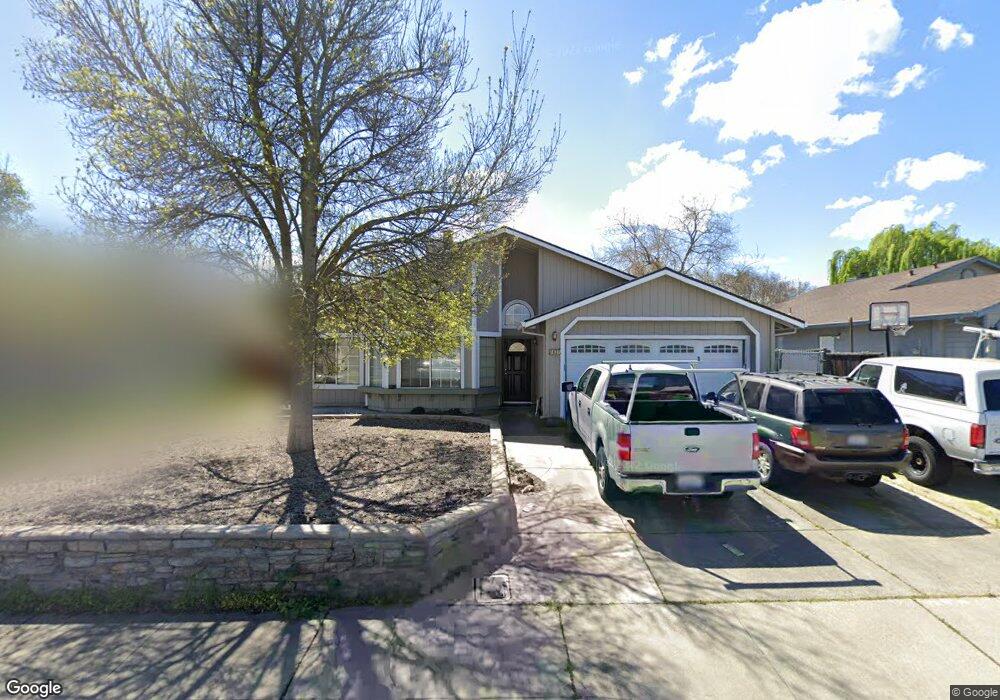

1837 Locke Ct Oakley, CA 94561

South Oakley NeighborhoodEstimated Value: $583,757 - $639,000

3

Beds

2

Baths

1,571

Sq Ft

$386/Sq Ft

Est. Value

About This Home

This home is located at 1837 Locke Ct, Oakley, CA 94561 and is currently estimated at $605,939, approximately $385 per square foot. 1837 Locke Ct is a home located in Contra Costa County with nearby schools including Laurel Elementary School, O'Hara Park Middle School, and Freedom High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 7, 2024

Sold by

Frambes Darrell N

Bought by

Darrell N Frambes Living Trust and Frambes

Current Estimated Value

Purchase Details

Closed on

Nov 16, 2011

Sold by

Castillo Brian and Ramos Juan P

Bought by

Frambes Darrell N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,969

Interest Rate

3.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 9, 2006

Sold by

Gordon Larry R and Gordon Holly Dee

Bought by

Castillo Brian and Ramos Juan P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$470,500

Interest Rate

6.55%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 25, 1999

Sold by

Ruth Adams Carol

Bought by

Gordon Larry R and Gordon Holly Dee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,844

Interest Rate

6.9%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Darrell N Frambes Living Trust | -- | None Listed On Document | |

| Frambes Darrell N | $159,000 | Fidelity National Title Co | |

| Castillo Brian | $470,500 | Chicago Title Co | |

| Gordon Larry R | $174,000 | North American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Frambes Darrell N | $154,969 | |

| Previous Owner | Castillo Brian | $470,500 | |

| Previous Owner | Gordon Larry R | $172,844 | |

| Closed | Gordon Larry R | $8,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,221 | $199,700 | $43,956 | $155,744 |

| 2024 | $3,192 | $195,786 | $43,095 | $152,691 |

| 2023 | $3,192 | $191,948 | $42,250 | $149,698 |

| 2022 | $3,171 | $188,185 | $41,422 | $146,763 |

| 2021 | $3,107 | $184,496 | $40,610 | $143,886 |

| 2019 | $2,868 | $179,025 | $39,406 | $139,619 |

| 2018 | $2,805 | $175,516 | $38,634 | $136,882 |

| 2017 | $2,785 | $172,076 | $37,877 | $134,199 |

| 2016 | $2,653 | $168,703 | $37,135 | $131,568 |

| 2015 | $2,668 | $166,170 | $36,578 | $129,592 |

| 2014 | $2,633 | $162,916 | $35,862 | $127,054 |

Source: Public Records

Map

Nearby Homes

- 0 Empire Ave Unit 41111855

- 0 Empire Ave Unit 41097524

- 80 Mandeville Ct

- 2107 Chicory Dr

- 2118 Connie Ln

- 151 Bedford Ln

- 4334 Redwood Dr

- 1541 Larkspur Ct

- 11 Pinenut Ct

- 512 Whitehall Ct

- 1450 Gamay Cir

- 1916 Gamay Dr

- 2019 Verona Ct

- 881 Chianti Way

- 204 Chaps Ct

- 1430 Carpenter Rd

- 4901 Beldin Ln

- 2085 Springbrook Ct

- 4014 Kenwood Cir

- 50 Safflower Ct

- 1833 Locke Ct

- 1841 Locke Ct

- 4097 Sequoia Dr

- 1829 Locke Ct

- 4095 Sequoia Dr

- 4105 Sequoia Dr

- 1838 Locke Ct

- 1834 Locke Ct

- 1842 Locke Ct

- 1825 Locke Ct

- 1830 Locke Ct

- 4109 Sequoia Dr

- 4086 Courtland Dr

- 4082 Courtland Dr

- 4090 Courtland Dr

- 4078 Courtland Dr

- 1826 Locke Ct

- 1821 Locke Ct

- 21 Courtland Ct

- 4094 Courtland Dr