1772 Twin Sisters Rd Unit 2 Fairfield, CA 94534

2

Beds

1

Bath

800

Sq Ft

158

Acres

About This Home

This home is located at 1772 Twin Sisters Rd Unit 2, Fairfield, CA 94534. 1772 Twin Sisters Rd Unit 2 is a home located in Solano County with nearby schools including Suisun Valley Elementary School and Angelo Rodriguez High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2024

Sold by

Marion Jesse and Marion Cathy A

Bought by

Grapeful Harvest Vineyards-Ca Llc

Purchase Details

Closed on

Feb 12, 2013

Sold by

Twin Sisters Llc

Bought by

Marion Jesse R and Marion Cathy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

3.36%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 19, 2012

Sold by

Cousins Distributing Inc

Bought by

Twin Sisters Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

3.36%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 10, 2006

Sold by

California F I Llc

Bought by

Cousins Distributing Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,338,125

Interest Rate

6.66%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 12, 2006

Sold by

Roscoe John F and Roscoe Marilyn J

Bought by

California F L Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grapeful Harvest Vineyards-Ca Llc | $3,015,000 | Placer Title | |

| Marion Jesse R | $1,000,000 | First American Title Company | |

| Twin Sisters Llc | $923,264 | Accommodation | |

| Cousins Distributing Inc | $2,600,000 | Commonwealth Land Title | |

| California F L Llc | $1,013,069 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Marion Jesse R | $1,000,000 | |

| Previous Owner | Cousins Distributing Inc | $1,338,125 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,903 | $621,864 | $554,140 | $67,724 |

| 2024 | $6,903 | $609,672 | $543,275 | $66,397 |

| 2023 | $6,689 | $595,423 | $530,327 | $65,096 |

| 2022 | $6,608 | $586,000 | $522,180 | $63,820 |

| 2021 | $6,542 | $574,511 | $511,942 | $62,569 |

| 2020 | $6,388 | $568,621 | $506,693 | $61,928 |

| 2019 | $6,226 | $557,473 | $496,759 | $60,714 |

| 2018 | $7,099 | $604,397 | $494,508 | $109,889 |

| 2017 | $6,768 | $592,548 | $484,813 | $107,735 |

| 2016 | $6,727 | $580,931 | $475,308 | $105,623 |

| 2015 | $6,276 | $572,206 | $468,169 | $104,037 |

| 2014 | $6,218 | $561,000 | $459,000 | $102,000 |

Source: Public Records

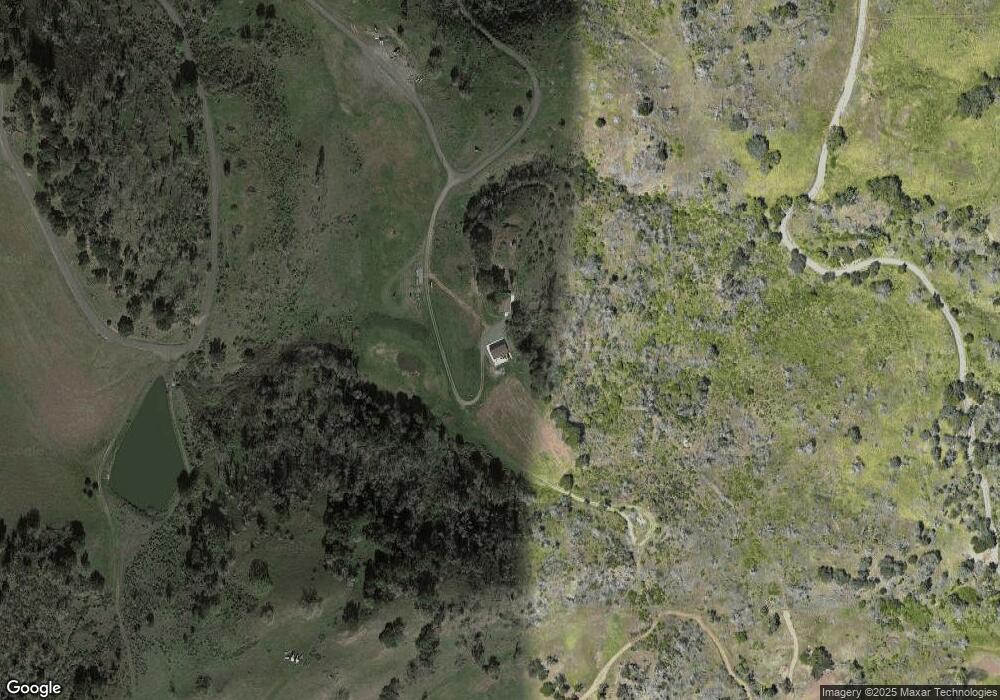

Map

Nearby Homes

- 0 Green Valley Ln Unit Lot 5 325038523

- 0 Green Valley Ln Unit Lot 6 325038375

- 0 Green Valley Ln Unit Lot 3 325038524

- 7490 Wild Horse Valley Rd

- 8000 Wild Horse Valley Rd

- 1424 Rockville Rd

- 4499 Green Valley Rd

- 3165 Wooden Valley Rd

- 4418 Green Valley Rd

- 1795 Green Valley Oaks Dr

- 6111 Wild Horse Valley Rd

- 0 Shadybrook Ln Unit 323038145

- 103 Brae Ct

- 5370 Country Ln

- 0 Vac Sn Luis Potosi Vic Eljorna Unit HD25051665

- 1687 Rockville Rd

- 0 Suisun Valley Rd

- 1069 Shadybrook Ln Unit 1

- 1069 Shadybrook Ln Unit 2

- 1069 Shadybrook Ln Unit 3

- 1772 Twin Sisters Rd

- 0 Twin Sisters Rd Unit 2,3,8 21107374

- 0 Twin Sisters Rd Unit 2,3,8 21200286

- 0 Twin Sisters Rd Unit 2,3,8 21210986

- 1735 Twin Sisters Rd

- 1727 Twin Sisters Rd

- 0 Twin Sisters Rd

- 6065 Twin Sisters Ct

- 6042 Twin Sisters Ct

- 1700 Twin Sisters Rd

- 2112 Joyce Ln

- 2018 Twin Sisters Rd

- 2025 Twin Sisters Rd

- 5987 Twin Sisters Ct

- 2030 Twin Sisters Rd

- 2060 Twin Sisters Rd

- 2038 Joyce Ln

- 2070 Joyce Ln