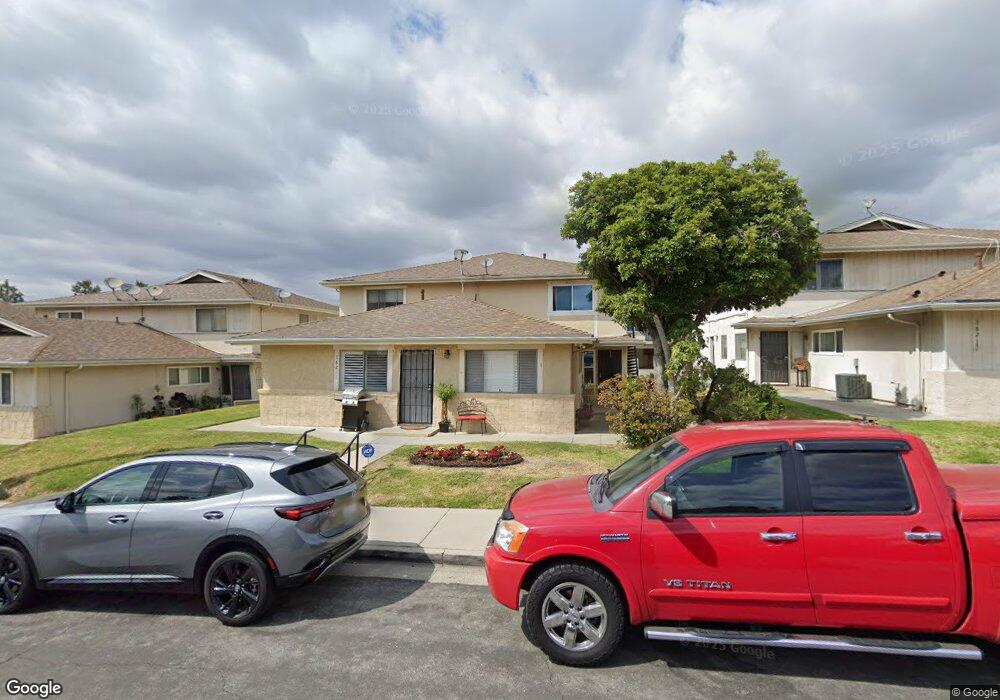

18211 Via Calma Unit 1 Rowland Heights, CA 91748

Estimated Value: $418,000 - $538,000

2

Beds

1

Bath

758

Sq Ft

$594/Sq Ft

Est. Value

About This Home

This home is located at 18211 Via Calma Unit 1, Rowland Heights, CA 91748 and is currently estimated at $450,624, approximately $594 per square foot. 18211 Via Calma Unit 1 is a home located in Los Angeles County with nearby schools including Rowland Elementary School, Alvarado Intermediate School, and John A. Rowland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2018

Sold by

Hansen David Carl and Frank J Pettey Irrevocable Tru

Bought by

Hansen David and Hansen Tracy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,125

Outstanding Balance

$253,205

Interest Rate

4.6%

Mortgage Type

New Conventional

Estimated Equity

$197,419

Purchase Details

Closed on

Jun 21, 2018

Sold by

Hansen David and Hansen Tracy

Bought by

Traslavina Melinda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,125

Outstanding Balance

$253,205

Interest Rate

4.6%

Mortgage Type

New Conventional

Estimated Equity

$197,419

Purchase Details

Closed on

Feb 28, 2018

Sold by

Hansen Tracy Suzanne

Bought by

Hansen David and Hansen Tracy

Purchase Details

Closed on

Feb 24, 2015

Sold by

Pettey Frank J

Bought by

The Frank J Pettey Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hansen David | -- | Fidelity National Title | |

| Hansen David Carl | -- | Fidelity National Title | |

| Traslavina Melinda | $307,500 | Fidelity National Title | |

| Hansen Tracy Suzanne | -- | Fidelity National Title | |

| Hansen David | -- | None Available | |

| Hansen Tracy Suzanne | -- | None Available | |

| The Frank J Pettey Revocable Trust | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Traslavina Melinda | $292,125 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,517 | $349,876 | $212,089 | $137,787 |

| 2024 | $4,517 | $343,017 | $207,931 | $135,086 |

| 2023 | $4,367 | $336,292 | $203,854 | $132,438 |

| 2022 | $4,270 | $329,699 | $199,857 | $129,842 |

| 2021 | $4,200 | $323,236 | $195,939 | $127,297 |

| 2019 | $4,074 | $313,650 | $190,128 | $123,522 |

| 2018 | $1,641 | $109,309 | $21,852 | $87,457 |

| 2016 | $1,573 | $105,066 | $21,004 | $84,062 |

| 2015 | $1,550 | $103,489 | $20,689 | $82,800 |

| 2014 | $1,552 | $101,463 | $20,284 | $81,179 |

Source: Public Records

Map

Nearby Homes

- 1912 Tomas Ct

- 18186 Rio Seco Dr

- 1808 Via Entrada

- 1902 Jellick Ave

- 2010 La Cueva Dr

- 18239 Villa Clara St

- 2474 Patrician View Ave

- 17834 Calle Los Arboles

- 1971 Via Tranquilo

- 18220 Gallineta St

- 2362 Cuatro Dr

- 2330 Donosa Dr

- 18716 Greengate St

- 2306 Doubletree Ln

- 18620 Mescalero St

- 2426 Batson Ave

- 2453 Fullerton Rd

- 18557 Mescal St

- 17812 Gallineta St

- 18536 Mescal St

- 18211 Via Calma Unit 4

- 18211 Via Calma Unit 3

- 18211 Via Calma Unit 2

- 18205 Via Calma Unit 4

- 18205 Via Calma Unit 3

- 18205 Via Calma Unit 2

- 18205 Via Calma Unit 1

- 18217 Via Calma Unit 4

- 18217 Via Calma Unit 3

- 18217 Via Calma Unit 2

- 18217 Via Calma Unit 1

- 18223 Via Calma Unit 4

- 18223 Via Calma

- 18223 Via Calma Unit 3

- 18223 Via Calma Unit 2

- 18223 Via Calma Unit 1

- 18124 Camino Bello Unit 1

- 18124 Camino Bello Unit 2

- 18124 Camino Bello Unit 4

- 18124 Camino Bello Unit 3