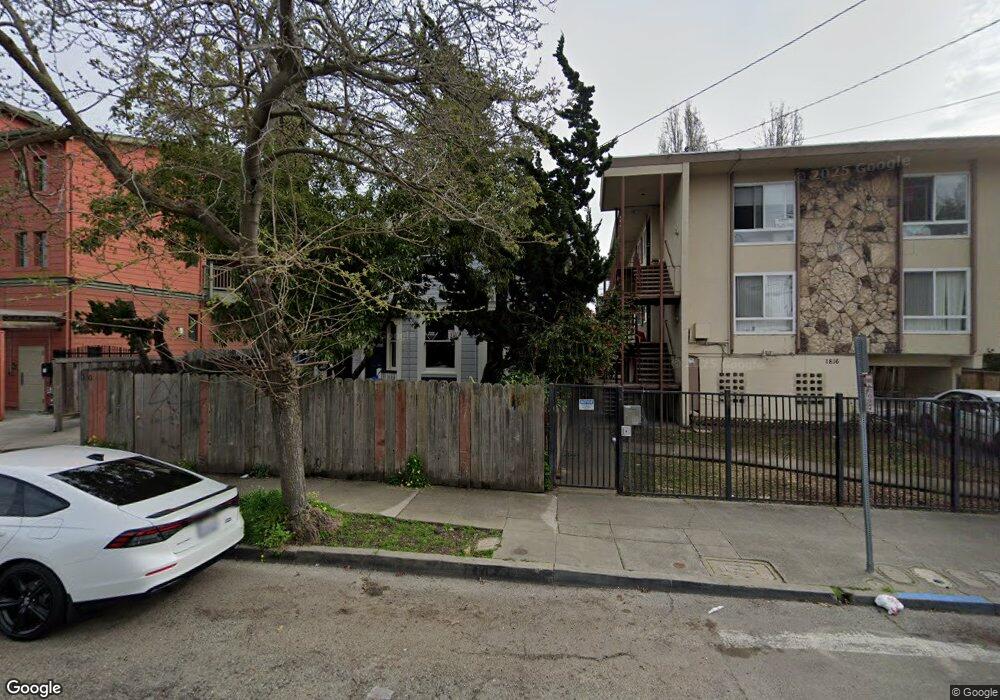

1820 Fairview St Berkeley, CA 94703

South Berkeley NeighborhoodEstimated Value: $995,000 - $1,237,000

3

Beds

1

Bath

1,734

Sq Ft

$627/Sq Ft

Est. Value

About This Home

This home is located at 1820 Fairview St, Berkeley, CA 94703 and is currently estimated at $1,087,248, approximately $627 per square foot. 1820 Fairview St is a home located in Alameda County with nearby schools including Malcolm X Elementary School, Emerson Elementary School, and John Muir Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2013

Sold by

Depierris Marta

Bought by

Marta De Pierris Trust

Current Estimated Value

Purchase Details

Closed on

Nov 1, 2004

Sold by

Depierris Marta

Bought by

Depierris Marta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$344,500

Interest Rate

5.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 4, 1995

Sold by

First National Mtg Company

Bought by

Depierris Marta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,200

Interest Rate

7.47%

Purchase Details

Closed on

Sep 27, 1994

Sold by

First National Mtg Company

Bought by

First National Mtg Company

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marta De Pierris Trust | -- | None Available | |

| Depierris Marta | -- | Financial Title Company | |

| Depierris Marta | $68,000 | Fidelity National Title Ins | |

| First National Mtg Company | $173,115 | North American Title Co Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Depierris Marta | $344,500 | |

| Previous Owner | Depierris Marta | $61,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,490 | $112,958 | $33,887 | $79,071 |

| 2024 | $5,490 | $110,743 | $33,223 | $77,520 |

| 2023 | $5,292 | $108,572 | $32,571 | $76,001 |

| 2022 | $5,285 | $106,444 | $31,933 | $74,511 |

| 2021 | $5,250 | $104,357 | $31,307 | $73,050 |

| 2020 | $4,872 | $103,287 | $30,986 | $72,301 |

| 2019 | $4,554 | $101,262 | $30,378 | $70,884 |

| 2018 | $4,414 | $99,277 | $29,783 | $69,494 |

| 2017 | $4,231 | $97,331 | $29,199 | $68,132 |

| 2016 | $3,975 | $95,423 | $28,627 | $66,796 |

| 2015 | $3,889 | $93,990 | $28,197 | $65,793 |

| 2014 | $3,749 | $92,150 | $27,645 | $64,505 |

Source: Public Records

Map

Nearby Homes

- 3233 Ellis St

- 3033 Ellis St Unit B

- 3138 California St

- 882 61st St

- 6555 Shattuck Ave

- 6015 Adeline St

- 619 62nd St

- 5936 Martin Luther King jr Way

- 6320 Shattuck Ave

- 2926 Ellis St

- 3224 Sacramento St

- 5914 Martin Luther King jr Way

- 3101 Sacramento St

- 722 59th St

- 1507 Prince St

- 1538 Ashby Ave

- 2057 Emerson St

- 960 62nd St

- 852 58th St

- 629 66th St

- 1816 Fairview St Unit 5

- 1816 Fairview St

- 1826 Fairview St

- 1829 Harmon St

- 1810 Fairview St

- 3212 Adeline St

- 1835 Harmon St

- 3228 Adeline St

- 3218 Adeline St

- 1823 Harmon St

- 1821 Fairview St

- 1831 Harmon St

- 1825 Harmon St

- 1831-1835 Harmon St

- 1823 Fairview St

- 3207 Ellis St

- 1817 Fairview St

- 1809 Fairview St

- 1815 Fairview St Unit 2

- 1815 Fairview St Unit 2