1856 Cherokee Dr Unit 3 Salinas, CA 93906

Northridge NeighborhoodEstimated Value: $584,834 - $605,000

3

Beds

4

Baths

1,621

Sq Ft

$367/Sq Ft

Est. Value

About This Home

This home is located at 1856 Cherokee Dr Unit 3, Salinas, CA 93906 and is currently estimated at $595,459, approximately $367 per square foot. 1856 Cherokee Dr Unit 3 is a home located in Monterey County with nearby schools including Henry F. Kammann Elementary School, Boronda Meadows Elementary School, and Harden Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2025

Sold by

Martinez Ralph A and Martinez Ana L

Bought by

Ralph And Ana Martinez Trust and Martinez

Current Estimated Value

Purchase Details

Closed on

Dec 31, 2024

Sold by

Gutierrez Miguel Obregon and Marron Ana

Bought by

Martinez Ralph A and Martinez Ana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,000

Interest Rate

6.81%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 12, 2019

Sold by

Bracco Dana R

Bought by

Gutierrez Miguel O and Gutierrez Ana M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Interest Rate

4.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 18, 1998

Sold by

Bond Barbara L

Bought by

Bracco Dana R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,075

Interest Rate

6.91%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ralph And Ana Martinez Trust | -- | None Listed On Document | |

| Martinez Ralph A | $580,000 | Chicago Title | |

| Martinez Ralph A | $580,000 | Chicago Title | |

| Gutierrez Miguel O | $365,000 | Chicago Title Co | |

| Bracco Dana R | $151,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Martinez Ralph A | $435,000 | |

| Previous Owner | Gutierrez Miguel O | $215,000 | |

| Previous Owner | Bracco Dana R | $147,075 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,677 | $407,159 | $217,524 | $189,635 |

| 2024 | $4,677 | $399,176 | $213,259 | $185,917 |

| 2023 | $4,520 | $391,350 | $209,078 | $182,272 |

| 2022 | $4,351 | $383,678 | $204,979 | $178,699 |

| 2021 | $4,180 | $376,156 | $200,960 | $175,196 |

| 2020 | $4,064 | $372,300 | $198,900 | $173,400 |

| 2019 | $2,362 | $212,205 | $49,183 | $163,022 |

| 2018 | $2,333 | $208,045 | $48,219 | $159,826 |

| 2017 | $2,335 | $203,967 | $47,274 | $156,693 |

| 2016 | $2,337 | $199,969 | $46,348 | $153,621 |

| 2015 | $2,357 | $196,966 | $45,652 | $151,314 |

| 2014 | $2,200 | $193,108 | $44,758 | $148,350 |

Source: Public Records

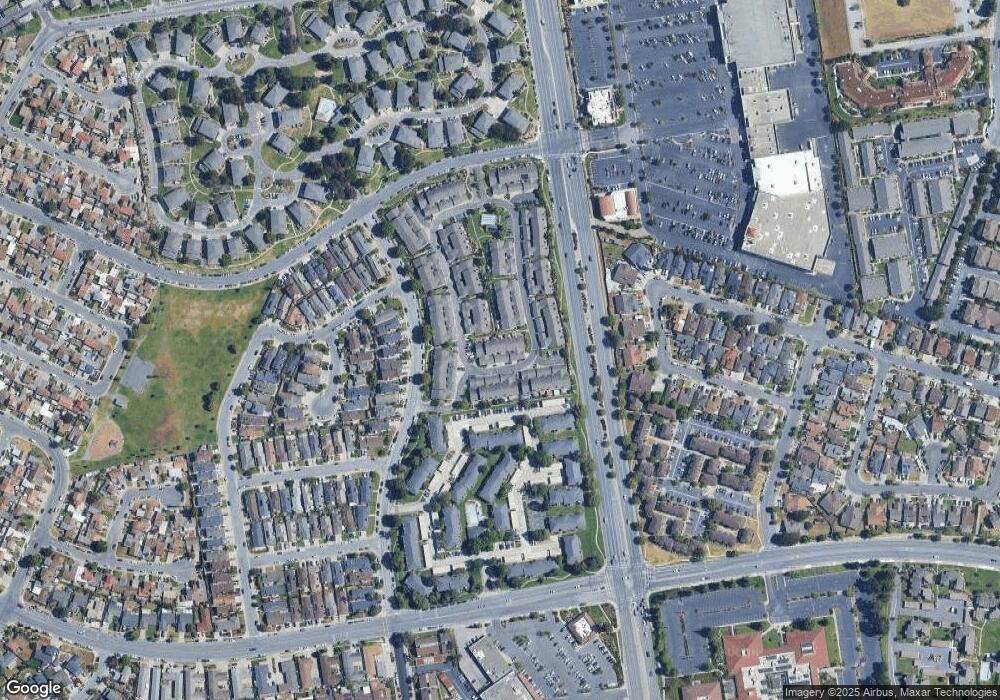

Map

Nearby Homes

- 730 N Main St

- 1712 Madrid Cir

- 1515 Aragon Cir

- 1588 Cherokee Dr

- 1588 Duran St

- 1518 Duran Cir

- 1520 Ebro Cir

- 530 Inca Way

- 233 Montclair Ln

- 344 Pueblo Dr

- 1829 Delancey Dr

- 1823 Broadway Dr

- 276 Noice Dr

- 336 Rainier Dr

- 55 San Juan Grade Rd Unit 79

- 55 San Juan Grade Rd Unit 18

- 55 San Juan Grade Rd Unit 63

- 1445 Amador Cir

- 323 Chaparral St

- 1421 Amador Cir

- 1856 Cherokee Dr Unit 6

- 1856 Cherokee Dr Unit 4

- 1856 Cherokee Dr Unit 3

- 1856 Cherokee Dr Unit 2

- 1856 Cherokee Dr Unit 1

- 1844 Cherokee Dr Unit 1

- 1844 Cherokee Dr Unit 2

- 1844 Cherokee Dr Unit 3

- 1836 Cherokee Dr Unit 3

- 1836 Cherokee Dr Unit 4

- 1836 Cherokee Dr Unit 1

- 1836 Cherokee Dr Unit 2

- 1836 Cherokee Dr Unit 3

- 1852 Cherokee Dr Unit 2

- 1852 Cherokee Dr Unit 6

- 1852 Cherokee Dr Unit 4

- 1852 Cherokee Dr Unit 3

- 1852 Cherokee Dr Unit 2

- 1848 Cherokee Dr Unit 5

- 1848 Cherokee Dr Unit 1

Your Personal Tour Guide

Ask me questions while you tour the home.