18033 Sundowner Way Unit 633 Canyon Country, CA 91387

Estimated Value: $359,000 - $461,000

2

Beds

2

Baths

843

Sq Ft

$458/Sq Ft

Est. Value

About This Home

This home is located at 18033 Sundowner Way Unit 633, Canyon Country, CA 91387 and is currently estimated at $386,245, approximately $458 per square foot. 18033 Sundowner Way Unit 633 is a home located in Los Angeles County with nearby schools including Mint Canyon Community Elementary School, Sierra Vista Junior High School, and Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2019

Sold by

Rundall Timothy C and Rundall Christine S

Bought by

Rundall Timothy Clarence and Rundall Christine Shobna

Current Estimated Value

Purchase Details

Closed on

Nov 19, 2008

Sold by

Diaz Richard Cesar and Diaz Patricia

Bought by

Rundall Timothy C and Rundall Christine S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

6.03%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 27, 2001

Sold by

Stiasny Harry and Stiasny Eleonore

Bought by

Diaz Richard Cesar and Diaz Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,550

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rundall Timothy Clarence | -- | None Available | |

| Rundall Timothy C | $150,000 | Southland Title | |

| Diaz Richard Cesar | $115,000 | Investors Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rundall Timothy C | $120,000 | |

| Previous Owner | Diaz Richard Cesar | $111,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,941 | $193,148 | $48,927 | $144,221 |

| 2024 | $2,941 | $189,362 | $47,968 | $141,394 |

| 2023 | $2,842 | $185,650 | $47,028 | $138,622 |

| 2022 | $2,792 | $182,010 | $46,106 | $135,904 |

| 2021 | $2,744 | $178,442 | $45,202 | $133,240 |

| 2019 | $2,640 | $173,151 | $43,862 | $129,289 |

| 2018 | $2,591 | $169,756 | $43,002 | $126,754 |

| 2016 | $2,429 | $163,166 | $41,333 | $121,833 |

| 2015 | $2,477 | $160,716 | $40,713 | $120,003 |

| 2014 | $2,438 | $157,569 | $39,916 | $117,653 |

Source: Public Records

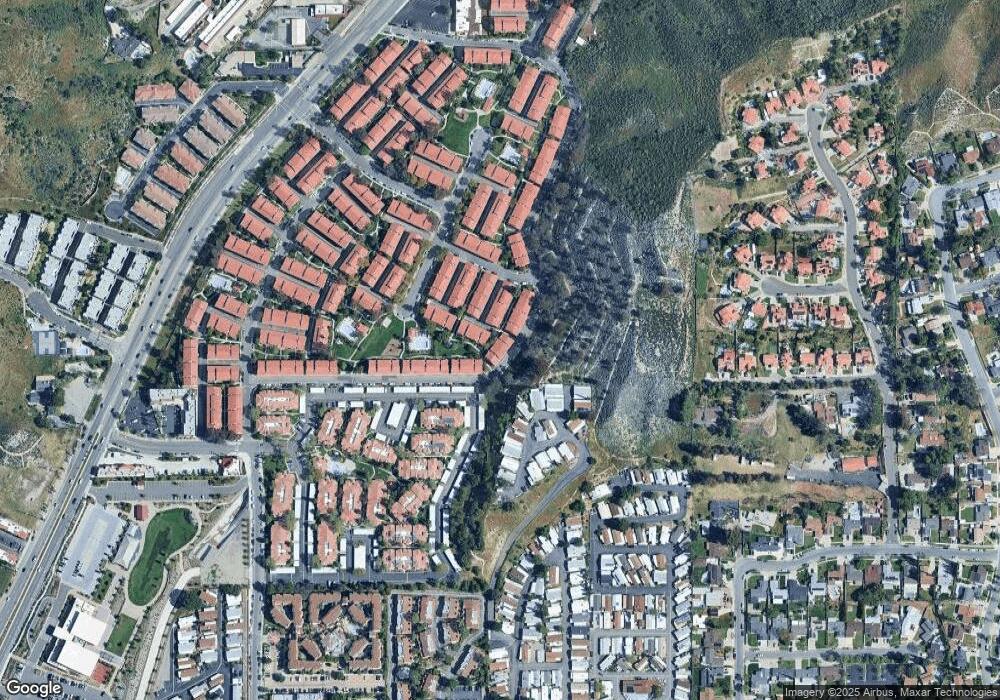

Map

Nearby Homes

- 18028 Saratoga Way Unit 557

- 27945 Tyler Ln Unit 339

- 27945 Tyler Ln Unit 341

- 27971 Sarabande Ln Unit 230

- 27907 Tyler Ln Unit 715

- 18193 Sundowner Way Unit 816

- 28010 Tiffany Ln Unit 309

- 18143 W Sundowner Way Unit 962

- 18105 Sundowner Way Unit 978

- 18143 Sundowner Way Unit 959

- 28069 Magic Mountain Ln

- 18126 W Sundowner Way Unit 1142

- 18035 Soledad Canyon Rd Unit 47

- 18035 Soledad Canyon Rd Unit 45

- 18035 Soledad Canyon Rd Unit 38

- 27951 Avalon Dr

- 18223 Soledad Canyon Rd Unit 15

- 27933 Magic Mountain Ln

- 18209 Sierra Hwy Unit 79

- 18209 Sierra Hwy Unit 95

- 18033 Sundowner Way Unit 635

- 18033 Sundowner Way Unit 636

- 18033 Sundowner Way Unit 631

- 18033 Sundowner Way Unit 634

- 18033 Sundowner Way Unit 632

- 18033 Sundowner Way Unit 629

- 18085 Sundowner Way

- 18085 Sundowner Way Unit 603

- 18065 Sundowner Way Unit 615

- 18085 Sundowner Way Unit 605

- 18085 Sundowner Way Unit 607

- 18065 Sundowner Way Unit 616

- 18065 Sundowner Way Unit 614

- 18065 Sundowner Way Unit 613

- 18065 Sundowner Way Unit 612

- 18065 Sundowner Way Unit 611

- 18065 Sundowner Way Unit 610

- 18065 Sundowner Way Unit 609

- 18085 Sundowner Way Unit 608

- 18085 Sundowner Way Unit 606