Bridge Rd

- 17614 Lanes Bridge Rd

- 128 Three C Rd

- 236 Three C Rd

- 272 Three C Rd

- 300 Three C Rd

- 192 Hummingbird Ln

- 11235 Lanes Bridge Rd

- 92 Sparrow Ln

- 6555 Lanes Bridge Rd

- 0 Oglethorpe Rd

- 438 Boardwalk Ave

- 192 Northshore Ave

- 200 Northshore Ave

- 88 Northshore Ave

- 177 Northshore Ave

- 796 Lud Oquinn Rd

- 876 Hires Rd

- 175 Phillips Rd

- 139 Phillips Rd

- 112 Phillips Rd

- 106 Phillips Rd

- 8940 Lanes Bridge Rd

- 8860 Lanes Bridge Rd

- 9044 Lanes Bridge Rd

- 8935 Lanes Bridge Rd

- 64 Seaboard Rd

- 919 Brannen Rd

- 130 Eva Madray Rd

- 9145 Lanes Bridge Rd

- 30 Eva Madray Rd

- 145 Seaboard Rd

- 8741 Lanes Bridge Rd

- 107 Seaboard Rd

- 125 Eva Madray Rd

- 289 Eva Madray Rd

- 370 Brannen Rd

- 17 Carroll Rd