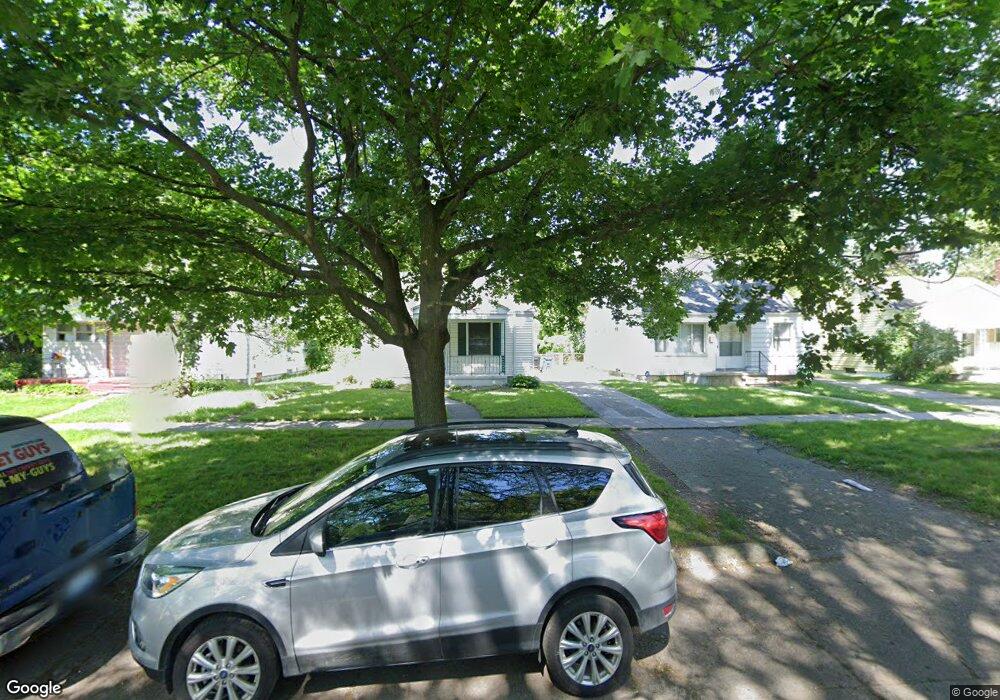

17669 Five Points Detroit, MI 48240

Estimated Value: $153,793 - $181,000

3

Beds

2

Baths

950

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 17669 Five Points, Detroit, MI 48240 and is currently estimated at $166,198, approximately $174 per square foot. 17669 Five Points is a home located in Wayne County with nearby schools including Beech Elementary School, Hilbert Elementary School, and David Ellis Academy PK.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2014

Sold by

Rolack Kamela S

Bought by

Diaz Eric

Current Estimated Value

Purchase Details

Closed on

Mar 29, 2010

Sold by

Mclean Adam and Mclean Meghan

Bought by

Rolack Kamela S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$33,285

Interest Rate

4.92%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 15, 1997

Sold by

James W Millsaps

Bought by

Udd Amy D and Udd Kris J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Diaz Eric | $35,000 | Title One Inc | |

| Rolack Kamela S | $33,000 | Homeland Title & Escrow Agen | |

| Udd Amy D | $58,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rolack Kamela S | $33,285 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $726 | $72,000 | $0 | $0 |

| 2024 | $706 | $64,500 | $0 | $0 |

| 2023 | $673 | $56,500 | $0 | $0 |

| 2022 | $1,705 | $41,600 | $0 | $0 |

| 2021 | $1,658 | $38,900 | $0 | $0 |

| 2020 | $1,636 | $31,500 | $0 | $0 |

| 2019 | $1,601 | $27,500 | $0 | $0 |

| 2018 | $607 | $23,900 | $0 | $0 |

| 2017 | $1,566 | $24,600 | $0 | $0 |

| 2016 | $1,377 | $22,500 | $0 | $0 |

| 2015 | $2,180 | $21,800 | $0 | $0 |

| 2013 | $1,910 | $19,900 | $0 | $0 |

| 2012 | $1,383 | $22,900 | $5,100 | $17,800 |

Source: Public Records

Map

Nearby Homes

- 17730 Five Points St

- 17674 Salem St

- 17421 Five Points St

- 17405 Brady

- 17343 Salem St

- 17465 Fenton St

- 17324 Salem St

- 17684 Fenton St

- 18404 Dalby

- 17699 Lennane

- 17334 Winston St

- 17618 Sumner

- 17213 Brady

- 17206 Salem St

- 17175 Five Points St

- 18458 Lennane

- 18244 Lenore

- 18254 Lenore

- 17697 Olympia

- 17695 Woodbine St

- 17669 Five Points St

- 17661 Five Points St

- 17677 Five Points St

- 17685 Five Points St

- 17645 5 Points St

- 17645 Five Points St

- 17693 Five Points St

- 17668 Brady

- 17660 Brady

- 17676 Brady

- 17652 Brady

- 17639 Five Points St

- 17701 Five Points St

- 17684 Brady

- 17646 Brady

- 17692 Brady

- 17629 Five Points St

- 17638 Brady

- 17709 Five Points St

- 17700 Brady

Your Personal Tour Guide

Ask me questions while you tour the home.