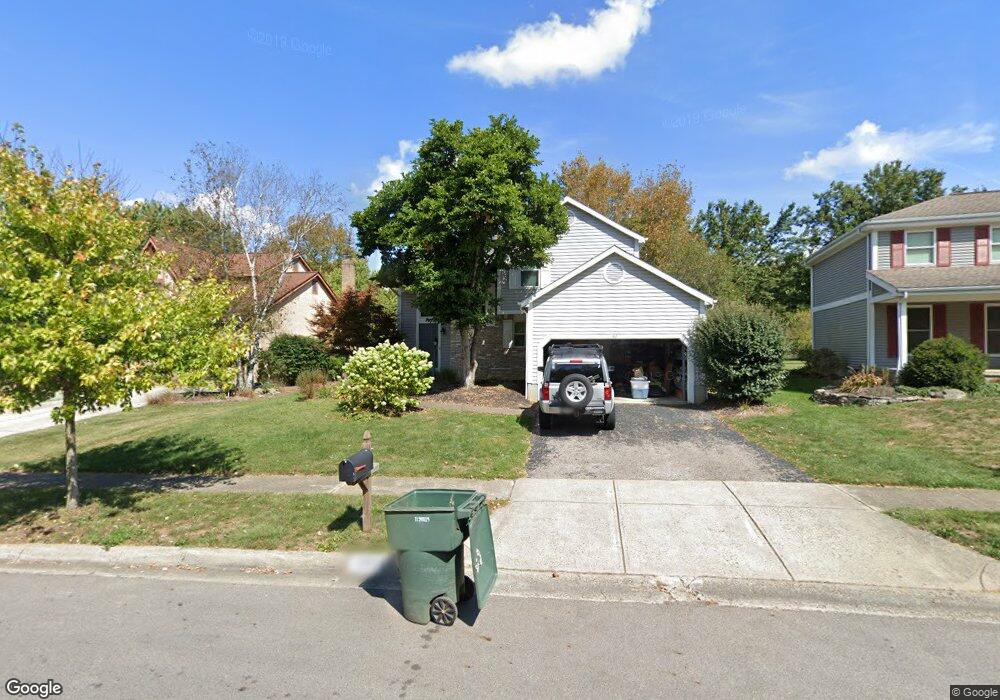

182 Brownsfell Dr Columbus, OH 43235

Village at Worthington NeighborhoodEstimated Value: $386,000 - $433,000

3

Beds

3

Baths

1,430

Sq Ft

$284/Sq Ft

Est. Value

About This Home

This home is located at 182 Brownsfell Dr, Columbus, OH 43235 and is currently estimated at $406,727, approximately $284 per square foot. 182 Brownsfell Dr is a home located in Franklin County with nearby schools including Slate Hill Elementary School, Worthingway Middle School, and Thomas Worthington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2006

Sold by

Baird Steven L and Baird Lori K

Bought by

Beckner Evans Derek E and Beckner Evans Kara M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Outstanding Balance

$110,012

Interest Rate

6.68%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$296,715

Purchase Details

Closed on

Dec 27, 2004

Sold by

Bishop Monica L and Moses Monica L

Bought by

Baird Steven L and Baird Lori K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,200

Interest Rate

5.82%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 29, 2001

Sold by

Theibert Charlotte L

Bought by

Bishop Monica L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,600

Interest Rate

7.18%

Purchase Details

Closed on

Oct 27, 1988

Bought by

Theibert Charlotte L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Beckner Evans Derek E | $185,000 | Col Title | |

| Baird Steven L | $172,500 | Family Fir | |

| Bishop Monica L | $152,500 | Esquire Title | |

| Theibert Charlotte L | $111,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Beckner Evans Derek E | $185,000 | |

| Closed | Baird Steven L | $137,200 | |

| Previous Owner | Bishop Monica L | $129,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,935 | $112,950 | $33,500 | $79,450 |

| 2023 | $6,631 | $112,945 | $33,495 | $79,450 |

| 2022 | $5,920 | $80,010 | $23,100 | $56,910 |

| 2021 | $5,462 | $80,010 | $23,100 | $56,910 |

| 2020 | $5,261 | $80,010 | $23,100 | $56,910 |

| 2019 | $4,794 | $65,800 | $19,250 | $46,550 |

| 2018 | $4,379 | $65,800 | $19,250 | $46,550 |

| 2017 | $4,296 | $65,800 | $19,250 | $46,550 |

| 2016 | $4,113 | $57,930 | $17,540 | $40,390 |

| 2015 | $4,114 | $57,930 | $17,540 | $40,390 |

| 2014 | $4,112 | $57,930 | $17,540 | $40,390 |

| 2013 | $2,046 | $57,925 | $17,535 | $40,390 |

Source: Public Records

Map

Nearby Homes

- 164 Cameron Ridge Dr Unit 164

- 365 Cover Place

- 0 Pocono Rd Unit 225030021

- 128 Green Springs Dr

- 67 Highland Pointe Cir Unit 67

- 90 Northwoods Blvd Unit B

- 7981 Oakwind Ct

- 8326 Bruntsfield Rd

- 580 Mawyer Dr Unit 132

- 716 Alta View Ct Unit 33

- 294 Lazelle Place Ln Unit Q294

- 7697 Barkwood Dr Unit 1D

- 737 Plant Dr Unit 2-C

- 836 Noddymill Ln W Unit 42C

- 874 Charnwood Ln Unit 5D

- 889 Pelham Ct

- 7850 Malton Ln Unit 14E

- 7634 Kelvinway Dr Unit 150

- 7685 Whitneyway Dr Unit 17

- 8747 Olenbrook Dr

- 188 Brownsfell Dr

- 176 Brownsfell Dr

- 170 Brownsfell Dr

- 194 Brownsfell Dr

- 177 Brownsfell Dr

- 193 Brownsfell Dr

- 171 Brownsfell Dr

- 185 Brownsfell Dr

- 7980 Flint Rd

- 200 Brownsfell Dr

- 199 Brownsfell Dr

- 206 Brownsfell Dr

- 205 Brownsfell Dr

- 212 Brownsfell Dr

- 211 Brownsfell Dr

- 75 Park Rd

- 218 Brownsfell Dr

- 7977 Leaview Dr

- 178 Collier Ridge Dr Unit 178

- 217 Brownsfell Dr