1830 Hanging Tree Ln Unit 53 Templeton, CA 93465

Estimated Value: $2,430,512 - $2,750,000

4

Beds

4

Baths

4,294

Sq Ft

$602/Sq Ft

Est. Value

About This Home

This home is located at 1830 Hanging Tree Ln Unit 53, Templeton, CA 93465 and is currently estimated at $2,582,878, approximately $601 per square foot. 1830 Hanging Tree Ln Unit 53 is a home located in San Luis Obispo County with nearby schools including Pat Butler Elementary School, George H. Flamson Middle School, and Paso Robles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2024

Sold by

David Morgan Jones 2014 Revocable Trust and Johnson Karen

Bought by

2002 Schultz Family Trust and Schultz

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,610,000

Outstanding Balance

$1,590,770

Interest Rate

6.99%

Mortgage Type

New Conventional

Estimated Equity

$992,108

Purchase Details

Closed on

May 15, 2014

Sold by

Jones David Morgan and Jones David M

Bought by

Jones David Morgan

Purchase Details

Closed on

Sep 8, 2010

Sold by

Jones Rorie A

Bought by

Jones David M

Purchase Details

Closed on

Aug 13, 2009

Sold by

Castro Nancy S

Bought by

Castro Javier D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.3%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 10, 2009

Sold by

Castro Edward A and Castro Jesus B

Bought by

Jones David M and Jones Rorie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.3%

Mortgage Type

Unknown

Purchase Details

Closed on

Jan 23, 2006

Sold by

Castro Edward and Castro Jesus B

Bought by

Castro Edward A and Castro Jesus B

Purchase Details

Closed on

Oct 26, 2004

Sold by

Castro Irma Perez

Bought by

Castro Edward

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

5.37%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 12, 2004

Sold by

Hilliard Development Llc

Bought by

Castro Edward and Castro Jesus B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

5.37%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 11, 2004

Sold by

Weyrich Development Co Inc

Bought by

Hilliard Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

5.37%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 2002 Schultz Family Trust | $2,300,000 | Placer Title | |

| Jones David Morgan | -- | None Available | |

| Jones David M | -- | None Available | |

| Castro Javier D | -- | Fidelity National Title Co | |

| Jones David M | $1,000,000 | Fidelity National Title Co | |

| Castro Edward A | -- | Public | |

| Castro Edward | -- | Cuesta Title Company | |

| Castro Edward | $400,000 | Cuesta Title Company | |

| Hilliard Development Llc | $347,000 | Cuesta Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | 2002 Schultz Family Trust | $1,610,000 | |

| Previous Owner | Jones David M | $100,000 | |

| Previous Owner | Castro Edward | $380,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $26,981 | $2,300,000 | $600,000 | $1,700,000 |

| 2024 | $13,412 | $2,500,000 | $600,000 | $1,900,000 |

| 2023 | $13,412 | $1,240,685 | $434,237 | $806,448 |

| 2022 | $13,106 | $1,216,359 | $425,723 | $790,636 |

| 2021 | $12,847 | $1,192,510 | $417,376 | $775,134 |

| 2020 | $12,715 | $1,180,283 | $413,097 | $767,186 |

| 2019 | $12,464 | $1,157,142 | $404,998 | $752,144 |

| 2018 | $12,218 | $1,134,454 | $397,057 | $737,397 |

| 2017 | $11,441 | $1,112,211 | $389,272 | $722,939 |

| 2016 | $11,215 | $1,090,404 | $381,640 | $708,764 |

| 2015 | $11,043 | $1,074,026 | $375,908 | $698,118 |

| 2014 | $10,626 | $1,052,988 | $368,545 | $684,443 |

Source: Public Records

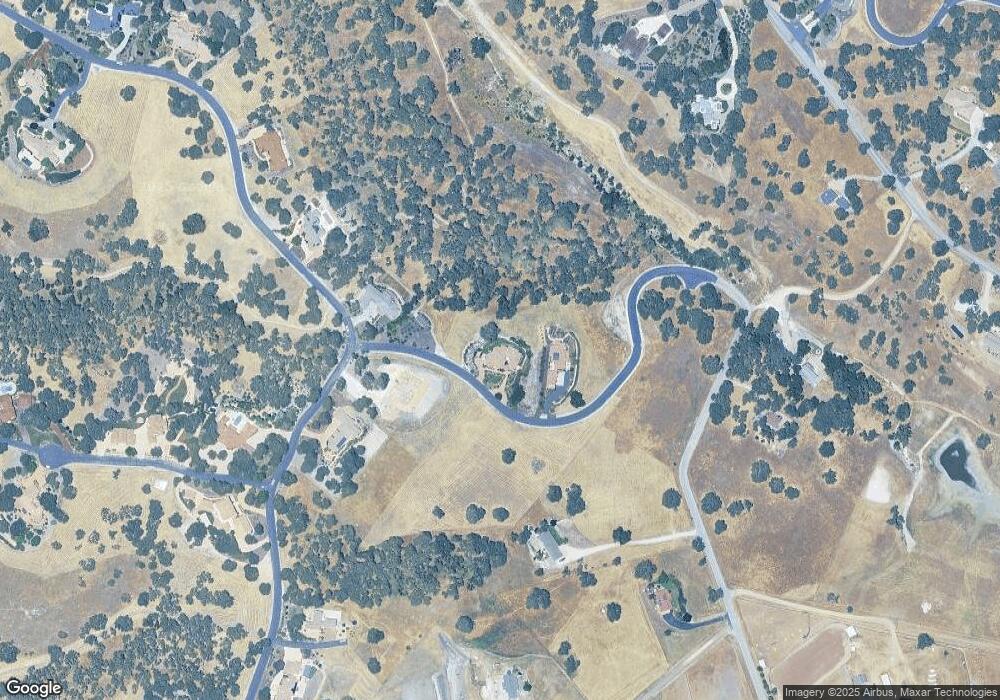

Map

Nearby Homes

- 2438 Battering Rock Rd

- 2264 Lake Ysabel Rd

- 2220 Battering Rock Rd

- 2035 Calle Pattito

- 1920 Fire Rock Loop

- 1655 Barley Grain Rd

- 1505 Barley Grain Rd

- 1880 Fire Rock Loop

- 698 Vaquero Rd

- 1810 LOT 28 Fire Rock Loop

- 1320 Fire Rock Loop

- 1410 Fire Rock Loop

- 880 Tracy Ln

- 829 Saint Andrews Cir

- 320 Cool Valley Dr

- 2483 Starling Ct

- 0 Volpi Ysabel Rd

- 204 Nighthawk Dr

- 911 Saint Ann Dr

- 155 Cow Meadow Place

- 1830 Hanging Tree Ln

- 1870 Hanging Tree Ln Unit 52

- 1870 Hanging Tree Ln Unit 52

- 1870 Hanging Tree Ln

- 1755 Hanging Tree Ln

- 1750 Hanging Tree Ln

- 1750 Hanging Tree Ln Unit 54

- 1855 Hanging Tree Ln Unit 82

- 1855 Hanging Tree Ln

- 1990 Burnt Rock Way Unit 84

- 1990 Burnt Rock Way

- 2085 Hanging Tree Ln

- 2488 Battering Rock Rd Unit 55

- 2488 Battering Rock Rd

- 1860 Burnt Rock Way Unit 96

- 1860 Burnt Rock Way

- 1650 Bunkhouse Ct Unit 85

- 1650 Bunkhouse Ct

- 2075 Hanging Tree Ln

- 2550 River Rd

Your Personal Tour Guide

Ask me questions while you tour the home.