Estimated Value: $208,392 - $259,000

3

Beds

2

Baths

1,525

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 1812 Yellowbrick Rd, Pharr, TX 78577 and is currently estimated at $238,848, approximately $156 per square foot. 1812 Yellowbrick Rd is a home located in Hidalgo County with nearby schools including Raul Longoria Elementary School, Lyndon B. Johnson Middle School, and PSJA North Early College High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2016

Sold by

Rios Reyes and Rios Naomi O

Bought by

Guajardo Lucas and Sanchez Lorena

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,609

Outstanding Balance

$106,549

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$132,299

Purchase Details

Closed on

Feb 27, 2006

Sold by

Garza Ruben and Red Leaf Builders

Bought by

Rios Reyes and Rios Naomi O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,500

Interest Rate

6.19%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 19, 2005

Sold by

V I P Homes Inc

Bought by

Garza Ruben and Red Leaf Builders

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,071

Interest Rate

5.92%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Guajardo Lucas | -- | Valley Land Title Company | |

| Rios Reyes | -- | Charge San Jacinto Title Ser | |

| Garza Ruben | -- | Charge San Jacint Title Serv |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Guajardo Lucas | $129,609 | |

| Previous Owner | Rios Reyes | $106,500 | |

| Previous Owner | Garza Ruben | $74,071 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,054 | $217,214 | $40,590 | $176,624 |

| 2024 | $5,054 | $188,436 | $36,900 | $151,536 |

| 2023 | $5,097 | $190,190 | $36,900 | $153,290 |

| 2022 | $4,807 | $171,377 | $33,600 | $137,777 |

| 2021 | $4,206 | $147,259 | $33,600 | $113,659 |

| 2020 | $3,996 | $138,143 | $33,600 | $104,543 |

| 2019 | $3,753 | $128,080 | $27,000 | $101,080 |

| 2018 | $3,721 | $126,235 | $24,000 | $102,235 |

| 2017 | $3,787 | $127,389 | $24,000 | $103,389 |

| 2016 | $3,800 | $127,852 | $24,000 | $103,852 |

| 2015 | $3,025 | $129,005 | $24,000 | $105,005 |

Source: Public Records

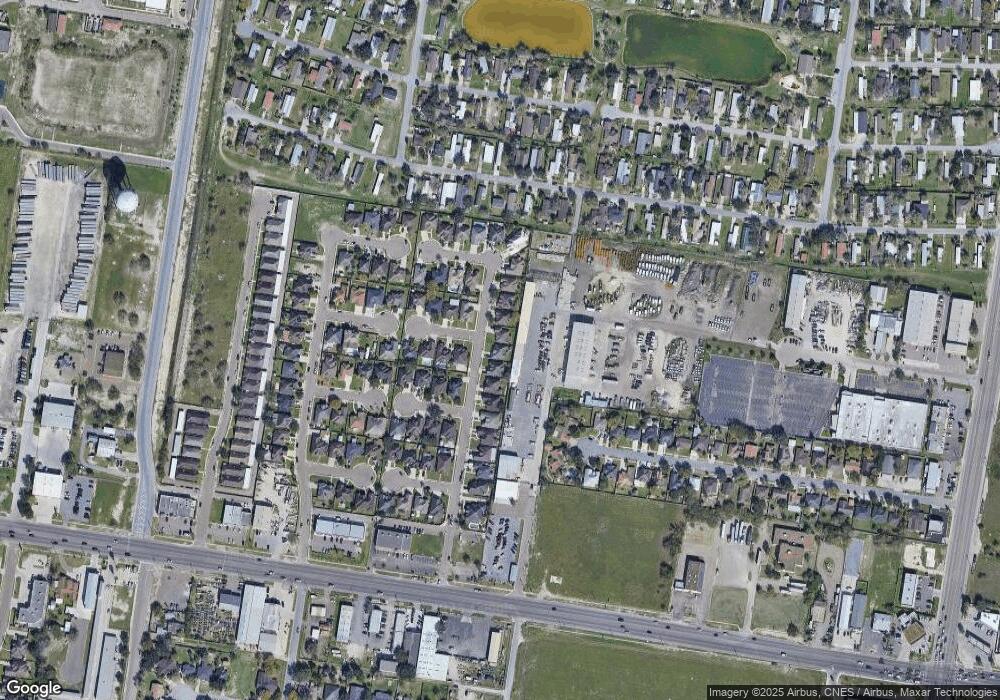

Map

Nearby Homes

- 4713 N Juniper St

- 1909 N Gumwood St

- 1207 Northpoint Dr

- 809 E Ferguson St

- 00 E Ferguson Ave

- 1007 E Bagwell St

- 5704 N Ebony St

- 0 Ferguson Ave Unit 394023

- 204 Lovely Way Ave

- 921 E Alan St

- 0 N I Rd Unit 449451

- 1218 E Alan St

- 1220 E Alan St

- 3705 N Veterans Blvd

- 2023 N Veterans Blvd

- 207 E Diaz Ave

- 4011 N Veterans Blvd

- 601 N Veterans Blvd

- 205 E Lee St

- 3403 N Amaretto Dr

- 1812 N Yellow Brick Rd

- 1900 Yellowbrick Rd

- 1808 Yellowbrick Rd

- 1808 N Yellow Brick Rd

- 1904 N Yellow Brick Rd Unit LOT 13

- 1904 Yellowbrick Rd

- 1804 Yellowbrick Rd

- 1004 Tinman Cir

- 1908 Yellow Brick Rd

- 1005 Tinman Cir

- 1908 Yellowbrick Rd

- 1800 Yellowbrick Rd

- 1800 N Yellow Brick Rd

- 1000 Tinman Cir Unit 33

- 1005 Lion Dr

- 1001 Tinman Cir

- 1912 Yellowbrick Rd

- 1001 Lion Dr

- 1001 Lion Dr Unit 36

- 1716 Yellowbrick Rd