Estimated Value: $275,000 - $341,000

4

Beds

2

Baths

1,641

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 1814 Aspen Ct, Heath, OH 43056 and is currently estimated at $309,569, approximately $188 per square foot. 1814 Aspen Ct is a home located in Licking County with nearby schools including Garfield Elementary School, Stevenson Elementary School, and Heath Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 26, 2021

Sold by

Hammond Michael T and Hammond Wendy J

Bought by

Arnold Katie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$229,500

Outstanding Balance

$208,828

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$100,741

Purchase Details

Closed on

Aug 18, 2010

Sold by

Conlisk Julie Ann

Bought by

Hammond Michael T and Hammond Wendy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,272

Interest Rate

4.6%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Arnold Katie | $255,000 | Ambassador Title | |

| Hammond Michael T | $130,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Arnold Katie | $229,500 | |

| Previous Owner | Hammond Michael T | $128,272 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,537 | $82,220 | $25,660 | $56,560 |

| 2023 | $3,914 | $82,220 | $25,660 | $56,560 |

| 2022 | $3,118 | $57,550 | $14,950 | $42,600 |

| 2021 | $3,182 | $57,550 | $14,950 | $42,600 |

| 2020 | $3,161 | $56,810 | $14,950 | $41,860 |

| 2019 | $2,807 | $51,350 | $14,950 | $36,400 |

| 2018 | $2,837 | $0 | $0 | $0 |

| 2017 | $2,765 | $0 | $0 | $0 |

| 2016 | $2,649 | $0 | $0 | $0 |

| 2015 | $2,694 | $0 | $0 | $0 |

| 2014 | $3,789 | $0 | $0 | $0 |

| 2013 | $2,486 | $0 | $0 | $0 |

Source: Public Records

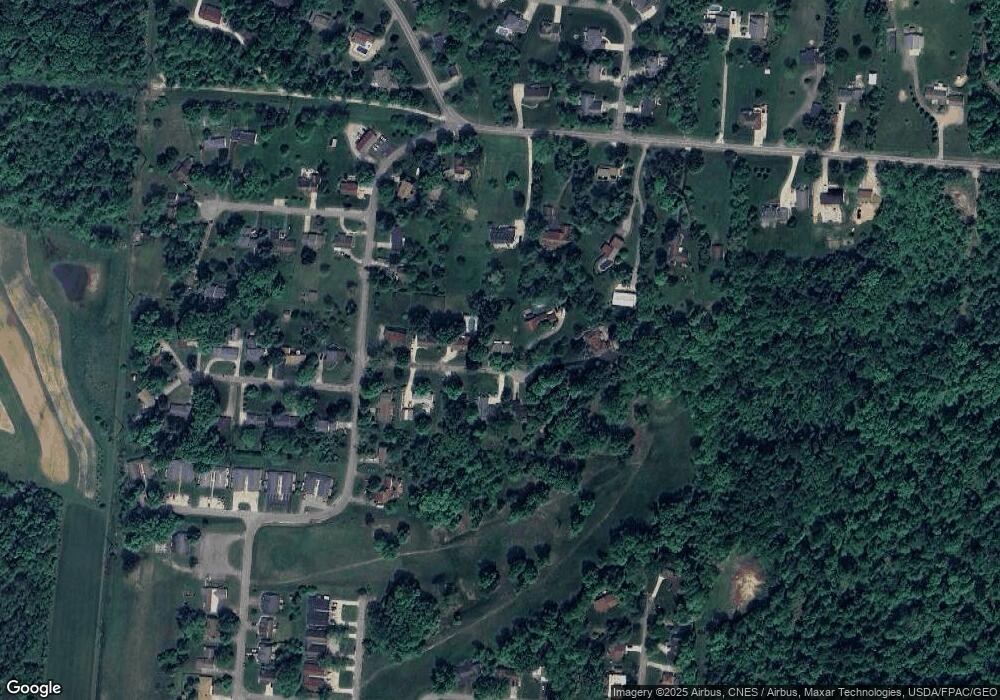

Map

Nearby Homes

- 1933 Blue Jay Rd

- 606 Kimberly Ct

- 0 Cumberland Crest

- 1782 Cumberland Crest

- 5185 Linnville Rd

- 793 Francis Dr

- 748 Francis Dr

- Yosemite Plan at Heron Manor - Maple Street Collection

- Cumberland Plan at Heron Manor - Maple Street Collection

- Wesley Plan at Linnview Crossing - Maple Street Collection

- Breckenridge Plan at Heron Manor - Maple Street Collection

- Yosemite Plan at Linnview Crossing - Maple Street Collection

- DaVinci Plan at Heron Manor - Maple Street Collection

- Fairfax Plan at Linnview Crossing - Maple Street Collection

- Greenbriar Plan at Linnview Crossing - Maple Street Collection

- Jensen Plan at Linnview Crossing - Maple Street Collection

- Jensen Plan at Heron Manor - Maple Street Collection

- Cumberland Plan at Linnview Crossing - Maple Street Collection

- Wesley Plan at Heron Manor - Maple Street Collection

- Preston Plan at Heron Manor - Maple Street Collection

- 1802 Aspen Ct

- 1822 Aspen Ct

- 1792 Aspen Ct

- 1827 Aspen Ct

- 1811 Aspen Ct

- 1825 Blue Jay Rd

- 1819 Aspen Ct

- 1830 Aspen Ct

- 746 Forest Hills Rd

- 1780 Aspen Ct

- 1789 Aspen Ct

- 1851 Blue Jay Rd

- 730 Forest Hills Rd

- 1873 Blue Jay Rd

- 794 Forest Hills Rd

- 800 Forest Hills Rd

- 1764 Fir Ct

- 720 Forest Hills Rd

- 1763 Evergreen Ct

- 1835 Blue Jay Rd