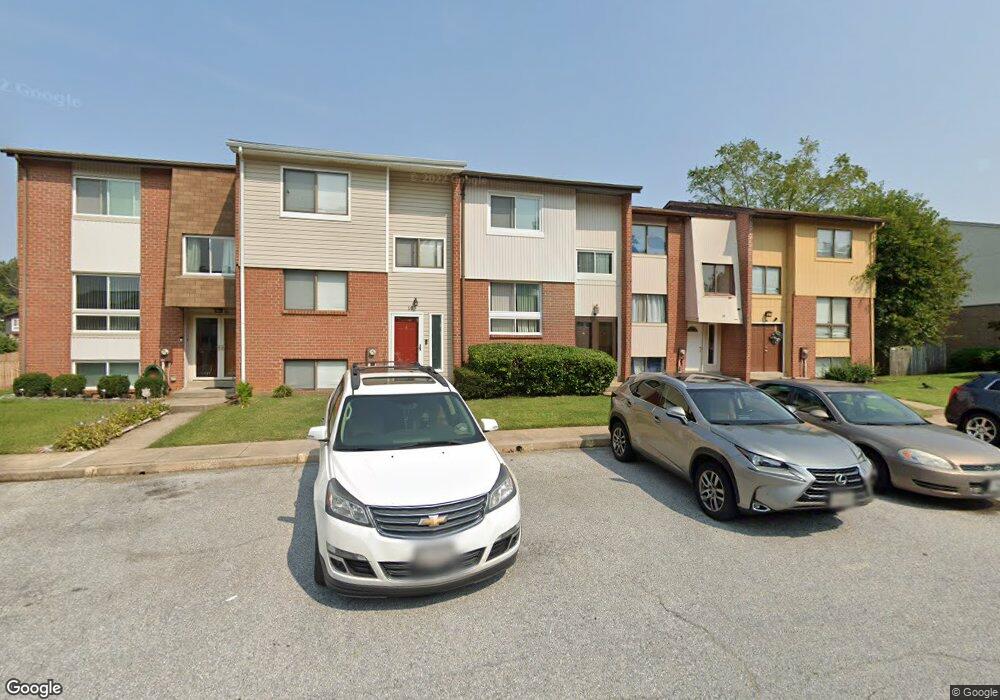

18 Bannock Ct Randallstown, MD 21133

Estimated Value: $289,057 - $299,000

--

Bed

4

Baths

1,440

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 18 Bannock Ct, Randallstown, MD 21133 and is currently estimated at $294,514, approximately $204 per square foot. 18 Bannock Ct is a home located in Baltimore County with nearby schools including Deer Park Elementary School, Deer Park Middle Magnet School, and New Town High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2018

Sold by

Carter Ezekiah and Carter Kimberly

Bought by

Carter Ezekiah

Current Estimated Value

Purchase Details

Closed on

Aug 11, 2016

Sold by

Carter Ezekiah

Bought by

Carter Kimberly

Purchase Details

Closed on

Dec 31, 2007

Sold by

Freeman Brenda

Bought by

Carter Ezekiah and Carter Audrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,622

Interest Rate

6.27%

Mortgage Type

VA

Purchase Details

Closed on

Dec 14, 2007

Sold by

Freeman Brenda

Bought by

Carter Ezekiah and Carter Audrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,622

Interest Rate

6.27%

Mortgage Type

VA

Purchase Details

Closed on

Jan 4, 2006

Sold by

Freeman Vernon

Bought by

Freeman Brenda

Purchase Details

Closed on

Aug 3, 1979

Sold by

Deer Park Estate S Incorporated

Bought by

Freeman Vernon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carter Ezekiah | -- | None Available | |

| Carter Kimberly | -- | None Available | |

| Carter Ezekiah | $215,000 | -- | |

| Carter Ezekiah | $215,000 | -- | |

| Freeman Brenda | -- | -- | |

| Freeman Vernon | $57,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carter Ezekiah | $219,622 | |

| Previous Owner | Carter Ezekiah | $219,622 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,524 | $201,667 | -- | -- |

| 2024 | $3,524 | $179,900 | $45,000 | $134,900 |

| 2023 | $1,691 | $169,233 | $0 | $0 |

| 2022 | $3,222 | $158,567 | $0 | $0 |

| 2021 | $3,063 | $147,900 | $45,000 | $102,900 |

| 2020 | $3,063 | $141,033 | $0 | $0 |

| 2019 | $2,978 | $134,167 | $0 | $0 |

| 2018 | $2,892 | $127,300 | $45,000 | $82,300 |

| 2017 | $2,724 | $127,300 | $0 | $0 |

| 2016 | $2,779 | $127,300 | $0 | $0 |

| 2015 | $2,779 | $128,900 | $0 | $0 |

| 2014 | $2,779 | $128,900 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 9 Bannock Ct

- 4264 Cayuga Rd

- 9931 Tuscarora Rd

- 3827 Rayton Rd

- 11 Hunters Forge Ct

- 3903 Innerdale Ct

- 4105 Hanwell Rd

- 30 Sheraton Rd

- 9519 Branchleigh Rd

- 4108 Brown Bark Cir

- 9804 Marriottsville Rd

- 9530 John Locke Way

- 9500 Georgian Way

- 9510 Coyle Rd Unit 109

- 9317 Edway Cir

- 9401 Summer Squal Dr

- 4550 Chaucer Way Unit 406

- 9406 Painted Tree Dr

- 3538 Corn Stream Rd

- 4500 Chaucer Way Unit 202

- 20 Bannock Ct

- 16 Bannock Ct

- 14 Bannock Ct

- 22 Bannock Ct

- 9917 Shoshone Way

- 12 Bannock Ct

- 24 Bannock Ct

- 9919 Shoshone Way

- 9915 Shoshone Way

- 9921 Shoshone Way

- 10 Bannock Ct

- 26 Bannock Ct

- 9923 Shoshone Way

- 9911 Shoshone Way

- 9913 Shoshone Way

- 8 Bannock Ct

- 28 Bannock Ct

- 11 Bannock Ct

- 7 Bannock Ct

- 6 Bannock Ct