1812 W Cliff Ct Carlsbad, CA 92008

Olde Carlsbad NeighborhoodEstimated Value: $1,195,000 - $1,523,000

3

Beds

2

Baths

1,469

Sq Ft

$953/Sq Ft

Est. Value

About This Home

This home is located at 1812 W Cliff Ct, Carlsbad, CA 92008 and is currently estimated at $1,399,302, approximately $952 per square foot. 1812 W Cliff Ct is a home located in San Diego County with nearby schools including Magnolia Elementary, Carlsbad High School, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2007

Sold by

Meddock Joann and Meddock Mark T

Bought by

Meddock Mark T and Meddock Joann

Current Estimated Value

Purchase Details

Closed on

Nov 29, 2006

Sold by

Meddock Mark T

Bought by

Meddock Mark T and Meddock Joann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Outstanding Balance

$149,553

Interest Rate

6.32%

Mortgage Type

Credit Line Revolving

Estimated Equity

$1,249,749

Purchase Details

Closed on

Sep 3, 1998

Sold by

Meddock Mark T and Ann Jo

Bought by

Meddock Mark T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

6.87%

Purchase Details

Closed on

Feb 27, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meddock Mark T | -- | None Available | |

| Meddock Mark T | -- | First American Title | |

| Meddock Mark T | -- | New Century Title Company | |

| -- | $121,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meddock Mark T | $250,000 | |

| Closed | Meddock Mark T | $146,342 | |

| Closed | Meddock Mark T | $168,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,959 | $277,437 | $83,343 | $194,094 |

| 2024 | $2,959 | $271,998 | $81,709 | $190,289 |

| 2023 | $2,943 | $266,665 | $80,107 | $186,558 |

| 2022 | $2,898 | $261,437 | $78,537 | $182,900 |

| 2021 | $2,877 | $256,312 | $76,998 | $179,314 |

| 2020 | $2,858 | $253,685 | $76,209 | $177,476 |

| 2019 | $2,807 | $248,712 | $74,715 | $173,997 |

| 2018 | $2,690 | $243,836 | $73,250 | $170,586 |

| 2017 | $90 | $239,056 | $71,814 | $167,242 |

| 2016 | $2,540 | $234,369 | $70,406 | $163,963 |

| 2015 | $2,530 | $230,850 | $69,349 | $161,501 |

| 2014 | $2,489 | $226,329 | $67,991 | $158,338 |

Source: Public Records

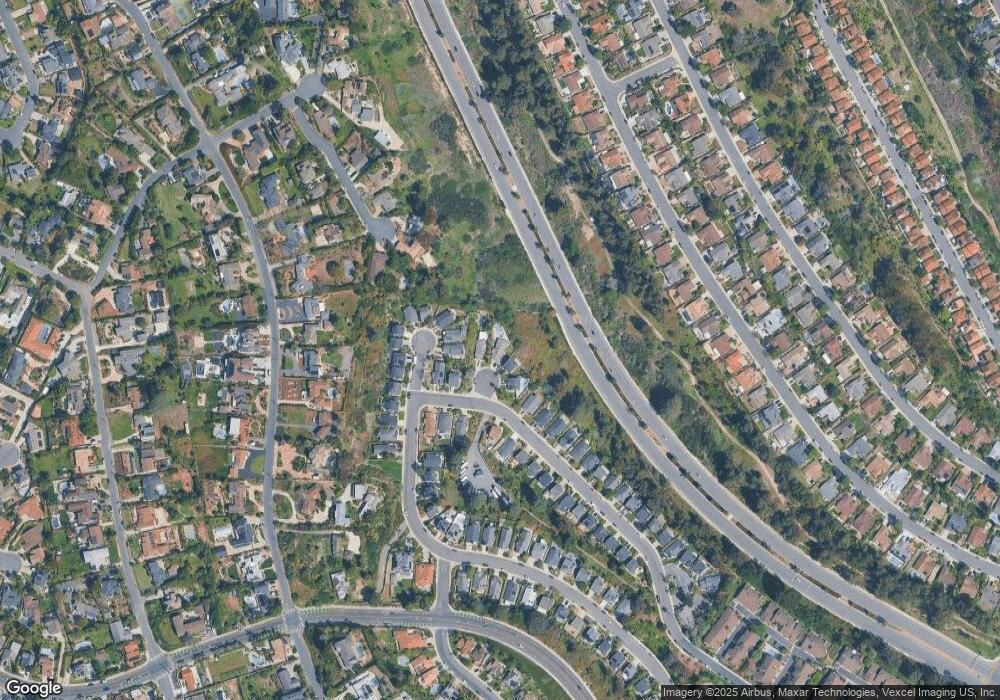

Map

Nearby Homes

- 1816 E Pointe Ave

- 3920 Holly Brae Ln

- 4427 Trieste Dr

- 4143 Sunnyhill Dr

- 4623 Telescope Ave

- 4439 Salisbury Dr

- 2591 Regent Rd Unit 52

- 3736 Donna Ct

- 3721 Donna Ct

- 4640 Sunburst Rd

- 0 Sunny Creek Unit PI25230627

- 4459 Dorchester Place

- 4000 James Dr

- 4814 Refugio Ave

- 1741 Bruce Rd

- 4583 Chancery Ct

- 4672 Catmint Ln

- 2508 Chamomile Ln

- 2513 Delphinium Ln

- 2541 Delphinium Ln

- 1816 W Cliff Ct

- 1808 W Cliff Ct

- 1820 W Cliff Ct

- 1726 E Pointe Ave

- 1732 E Pointe Ave

- 1806 Palisades Dr Unit 2

- 1720 E Pointe Ave

- 1824 Palisades Dr

- 1802 Palisades Dr

- 1828 Palisades Dr

- 1715 E Pointe Ave

- 1821 Palisades Dr

- 1811 Palisades Dr

- 1807 Palisades Dr

- 1832 Palisades Dr

- 1825 Palisades Dr

- 1803 Palisades Dr

- 1721 E Pointe Ave

- 1836 Palisades Dr

- 1829 Palisades Dr