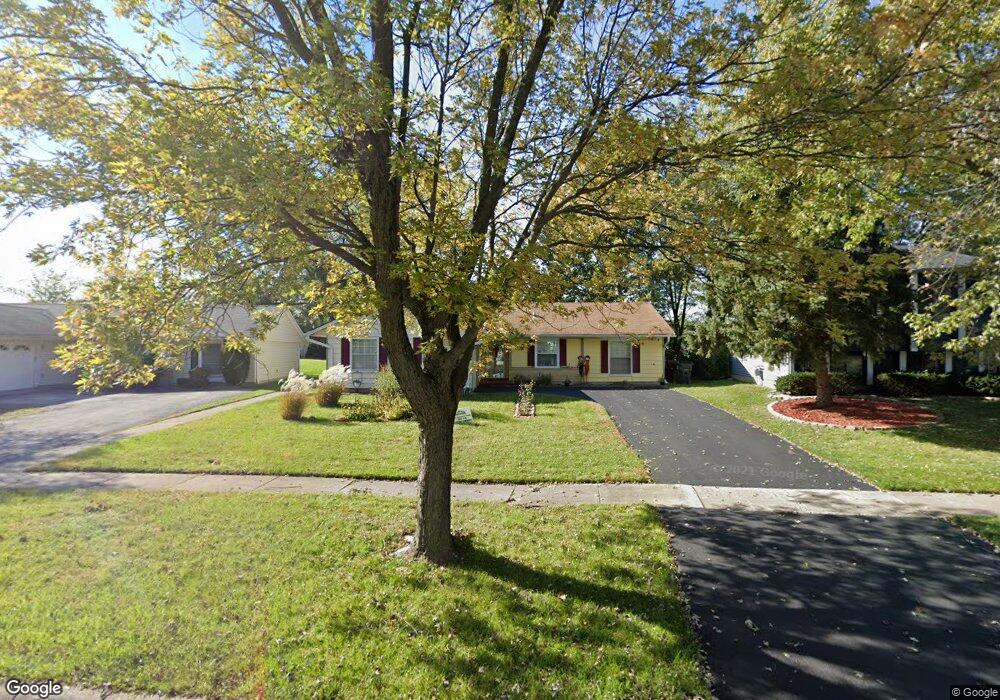

18108 Charlemagne Ave Unit S2 Hazel Crest, IL 60429

Chateaux-Versailles NeighborhoodEstimated Value: $184,857 - $223,000

3

Beds

2

Baths

1,280

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 18108 Charlemagne Ave Unit S2, Hazel Crest, IL 60429 and is currently estimated at $208,714, approximately $163 per square foot. 18108 Charlemagne Ave Unit S2 is a home located in Cook County with nearby schools including Chateaux School, Prairie-Hills Junior High School, and Hillcrest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2016

Sold by

Wright Earline K

Bought by

Wright Earline K and Earline K Wright Living Trust

Current Estimated Value

Purchase Details

Closed on

Mar 10, 2008

Sold by

Wright Arthur L

Bought by

Wright Earline K and Wright Arthur L

Purchase Details

Closed on

Aug 21, 1997

Sold by

Bankers Trust Company Of California Na

Bought by

Wright Arthur L and Wright Earline K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,550

Interest Rate

7.42%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 22, 1995

Sold by

Va

Bought by

Bankers Trust Company Of California Na and Vendee Mtg Trust 1995-2

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wright Earline K | -- | None Available | |

| Wright Earline K | -- | None Available | |

| Wright Arthur L | $57,000 | -- | |

| Bankers Trust Company Of California Na | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wright Arthur L | $68,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,114 | $14,000 | $2,535 | $11,465 |

| 2023 | $1,097 | $14,000 | $2,535 | $11,465 |

| 2022 | $1,097 | $9,552 | $2,173 | $7,379 |

| 2021 | $1,030 | $9,551 | $2,172 | $7,379 |

| 2020 | $911 | $9,551 | $2,172 | $7,379 |

| 2019 | $1,003 | $8,726 | $1,991 | $6,735 |

| 2018 | $974 | $8,726 | $1,991 | $6,735 |

| 2017 | $894 | $8,726 | $1,991 | $6,735 |

| 2016 | $3,206 | $7,980 | $1,810 | $6,170 |

| 2015 | $3,000 | $7,980 | $1,810 | $6,170 |

| 2014 | $2,956 | $7,980 | $1,810 | $6,170 |

| 2013 | $3,463 | $9,861 | $1,810 | $8,051 |

Source: Public Records

Map

Nearby Homes

- 3400 Seine Ct

- 3406 Seine Ct

- 18106 Charlemagne Ave

- 3411 Montmarte Ave

- 18120 Versailles Ln

- 3525 Marseilles Ln

- 3407 Fountainbleau Dr

- 17922 Normandy Ln

- 18108 Fountainbleau Dr

- 3255 183rd St

- 18208 Fountainbleau Dr

- 18018 Chantilly Ln Unit S3

- 3360 184th St Unit 3W

- 18107 Kedzie Ave

- 17910 Millstone Rd

- 3068 Hickory Rd

- 3112 Shagbark Ln

- 3114 Shagbark Ln

- 3240 Knollwood Ln

- 3505 Lakeview Dr Unit 204

- 18110 Charlemagne Ave

- 3402 Seine Ct

- 18104 Charlemagne Ave

- 18109 Charlemagne Ave

- 18107 Charlemagne Ave

- 18111 Charlemagne Ave

- 18102 Charlemagne Ave

- 3401 Seine Ct

- 18113 Charlemagne Ave

- 3408 Seine Ct

- 18105 Charlemagne Ave

- 3403 Seine Ct

- 18100 Charlemagne Ave

- 18115 Charlemagne Ave

- 3405 Seine Ct

- 18106 Orleans Dr

- 18108 Orleans Dr Unit S2

- 3410 Seine Ct

- 18120 Charlemagne Ave

- 18104 Orleans Dr