179 Sea Crest Cir Unit 179 Vallejo, CA 94590

South Vallejo NeighborhoodEstimated Value: $303,000 - $348,922

2

Beds

2

Baths

1,018

Sq Ft

$319/Sq Ft

Est. Value

About This Home

This home is located at 179 Sea Crest Cir Unit 179, Vallejo, CA 94590 and is currently estimated at $324,731, approximately $318 per square foot. 179 Sea Crest Cir Unit 179 is a home located in Solano County with nearby schools including Grace Patterson Elementary School, Vallejo High School, and Saint Vincent Ferrer School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2013

Sold by

Ramkowsky Mathias

Bought by

Fong Jennie

Current Estimated Value

Purchase Details

Closed on

Dec 9, 2004

Sold by

Cfse Llc

Bought by

Ramkowsky Mathias

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,868

Interest Rate

5.77%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 14, 2003

Sold by

Lnf Partners Llc

Bought by

Cfse Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$5,100,000

Interest Rate

5.72%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fong Jennie | $100,000 | Placer Title Company | |

| Ramkowsky Mathias | $320,000 | Chicago Title Co | |

| Henry Joseph | $181,500 | Chicago Title Co | |

| Cfse Llc | $5,800,000 | Frontier Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Henry Joseph | $144,868 | |

| Previous Owner | Ramkowsky Mathias | $239,925 | |

| Previous Owner | Cfse Llc | $5,100,000 | |

| Closed | Henry Joseph | $36,217 | |

| Closed | Ramkowsky Mathias | $47,980 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,471 | $123,132 | $36,938 | $86,194 |

| 2024 | $2,471 | $120,718 | $36,214 | $84,504 |

| 2023 | $2,675 | $118,352 | $35,504 | $82,848 |

| 2022 | $2,555 | $116,032 | $34,808 | $81,224 |

| 2021 | $2,505 | $113,758 | $34,126 | $79,632 |

| 2020 | $2,493 | $112,593 | $33,777 | $78,816 |

| 2019 | $2,408 | $110,386 | $33,115 | $77,271 |

| 2018 | $2,263 | $108,222 | $32,466 | $75,756 |

| 2017 | $2,159 | $106,101 | $31,830 | $74,271 |

| 2016 | $1,599 | $104,021 | $31,206 | $72,815 |

| 2015 | $1,583 | $102,460 | $30,738 | $71,722 |

| 2014 | $1,567 | $100,454 | $30,136 | $70,318 |

Source: Public Records

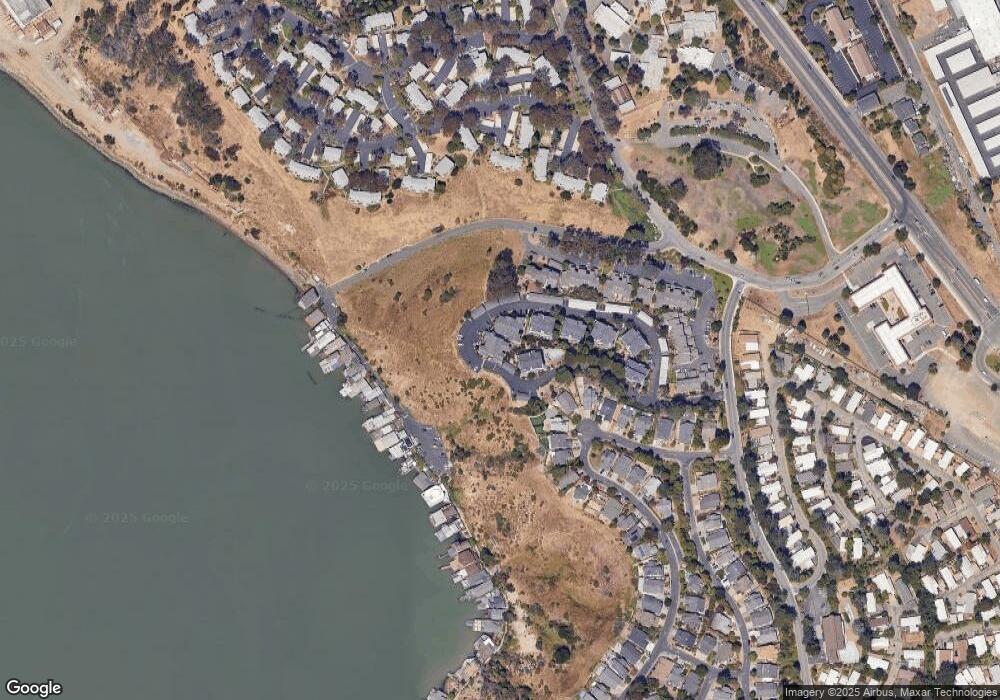

Map

Nearby Homes

- 143 Sea Crest Cir

- 201 Sandy Beach Rd

- 219 Sea Crest Cir

- 9 Sandy Beach Rd

- 199 Sandy Beach Rd

- 175 Frieda Cir

- 87 Gloria Ct

- 15 Constance Dr

- 961 Grant St

- 954 Grant St

- 103 Kay Dr

- 173 Jordan St

- 126 Jordan St

- 849 5th St

- 2 Jordan St

- 392 Winchester St

- 706 Porter St

- 657 Porter St

- 810 Fahey Ct

- 227 Clearpointe Dr

- 279 Sea Crest Cir

- 173 Sea Crest Cir Unit 173

- 278 Sea Crest Cir Unit 278

- 178 Sea Crest Cir

- 273 Sea Crest Cir

- 172 Sea Crest Cir

- 272 Sea Crest Cir

- 167 Sea Crest Cir Unit 167

- 267 Sea Crest Cir

- 261 Sea Crest Cir

- 161 Sea Crest Cir

- 284 Sea Crest Cir Unit 184

- 184 Sea Crest Cir Unit 184

- 285 Sea Crest Cir

- 166 Sea Crest Cir

- 266 Sea Crest Cir

- 185 Sea Crest Cir Unit 185

- 260 Sea Crest Cir Unit 260

- 160 Sea Crest Cir Unit 160

- 290 Sea Crest Cir