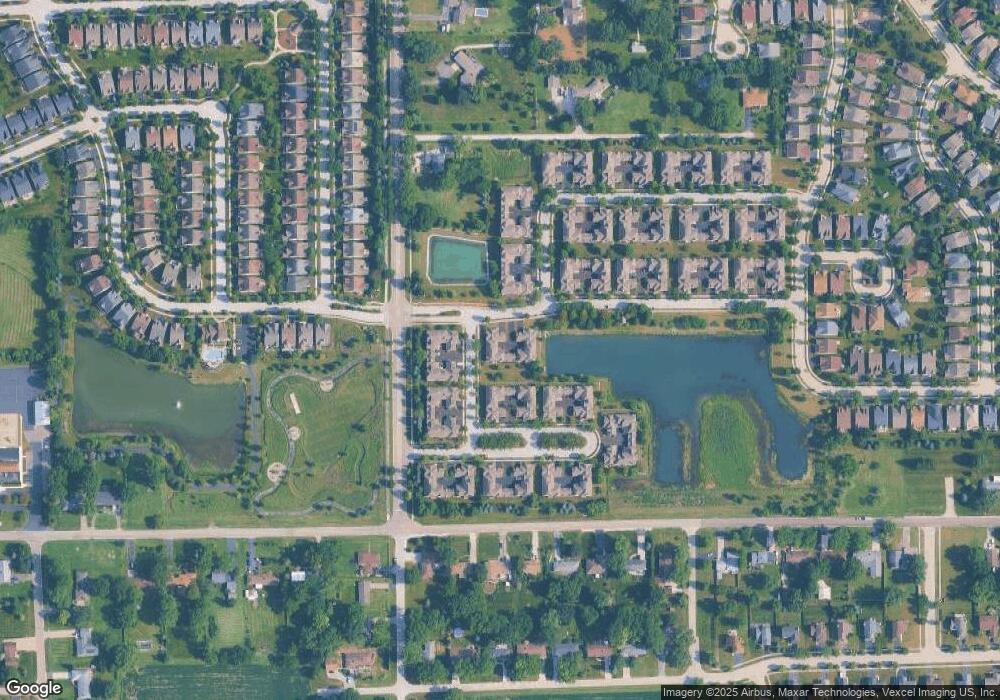

1835 Havenshire Rd Unit 94 Aurora, IL 60502

Indian Creek NeighborhoodEstimated Value: $311,000 - $333,000

2

Beds

2

Baths

1,636

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 1835 Havenshire Rd Unit 94, Aurora, IL 60502 and is currently estimated at $323,759, approximately $197 per square foot. 1835 Havenshire Rd Unit 94 is a home located in Kane County with nearby schools including Mabel O Donnell Elementary School, Simmons Middle School, and East Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2021

Sold by

Arriaga Oscar

Bought by

Declaration Of Revocable Living Trust and Arriaga

Current Estimated Value

Purchase Details

Closed on

Aug 17, 2021

Sold by

Slagle Scott and Betty S Jessen Declaration Of

Bought by

Arriaga Oscar

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Interest Rate

2.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 18, 2016

Sold by

Jessen Betty S

Bought by

Jessen Betty S and The Betty S Jessen Declaration Trust

Purchase Details

Closed on

Jun 26, 2008

Sold by

Stonegate West Carriage Homes Llc

Bought by

Jessen Betty S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Declaration Of Revocable Living Trust | -- | None Listed On Document | |

| Arriaga Oscar | $240,000 | Fidelity National Title | |

| Jessen Betty S | -- | None Available | |

| Jessen Betty S | $220,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Arriaga Oscar | $144,000 | |

| Previous Owner | Jessen Betty S | $165,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,275 | $99,538 | $14,669 | $84,869 |

| 2023 | $6,048 | $88,937 | $13,107 | $75,830 |

| 2022 | $5,710 | $81,147 | $11,959 | $69,188 |

| 2021 | $5,211 | $75,549 | $11,134 | $64,415 |

| 2020 | $5,751 | $80,155 | $10,342 | $69,813 |

| 2019 | $5,575 | $74,266 | $9,582 | $64,684 |

| 2018 | $3,283 | $69,269 | $8,863 | $60,406 |

| 2017 | $5,294 | $64,979 | $8,166 | $56,813 |

| 2016 | $4,920 | $57,755 | $7,593 | $50,162 |

| 2015 | -- | $50,436 | $6,529 | $43,907 |

| 2014 | -- | $47,051 | $6,279 | $40,772 |

| 2013 | -- | $47,226 | $6,190 | $41,036 |

Source: Public Records

Map

Nearby Homes

- 1771 Briarheath Dr

- 1176 Heathrow Ln

- 1148 Drury Ln

- 1129 Drury Ln

- 1671 Sheffer Rd

- 970 Waterside Ct

- 0000 N Farnsworth Ave

- 1425 Mcclure Rd Unit 10

- 1648 Mcclure Rd Unit 814

- Lot 1 Reckinger Rd

- 2420 Glenford Dr

- 2428 Ridgewood Ct

- 1008 Asbury Dr

- 1611 Indian Ave

- 2263 Reflections Dr Unit C1108

- 2279 Reflections Dr Unit 1208

- 2578 Crestview Dr

- 1147 Rural St Unit 41

- 1110 Oakhill Dr

- 973 Parkhill Cir Unit 973-B

- 1831 Havenshire Rd Unit 95

- 1831 Havenshire Rd Unit 1831

- 1831 Havenshire Rd Unit 92

- 1839 Havenshire Rd Unit 93

- 1843 Havenshire Rd Unit 92

- 1847 Havenshire Rd Unit 91

- 1827 Havenshire Rd Unit 96

- 1826 Foxridge Ct

- 1838 Foxridge Ct

- 1842 Foxridge Ct

- 1842 Foxridge Ct Unit 1842

- 1850 Foxridge Ct Unit 65

- 1830 Foxridge Ct

- 1834 Foxridge Ct

- 1830 Foxridge Ct Unit 1830

- 1812 Chase Ln Unit 103

- 1808 Chase Ln Unit 102

- 1846 Foxridge Ct

- 1896 Chase Ln Unit 136

- 1904 Chase Ln Unit 142