1825 NW 44th St Unit 1825 Ocala, FL 34475

Northwest Ocala NeighborhoodEstimated Value: $252,000 - $397,000

3

Beds

2

Baths

1,854

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 1825 NW 44th St Unit 1825, Ocala, FL 34475 and is currently estimated at $309,878, approximately $167 per square foot. 1825 NW 44th St Unit 1825 is a home located in Marion County with nearby schools including Shady Hill Elementary School, Howard Middle School, and Vanguard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2014

Sold by

Quezada Crispin Hernandez

Bought by

Quezada Crispin Hernandez and Hernandez Diana

Current Estimated Value

Purchase Details

Closed on

Dec 12, 2013

Sold by

Caledonian Investments Llc

Bought by

Fulton Alison

Purchase Details

Closed on

May 15, 2012

Sold by

Torres Kim

Bought by

Caledonian Investments Llc

Purchase Details

Closed on

Feb 4, 2006

Sold by

Shehan Sherry L and Williams Alissa D

Bought by

Torres Kim and Torres Reinaldo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

7.75%

Mortgage Type

Balloon

Purchase Details

Closed on

Nov 10, 2005

Sold by

Shehan Sherry L

Bought by

Shehan Sherry L and Williams Alissa D

Purchase Details

Closed on

Aug 19, 2005

Sold by

Travis Sawin Nancy L

Bought by

Shehan Sherry L

Purchase Details

Closed on

Feb 12, 2005

Sold by

Sawin Ralph L

Bought by

Sawin Ralph L and Shehan Sherry L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Quezada Crispin Hernandez | -- | Attorney | |

| Quezada Crispin Hernandez | -- | Attorney | |

| Quezada Crispin Hernandez | $108,000 | Attorney | |

| Fulton Alison | $60,200 | Attorney | |

| Caledonian Investments Llc | $60,400 | Attorney | |

| Torres Kim | $250,000 | In Town Title Llc | |

| Shehan Sherry L | -- | -- | |

| Shehan Sherry L | -- | -- | |

| Sawin Ralph L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Torres Kim | $225,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,168 | $159,310 | -- | -- |

| 2023 | $2,110 | $154,670 | $0 | $0 |

| 2022 | $2,049 | $150,165 | $0 | $0 |

| 2021 | $2,043 | $145,791 | $0 | $0 |

| 2020 | $2,024 | $143,778 | $0 | $0 |

| 2019 | $1,991 | $140,545 | $0 | $0 |

| 2018 | $1,890 | $137,924 | $0 | $0 |

| 2017 | $1,855 | $135,087 | $0 | $0 |

| 2016 | $1,816 | $132,309 | $0 | $0 |

| 2015 | $1,825 | $131,389 | $0 | $0 |

| 2014 | $2,275 | $127,382 | $0 | $0 |

Source: Public Records

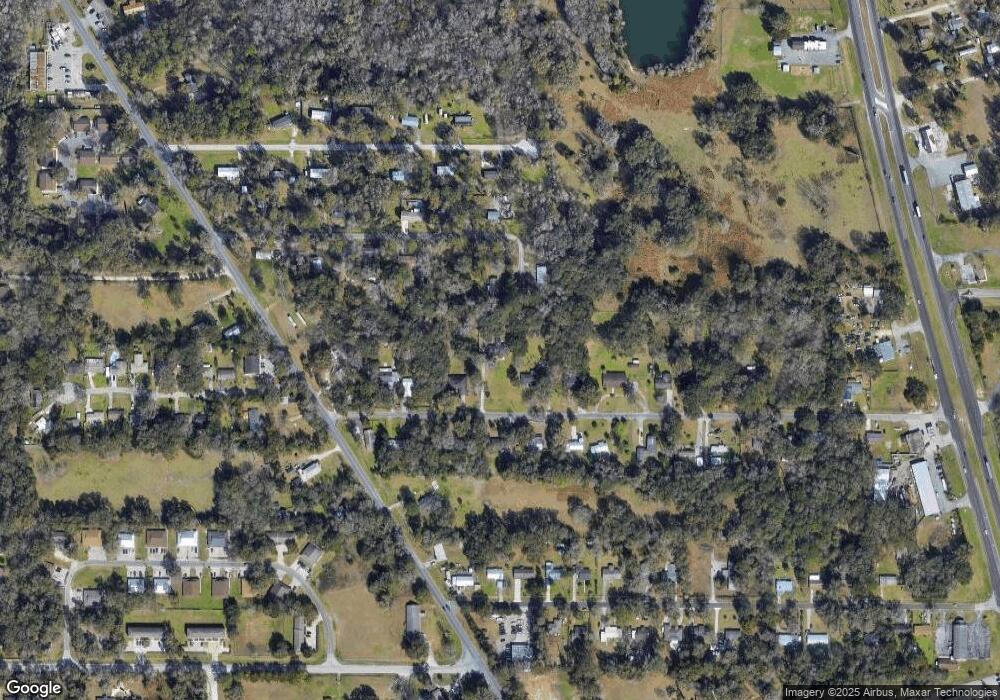

Map

Nearby Homes

- 1620 NW 44th St

- 4051 NW 19th Ave

- 4296 NW 21st Ave

- 4810 NW 11th Ct

- 1210 NW 42nd Ln

- 4925 N Us Highway 441

- 2025 NW 39th St

- 0 NW 40th St

- 1110 NW 42nd Ln

- 972 NW 46th Place

- 4520 NW 37th St

- 4488 NW 37th St

- 4480 NW 37th St

- 891 NW 44th Street Rd

- 4555 NW 6th Cir

- 2242 NW 23rd Rd

- 2274 NW 23rd Rd

- 2258 NW 23rd Rd

- 2523 NW 23rd Ave

- 2460 NW 23rd Ave

- 1773 NW 44th St

- 1839 NW 44th St

- 1800 NW 46th St

- 1824 NW 44th St

- 1917 NW 44th St

- 1836 NW 44th St

- 1802 NW 44th St

- 4575 NW 17th Terrace

- 1921 NW 44th St

- 1910 NW 44th St

- 1900 NW 44th St

- 1760 NW 44th St

- 1721 NW 44th St

- 1918 NW 44th St

- 1840 NW 46th St

- 1748 NW 44th St

- 4505 NW 19th Ave

- 1805 NW 46th St

- 1825 NW 46th St

- 4325 NW Gainesville Rd