17607 Fritz Falls Ct Tomball, TX 77377

Northpointe NeighborhoodEstimated Value: $549,000 - $601,987

4

Beds

4

Baths

3,662

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 17607 Fritz Falls Ct, Tomball, TX 77377 and is currently estimated at $583,497, approximately $159 per square foot. 17607 Fritz Falls Ct is a home located in Harris County with nearby schools including Willow Creek Elementary School, Willow Wood Junior High School, and Northpointe Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2014

Sold by

Knight Christopher Neal and Smiers Knight Christina Marie

Bought by

Breaux Brian A and Breaux Amy C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,800

Outstanding Balance

$211,975

Interest Rate

4.46%

Mortgage Type

New Conventional

Estimated Equity

$371,522

Purchase Details

Closed on

May 30, 2012

Sold by

Ashton Houston Residential Llc

Bought by

Knight Christopher Neal and Smiers Knight Christina Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$285,554

Interest Rate

3.9%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Breaux Brian A | -- | None Available | |

| Knight Christopher Neal | -- | Dominion Title Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Breaux Brian A | $276,800 | |

| Previous Owner | Knight Christopher Neal | $285,554 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,293 | $609,912 | $93,453 | $516,459 |

| 2024 | $11,293 | $588,139 | $87,277 | $500,862 |

| 2023 | $11,293 | $582,576 | $82,337 | $500,239 |

| 2022 | $11,260 | $516,741 | $82,337 | $434,404 |

| 2021 | $10,609 | $384,871 | $57,636 | $327,235 |

| 2020 | $11,008 | $385,061 | $57,636 | $327,425 |

| 2019 | $10,351 | $352,234 | $49,402 | $302,832 |

| 2018 | $4,397 | $353,128 | $40,346 | $312,782 |

| 2017 | $10,427 | $353,128 | $40,346 | $312,782 |

| 2016 | $10,427 | $353,128 | $40,346 | $312,782 |

| 2015 | $9,555 | $353,128 | $40,346 | $312,782 |

| 2014 | $9,555 | $348,011 | $38,286 | $309,725 |

Source: Public Records

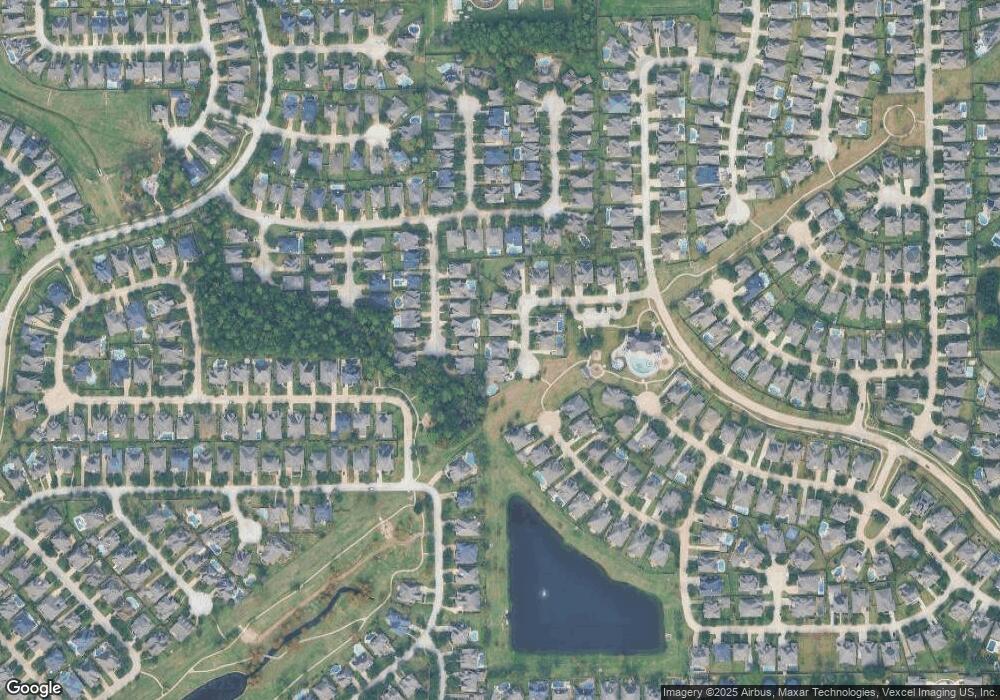

Map

Nearby Homes

- 12506 Opal Valley Dr

- 17511 Pecks Park Ct

- 17814 Winkler Willow Ct

- 12703 Songhollow Dr

- 17623 Edengrove Dr

- 19307 Hillside Pasture Ln

- 20618 Yearling Pasture Ln

- 19243 Palfrey Prairie Trail

- 19219 Palfrey Prairie Trail

- 19326 Palfrey Prairie Trail

- 12331 Westwold Dr

- 12611 Wandering Streams Dr

- 12222 Brighton Brook Ln

- 12427 Pedder Way Dr

- 12802 Mossy Ledge Dr

- 12226 Westwold Dr

- 12806 Wandering Streams Dr

- 12242 Westlock Dr

- 12730 Holsberry Ct

- 12823 Mossy Ledge Dr

- 17611 Fritz Falls Ct

- 17603 Fritz Falls Ct

- 17606 Empress Cove Ln

- 17602 Empress Cove Ln

- 17610 Empress Cove Ln

- 17615 Fritz Falls Ct

- 17610 Fritz Falls Ct

- 17614 Fritz Falls Ct

- 17614 Empress Cove Ln

- 17618 Empress Cove Ln

- 12422 Milo Pass Ln

- 12418 Milo Pass Ln

- 17622 Empress Cove Ln

- 12435 Muller Sky Ct

- 12426 Muller Sky Ct

- 17603 Empress Cove Ln

- 17607 Empress Cove Ln

- 12414 Milo Pass Ln

- 17611 Empress Cove Ln

- 17615 Empress Cove Ln