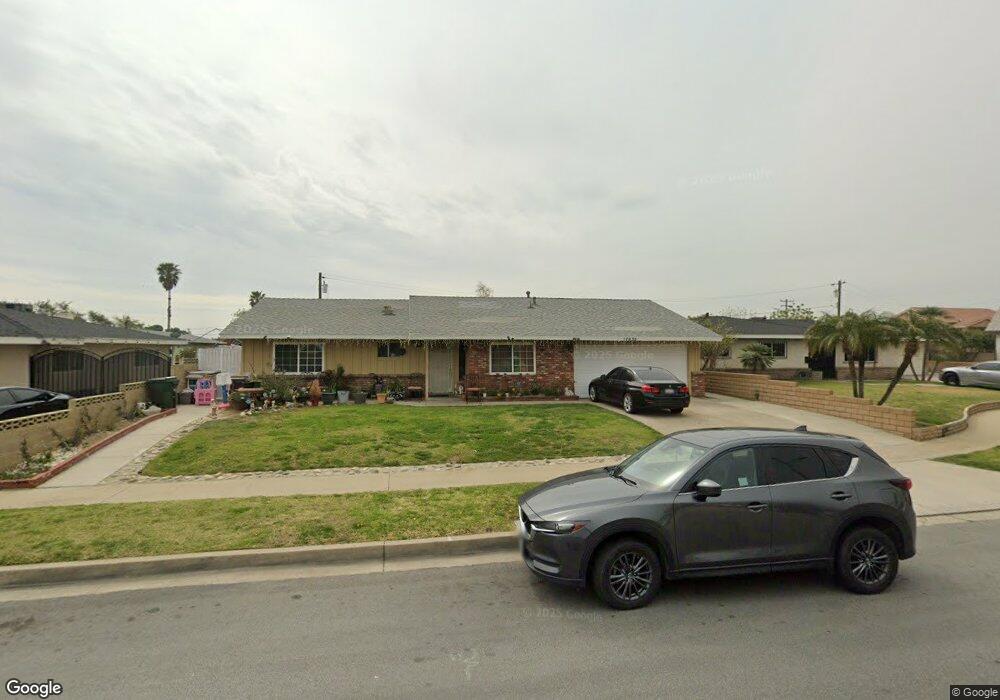

17635 Owen Ct Fontana, CA 92335

Estimated Value: $596,000 - $639,000

3

Beds

2

Baths

1,842

Sq Ft

$332/Sq Ft

Est. Value

About This Home

This home is located at 17635 Owen Ct, Fontana, CA 92335 and is currently estimated at $610,746, approximately $331 per square foot. 17635 Owen Ct is a home located in San Bernardino County with nearby schools including South Tamarind Elementary School, Fontana Middle School, and Fontana High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2024

Sold by

Rincon Decuara Imelda M

Bought by

Imelda M Rincon De Cuara Revocable Trust and De Cuara

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2012

Sold by

Rincon Decuara Imelda Rincon

Bought by

Decuara Imelda Rincon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,705

Interest Rate

3.36%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 7, 2011

Sold by

Rincon Cano Jonathan

Bought by

Decuara Imelda M Rincon

Purchase Details

Closed on

Nov 9, 2009

Sold by

Andersen David L

Bought by

Rincon Cano Jonathan and Rincon De Cuara Imelda M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,830

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 4, 1995

Sold by

Andersen David L

Bought by

Andersen David L and Andersen Joan L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Imelda M Rincon De Cuara Revocable Trust | -- | None Listed On Document | |

| Decuara Imelda Rincon | -- | Advantage Title | |

| Decuara Imelda Rincon | -- | Title 365 | |

| Decuara Imelda M Rincon | -- | None Available | |

| Rincon Cano Jonathan | $185,000 | Ticor Title Company | |

| Andersen David L | -- | United Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Decuara Imelda Rincon | $168,705 | |

| Previous Owner | Rincon Cano Jonathan | $171,830 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,325 | $242,950 | $53,361 | $189,589 |

| 2024 | $3,325 | $238,187 | $52,315 | $185,872 |

| 2023 | $2,794 | $233,516 | $51,289 | $182,227 |

| 2022 | $2,765 | $228,937 | $50,283 | $178,654 |

| 2021 | $2,726 | $224,448 | $49,297 | $175,151 |

| 2020 | $2,705 | $222,147 | $48,792 | $173,355 |

| 2019 | $2,632 | $217,791 | $47,835 | $169,956 |

| 2018 | $2,647 | $213,521 | $46,897 | $166,624 |

| 2017 | $2,607 | $209,334 | $45,977 | $163,357 |

| 2016 | $2,541 | $205,229 | $45,075 | $160,154 |

| 2015 | $2,492 | $173,407 | $44,398 | $129,009 |

| 2014 | $2,154 | $170,010 | $43,528 | $126,482 |

Source: Public Records

Map

Nearby Homes

- 17655 Vine Ct

- 17394 Seville Ct

- 17425 Arrow Blvd Unit 8

- 17334 Seville Ct

- 8019 Alder Ave

- 17626 Orange Ct

- 17848 17858 Foothill Blvd

- 7936 Alder Ave

- 17392 Paine St

- 17903 Dorsey Way

- 18013 Arrow Blvd

- 8560 Buckeye Dr

- 18045 Foothill Blvd

- 17562 Court St

- 17548 Court St

- 7852 Grace Ave

- 17232 Ceres Ave

- 18100 Arrow Blvd

- 17196 Barbee St

- 7835 Laurel Ave

- 8330 Boxwood Ave

- 17625 Owen Ct

- 17630 Seville Ct

- 17640 Seville Ct

- 8350 Boxwood Ave

- 17620 Seville Ct

- 17615 Owen Ct

- 17634 Owen Ct

- 8306 Boxwood Ave

- 17624 Owen Ct

- 17610 Owen Ct

- 8335 Boxwood Ave

- 17610 Seville Ct

- 8325 Boxwood Ave

- 17614 Owen Ct

- 8315 Boxwood Ave

- 17635 Upland Ave

- 17672 Seville Ave

- 8292 Boxwood Ave

- 17595 Owen St