1831 Abbey Rd Unit 9A West Palm Beach, FL 33415

Abbey Park NeighborhoodEstimated Value: $257,754 - $272,000

2

Beds

2

Baths

1,073

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 1831 Abbey Rd Unit 9A, West Palm Beach, FL 33415 and is currently estimated at $264,939, approximately $246 per square foot. 1831 Abbey Rd Unit 9A is a home located in Palm Beach County with nearby schools including Forest Hill Elementary School, John I. Leonard High School, and L C Swain Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 10, 2014

Sold by

Werle Gary Albert

Bought by

Gaw Rentals Llc

Current Estimated Value

Purchase Details

Closed on

Apr 21, 2010

Sold by

Us Bank National Association

Bought by

Werle Gary Albert

Purchase Details

Closed on

Feb 18, 2010

Sold by

Kamin Jacob and Abbey Park Homeowners Associat

Bought by

Us Bank National Association

Purchase Details

Closed on

Nov 29, 2005

Sold by

Toohey David and Toohey Kim

Bought by

Kamin Jacob

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

6.1%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 12, 1997

Sold by

Tyner Samuel D

Bought by

Toohey David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$41,900

Interest Rate

7.98%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gaw Rentals Llc | -- | Attorney | |

| Werle Gary Albert | $48,500 | Servicelink | |

| Us Bank National Association | $20,500 | None Available | |

| Kamin Jacob | $185,000 | Universal Land Title Inc | |

| Toohey David | $44,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kamin Jacob | $175,750 | |

| Previous Owner | Toohey David | $41,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,749 | $178,537 | -- | -- |

| 2023 | $3,340 | $162,306 | $0 | $0 |

| 2022 | $3,146 | $147,551 | $0 | $0 |

| 2021 | $2,867 | $145,351 | $0 | $145,351 |

| 2020 | $2,714 | $140,351 | $0 | $140,351 |

| 2019 | $2,490 | $120,351 | $0 | $120,351 |

| 2018 | $2,132 | $107,288 | $0 | $107,288 |

| 2017 | $2,031 | $106,288 | $0 | $0 |

| 2016 | $1,823 | $83,288 | $0 | $0 |

| 2015 | $1,816 | $80,288 | $0 | $0 |

| 2014 | $1,151 | $43,217 | $0 | $0 |

Source: Public Records

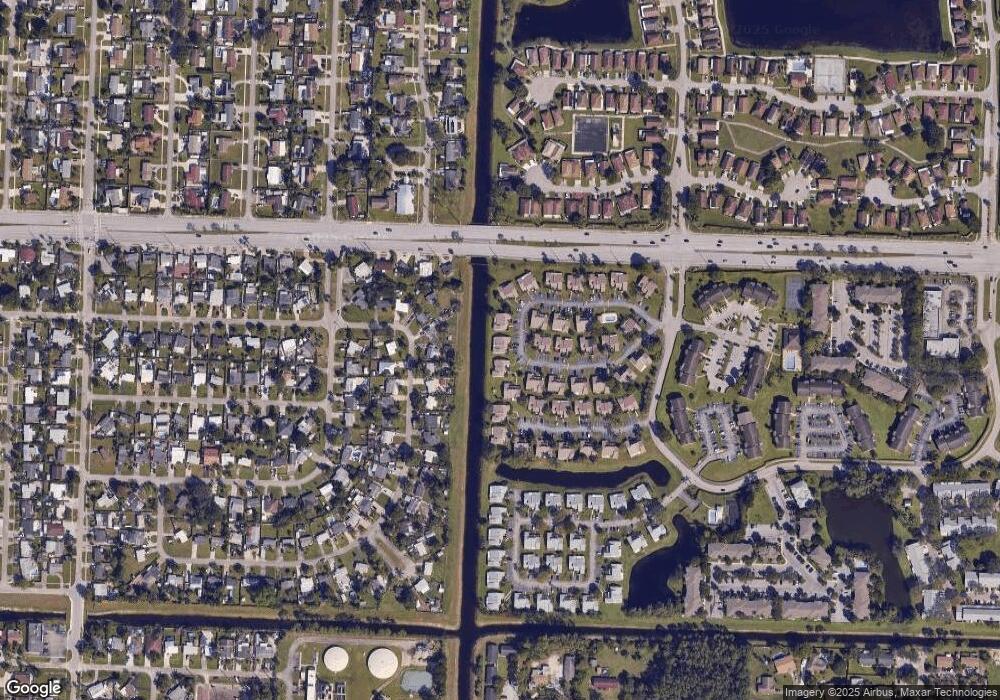

Map

Nearby Homes

- 1871 Abbey Rd Unit 19A

- 1763 Abbey Rd

- 1790 Abbey Rd Unit 104B

- 1970 Monks Ct

- 5642 Cinnamon Dr

- 5445 Mendoza St

- 1838 Abbey Rd Unit 208

- 1943 Iris Rd

- 2084 Laura Ln

- 1442 Summit Run Cir

- 5072 Pine Abbey Dr S

- 2117 E Bond Dr Unit 1

- 5894 Longbow Ln Unit 10

- 1865 W Chatham Rd

- 5975 Forest Hill Blvd Unit 101

- 4900 Pimlico Ct

- 1251 Summit Run Cir

- 5935 Forest Hill Blvd Unit 1

- 1527 Live Oak Dr

- 5954 Longbow Ln Unit 50

- 1829 Abbey Rd

- 1833 Abbey Rd Unit P-208

- 1833 Abbey Rd

- 1835 Abbey Rd Unit 10A

- 1827 Abbey Rd Unit A

- 1827 Abbey Rd

- 1825 Abbey Rd Unit 8B

- 1823 Abbey Rd

- 1837 Abbey Rd Unit 11A

- 1841 Abbey Rd Unit 12A

- 1839 Abbey Rd Unit 11B

- 1821 Abbey Rd Unit 35B

- 1789 Abbey Rd Unit 36A

- 1843 Abbey Rd Unit 12B

- 1791 Abbey Rd Unit 36B

- 1787 Abbey Rd Unit 7A

- 1819 Abbey Rd Unit 34A

- 1885 Abbey Rd

- 1785 Abbey Rd

- 1845 Abbey Rd Unit 13A