18242 Parkview Ln Unit 61 Huntington Beach, CA 92648

Estimated Value: $382,635 - $520,000

1

Bed

1

Bath

593

Sq Ft

$729/Sq Ft

Est. Value

About This Home

This home is located at 18242 Parkview Ln Unit 61, Huntington Beach, CA 92648 and is currently estimated at $432,159, approximately $728 per square foot. 18242 Parkview Ln Unit 61 is a home located in Orange County with nearby schools including Hope View Elementary School, Mesa View Middle School, and Ocean View High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2020

Sold by

Lee Christine Haeeun

Bought by

Lee Justin Jin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$167,512

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$264,647

Purchase Details

Closed on

Dec 19, 2019

Sold by

Shoemaker Carol and The Christine Davey Trust

Bought by

Lee Hae Sung and Lee Jutin Jin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$167,512

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$264,647

Purchase Details

Closed on

Jun 28, 2019

Sold by

Davey Christine

Bought by

Davey Christine and Christine Davey Family Trust

Purchase Details

Closed on

Oct 17, 2006

Sold by

Cavener James E and Cavener Marilyn J

Bought by

Davey Christine Ruth

Purchase Details

Closed on

Oct 16, 1998

Sold by

Cavener James E and Cavener Marilyn J

Bought by

Cavener James E and Cavener Marilyn J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Justin Jin | -- | Western Resources Title | |

| Lee Hae Sung | $272,000 | Western Resources Title | |

| Davey Christine | -- | None Available | |

| Davey Christine Ruth | $252,000 | Equity Title Company | |

| Cavener James E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lee Hae Sung | $190,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,581 | $297,469 | $243,007 | $54,462 |

| 2024 | $3,581 | $291,637 | $238,242 | $53,395 |

| 2023 | $3,498 | $285,919 | $233,570 | $52,349 |

| 2022 | $3,444 | $280,313 | $228,990 | $51,323 |

| 2021 | $3,382 | $274,817 | $224,500 | $50,317 |

| 2020 | $1,459 | $107,500 | $45,452 | $62,048 |

| 2019 | $1,437 | $105,393 | $44,561 | $60,832 |

| 2018 | $1,407 | $103,327 | $43,687 | $59,640 |

| 2017 | $1,384 | $101,301 | $42,830 | $58,471 |

| 2016 | $1,334 | $99,315 | $41,990 | $57,325 |

| 2015 | $1,313 | $97,824 | $41,360 | $56,464 |

| 2014 | $1,286 | $95,908 | $40,550 | $55,358 |

Source: Public Records

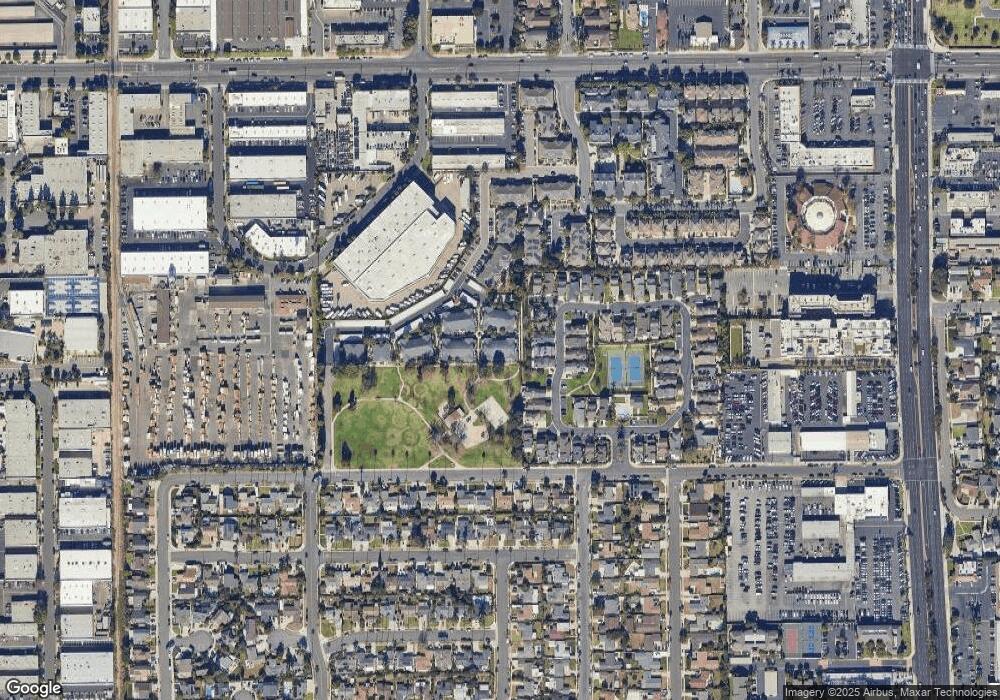

Map

Nearby Homes

- 18272 Parkview Ln Unit 101

- 18232 Parkview Ln Unit 103

- 7827 Orchid Dr

- 7841 Essex Dr Unit 201

- 7702 Alberta Dr

- 7802 Newman Ave

- 7667 Whitewater Dr

- 7792 Liberty Dr

- 18441 Patterson Ln

- 18101 Wharton Ln

- 7942 Speer Dr

- 17722 Sergio Cir Unit 104

- 17722 Sergio Cir Unit 203

- 7850 Slater Ave Unit 31

- 7850 Slater Ave Unit 99

- 7850 Slater Ave Unit 21

- 17661 Sergio Cir Unit 103

- 18507 Pueblo Cir

- 17641 Sergio Cir Unit 203

- 18021 Gulf Ln

- 18242 Parkview Ln Unit 201

- 18242 Parkview Ln

- 18242 Parkview Ln Unit 203

- 18242 Parkview Ln Unit 107

- 18242 Parkview Ln Unit 104

- 18242 Parkview Ln Unit 53

- 18242 Parkview Ln Unit 207

- 18242 Parkview Ln Unit 204

- 18242 Parkview Ln Unit 102

- 18242 Parkview Ln Unit 205

- 18242 Parkview Ln Unit 50

- 18242 Parkview Ln Unit 101

- 18242 Parkview Ln Unit 202

- 18242 Parkview Ln Unit 204

- 18242 Parkview Ln Unit 106

- 18242 Parkview Ln Unit 55

- 18242 Parkview Ln Unit 108

- 18242 Parkview Ln Unit 206

- 18242 Parkview Ln Unit 57

- 18242 Parkview Ln Unit 208