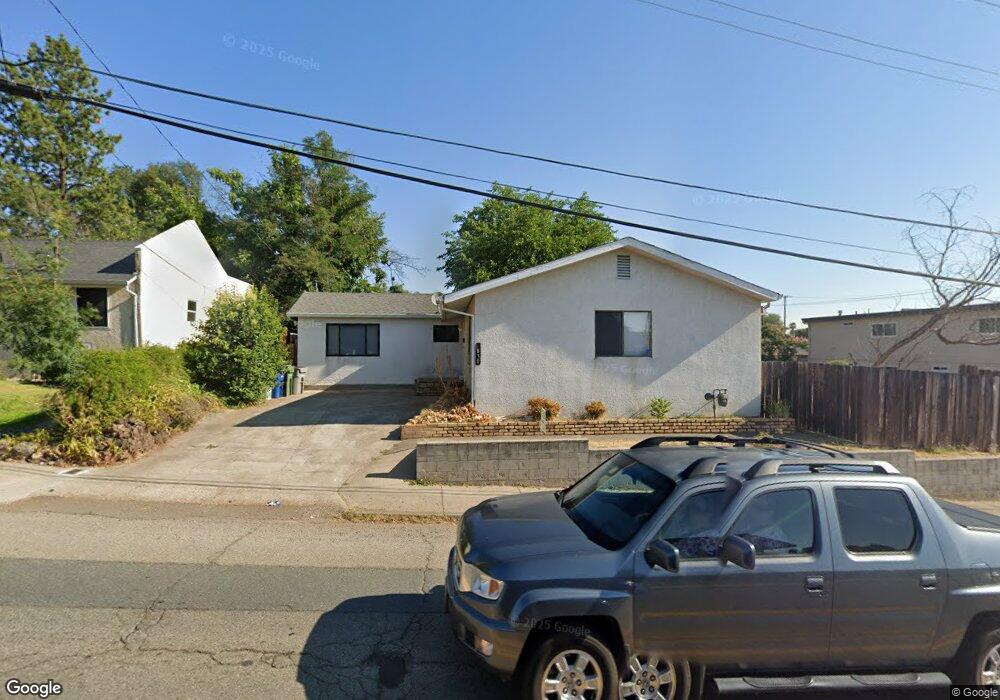

1830 Rosaline Ave Redding, CA 96001

Greenwood NeighborhoodEstimated Value: $255,000 - $347,000

Studio

--

Bath

1,750

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 1830 Rosaline Ave, Redding, CA 96001 and is currently estimated at $295,798, approximately $169 per square foot. 1830 Rosaline Ave is a home located in Shasta County with nearby schools including Cypress Elementary School, Sequoia Middle School, and Shasta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 23, 2003

Sold by

Palfini Richard and Palfini Dorothy

Bought by

Dudley Steve and Dudley Kim

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$64,932

Interest Rate

5.72%

Mortgage Type

VA

Estimated Equity

$230,866

Purchase Details

Closed on

Dec 7, 1999

Sold by

Palfini and D

Bought by

Palfini Richard and Palfini Dorothy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,600

Interest Rate

7.68%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dudley Steve | $144,000 | Fidelity National Title Co | |

| Palfini Richard | $52,500 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dudley Steve | $144,000 | |

| Previous Owner | Palfini Richard | $69,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,134 | $204,713 | $99,514 | $105,199 |

| 2024 | $2,101 | $200,700 | $97,563 | $103,137 |

| 2023 | $2,101 | $196,765 | $95,650 | $101,115 |

| 2022 | $2,066 | $192,908 | $93,775 | $99,133 |

| 2021 | $2,056 | $189,127 | $91,937 | $97,190 |

| 2020 | $2,083 | $187,189 | $90,995 | $96,194 |

| 2019 | $1,903 | $183,519 | $89,211 | $94,308 |

| 2018 | $1,702 | $160,000 | $65,000 | $95,000 |

| 2017 | $1,648 | $153,000 | $65,000 | $88,000 |

| 2016 | $1,595 | $150,000 | $65,000 | $85,000 |

| 2015 | $1,543 | $145,000 | $60,000 | $85,000 |

| 2014 | $1,507 | $140,000 | $55,000 | $85,000 |

Source: Public Records

Map

Nearby Homes

- 2429 Court St

- 2233 Vista Ave

- 2514 California St

- 2077 Skyline Dr

- 2405 Cliff Dr

- 2123 Waldon St

- 2381/2401 West St

- 2330 West St

- 1901 Chestnut St

- 3035 West St

- 1025 Parkview Ave

- 0 California St Unit 25-5331

- 864 Kite Ln

- 1621 Magnolia Ave

- 804 Kite Ln

- 3085 Seminole Dr

- 745 Parkview Ave

- 3443 West St

- 3244 Veda St

- 760 Locust St

- 2424 Court St

- 1850 Rosaline

- 2420 Court St

- 2425 West St

- 2417 West St

- 2410 Court St

- 2402 Court St

- 1870 Rosaline Ave

- 2402 Court 12

- 2405 West St

- 2405 W 1weup7o1l2hu

- 2409 West St

- 2460 Railroad Ave

- 2487 Court St

- 1803 Sheridan St

- 1791 Sheridan St

- 2391 Court

- 1950 Rosaline Ave Unit D

- 1950 Rosaline Ave

- 0 Court St