1813 Middleton Way Unit 13A West Palm Beach, FL 33409

Palm Beach Lakes NeighborhoodEstimated Value: $278,000 - $332,000

2

Beds

3

Baths

1,362

Sq Ft

$223/Sq Ft

Est. Value

About This Home

This home is located at 1813 Middleton Way Unit 13A, West Palm Beach, FL 33409 and is currently estimated at $303,679, approximately $222 per square foot. 1813 Middleton Way Unit 13A is a home located in Palm Beach County with nearby schools including Seminole Trails Elementary School, Bear Lakes Middle School, and Palm Beach Lakes Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 3, 2020

Sold by

Moschetto Martin and Moschetto Elaine

Bought by

Enoch Cassondra N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,196

Outstanding Balance

$182,616

Interest Rate

3.5%

Mortgage Type

FHA

Estimated Equity

$121,063

Purchase Details

Closed on

May 20, 2015

Sold by

Fannie Mae

Bought by

Moschetto Martin

Purchase Details

Closed on

Sep 19, 2014

Sold by

Markowski Kevin and Bank Of America Na

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Dec 17, 1996

Sold by

Maureen Michael S and Maureen Smith

Bought by

Markowski Kevin J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Interest Rate

7.77%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 22, 1995

Sold by

Lisa Wayne F and Lisa Barba Simone

Bought by

Smith Michael S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,150

Interest Rate

7.33%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Enoch Cassondra N | $210,000 | Bc Title Inc | |

| Moschetto Martin | $115,000 | Heritage Title Ins Agency In | |

| Federal National Mortgage Association | -- | Attorney | |

| Markowski Kevin J | $85,000 | -- | |

| Smith Michael S | $83,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Enoch Cassondra N | $206,196 | |

| Previous Owner | Smith Michael S | $45,000 | |

| Previous Owner | Smith Michael S | $79,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,844 | $167,741 | -- | -- |

| 2023 | $2,761 | $162,855 | $0 | $0 |

| 2022 | $2,707 | $158,112 | $0 | $0 |

| 2021 | $2,684 | $153,507 | $0 | $153,507 |

| 2020 | $3,614 | $153,507 | $0 | $153,507 |

| 2019 | $3,543 | $148,507 | $0 | $148,507 |

| 2018 | $3,207 | $139,416 | $0 | $139,416 |

| 2017 | $2,950 | $126,416 | $0 | $0 |

| 2016 | $2,767 | $116,416 | $0 | $0 |

| 2015 | $2,839 | $116,416 | $0 | $0 |

Source: Public Records

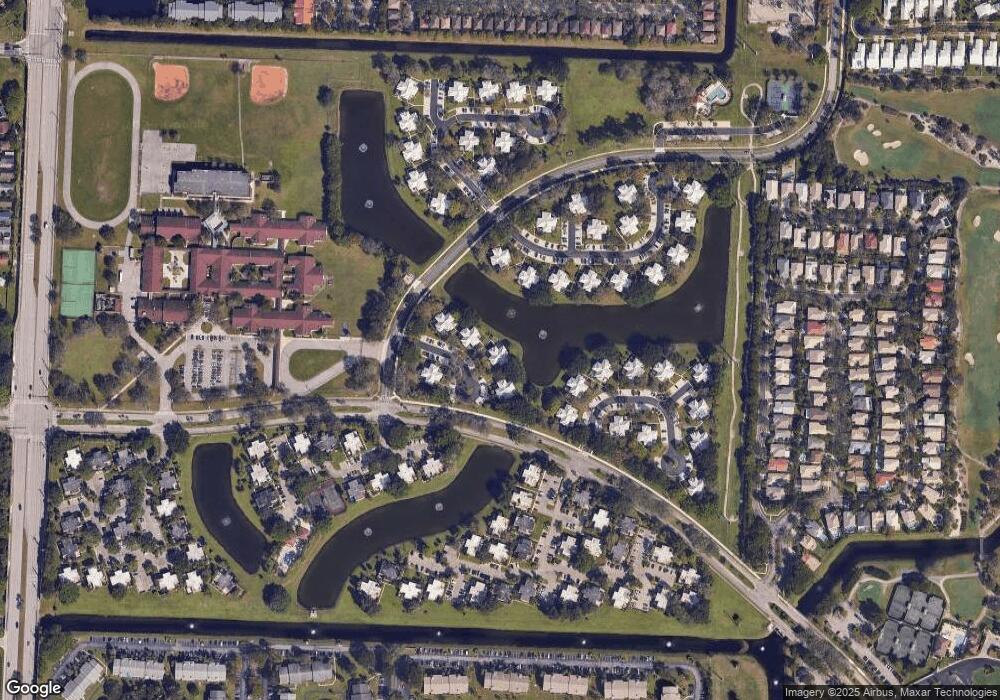

Map

Nearby Homes

- 3104 Kingston Ct

- 3133 Kingston Ct Unit 5A

- 515 Green Springs Place

- 507 Green Springs Place

- 728 Mill Valley Place Unit 728

- 1945 Stratford Way

- 719 Mill Valley Place

- 540 Green Springs Place

- 2076 Cezanne Rd

- 2119 Chagall Cir

- 4083 Lake Tahoe Cir

- 4043 Lake Tahoe Cir

- 2060 Cezanne Rd

- 1104 Green Pine Blvd Unit 42

- 1103 Green Pine Blvd Unit 32

- 4041 San Marino Blvd Unit 307

- 4041 San Marino Blvd Unit 202

- 4021 San Marino Blvd Unit 102

- 1011 Green Pine Blvd Unit 71

- 1102 Green Pine Blvd Unit 81

- 1813 Middleton Way

- 1816 Middleton Way

- 1815 Middleton Way

- 1810 Middleton Way Unit 14B

- 1811 Middleton Way

- 1817 Middleton Way Unit 1817

- 1817 Middleton Way Unit A12

- 1817 Middleton Way

- 1809 Middleton Way Unit 14A

- 1820 Middleton Way Unit 12D

- 1812 Middleton Way Unit 14D

- 1818 Middleton Way Unit 12B

- 1819 Middleton Way

- 1803 Middleton Way Unit 15C

- 1801 Middleton Way Unit 15A

- 1806 Middleton Way

- 1806 Middleton Way Unit 16B

- 1804 Middleton Way

- 1807 Middleton Way Unit 16C

- 1805 Middleton Way