1753 Umbria Dr Unit 119 Brentwood, TN 37027

Estimated Value: $1,971,011 - $2,222,000

--

Bed

6

Baths

4,510

Sq Ft

$470/Sq Ft

Est. Value

About This Home

This home is located at 1753 Umbria Dr Unit 119, Brentwood, TN 37027 and is currently estimated at $2,120,753, approximately $470 per square foot. 1753 Umbria Dr Unit 119 is a home located in Williamson County with nearby schools including Jordan Elementary School, Sunset Middle School, and Ravenwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2021

Sold by

Rabun Jonathan Tyler and Rabun Amanda Bowers

Bought by

Williams Blake S and Williams Angela M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,280,000

Outstanding Balance

$1,163,916

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$956,837

Purchase Details

Closed on

Jun 15, 2020

Sold by

Aspen Construction Llc

Bought by

Rabun Jonathan Tyler and Rabun Amanda Bowers

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,004,900

Interest Rate

2.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 24, 2019

Sold by

Tuscany Hills 7 Llc

Bought by

Aspen Construction Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Williams Blake S | $1,600,000 | Four Star Title Llc | |

| Rabun Jonathan Tyler | $1,339,900 | The Closing Co T & E Llc | |

| Aspen Construction Llc | $275,000 | Lehman Title &Escrow Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Williams Blake S | $1,280,000 | |

| Previous Owner | Rabun Jonathan Tyler | $1,004,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,067 | $480,100 | $123,750 | $356,350 |

| 2024 | $7,067 | $325,675 | $68,750 | $256,925 |

| 2023 | $7,067 | $325,675 | $68,750 | $256,925 |

| 2022 | $7,067 | $325,675 | $68,750 | $256,925 |

| 2021 | $7,067 | $325,675 | $68,750 | $256,925 |

| 2020 | $3,710 | $143,775 | $38,750 | $105,025 |

| 2019 | $1,000 | $38,750 | $38,750 | $0 |

Source: Public Records

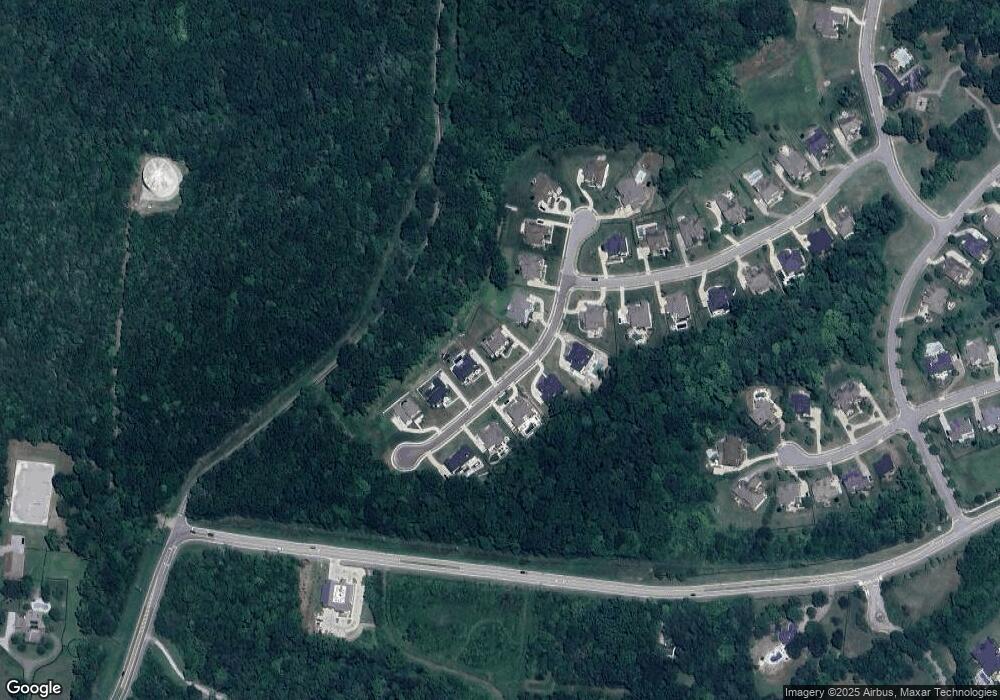

Map

Nearby Homes

- 9603 Romano Way

- 9626 Portofino Dr

- 1841 Dartmouth Dr

- Belvidere Plan at Arcadia

- Belterra Plan at Arcadia

- Elmsley Plan at Arcadia

- Marabelle Plan at Arcadia

- Elmsdale Plan at Arcadia

- Ballentine Plan at Arcadia

- Dresden Plan at Arcadia

- Wilshire Plan at Arcadia

- Pebblebeach Plan at Arcadia

- Plan 25865 at Arcadia

- Cappiello Plan at Arcadia

- Laguna IV Plan at Arcadia

- Pinehurst Plan at Arcadia

- Plan 25862 at Arcadia

- 9514 Glenfiddich Trace

- 1941 Dartmouth Dr

- 9553 Loyola Dr

- 1753 Umbria Dr

- 1755 Umbria Dr Unit 118

- 1755 Umbria Dr

- 1751 Umbria Dr Unit 120

- 1751 Umbria Dr

- 1753 Umbria Drive Lot 119

- 1755 Umbria Drive Lot 118

- 1756 Umbria Dr

- 1754 Umbria Dr

- 1752 Umbria Dr Unit 111

- 1752 Umbria Dr

- 1757 Umbria Drive Lot 117

- 1757 Umbria Dr

- 1757 Umbria Dr Unit 117

- 1749 Umbria Dr

- 1749 Umbria Dr

- 1758 Umbria Dr

- 9597 Romano Way

- 1747 Umbria Dr

- 1759 Umbria Dr