1810 11th Ave Newport, MN 55055

Estimated Value: $347,000 - $438,700

3

Beds

2

Baths

1,930

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 1810 11th Ave, Newport, MN 55055 and is currently estimated at $396,925, approximately $205 per square foot. 1810 11th Ave is a home located in Washington County with nearby schools including Newport Elementary School, Oltman Middle School, and East Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2022

Sold by

Swanlund Steve and Swanlund Pamela

Bought by

Sandberg Faith

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$192,583

Interest Rate

4.42%

Mortgage Type

New Conventional

Estimated Equity

$204,342

Purchase Details

Closed on

May 4, 2022

Sold by

Jean Swanlund and Jean Pamela

Bought by

Sandberg Faith

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$192,583

Interest Rate

4.42%

Mortgage Type

New Conventional

Estimated Equity

$204,342

Purchase Details

Closed on

Feb 26, 2014

Sold by

Swanlund Peter and The Howard W Swanlund Living T

Bought by

Swanlund Gertrude T and Swanlund Peter

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sandberg Faith | $410,000 | -- | |

| Sandberg Faith | $410,000 | Stewart Title Company | |

| Swanlund Gertrude T | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sandberg Faith | $205,000 | |

| Closed | Sandberg Faith | $205,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,898 | $407,500 | $157,900 | $249,600 |

| 2023 | $5,898 | $423,000 | $187,900 | $235,100 |

| 2022 | $5,792 | $425,900 | $214,800 | $211,100 |

| 2021 | $5,350 | $351,400 | $178,100 | $173,300 |

| 2020 | $5,490 | $331,100 | $163,800 | $167,300 |

| 2019 | $5,516 | $333,400 | $163,800 | $169,600 |

| 2018 | $5,224 | $320,200 | $163,800 | $156,400 |

| 2017 | $4,720 | $298,600 | $148,800 | $149,800 |

| 2016 | $4,722 | $273,500 | $128,800 | $144,700 |

| 2015 | $4,550 | $250,700 | $127,500 | $123,200 |

| 2013 | -- | $234,300 | $116,000 | $118,300 |

Source: Public Records

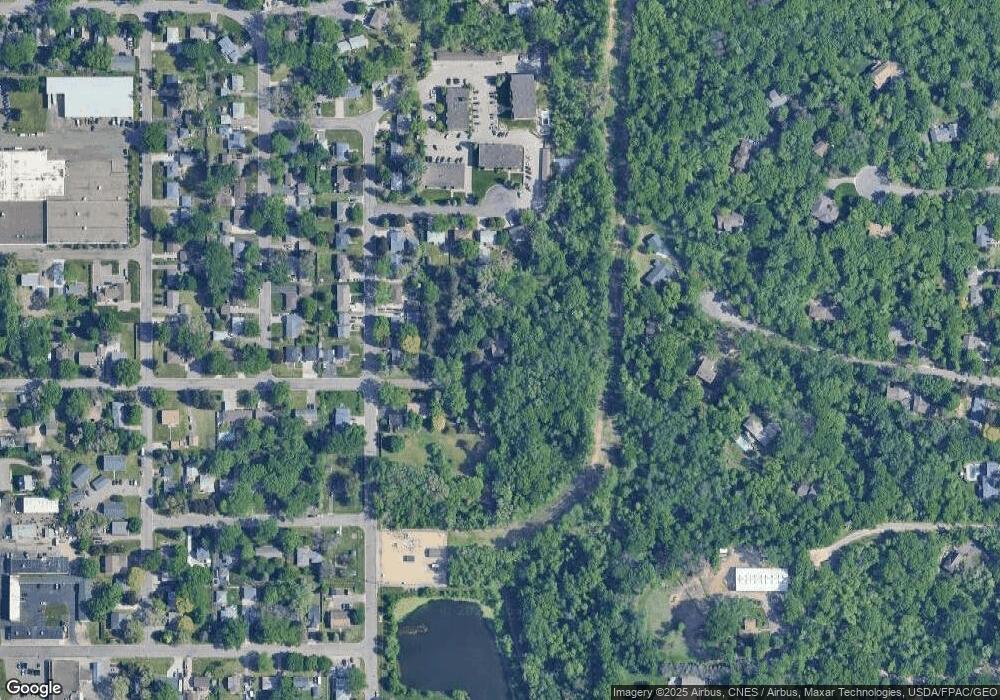

Map

Nearby Homes

- 1761 8th Ave

- 2250 Larry Ln

- 1391 12th Ave

- 1493 3rd Ave

- 1523 Cedar Ln

- 6287 Crackleberry Trail

- 1012 Catherine Dr

- 1081 Oakwood Rd

- 1530 Burg Ave

- 6254 61st St S

- 6248 61st St S

- 6253 61st St S

- 6266 61st St S

- 6265 61st St S

- 6260 61st St S

- 6162 Goodwin Ave N

- 6720 Crackleberry Trail

- 6135 Goodwin Ave S

- 15016 Ashtown Ln

- 10525 Goodwin Ave S