Estimated Value: $863,325 - $1,023,000

Studio

4

Baths

2,810

Sq Ft

$332/Sq Ft

Est. Value

About This Home

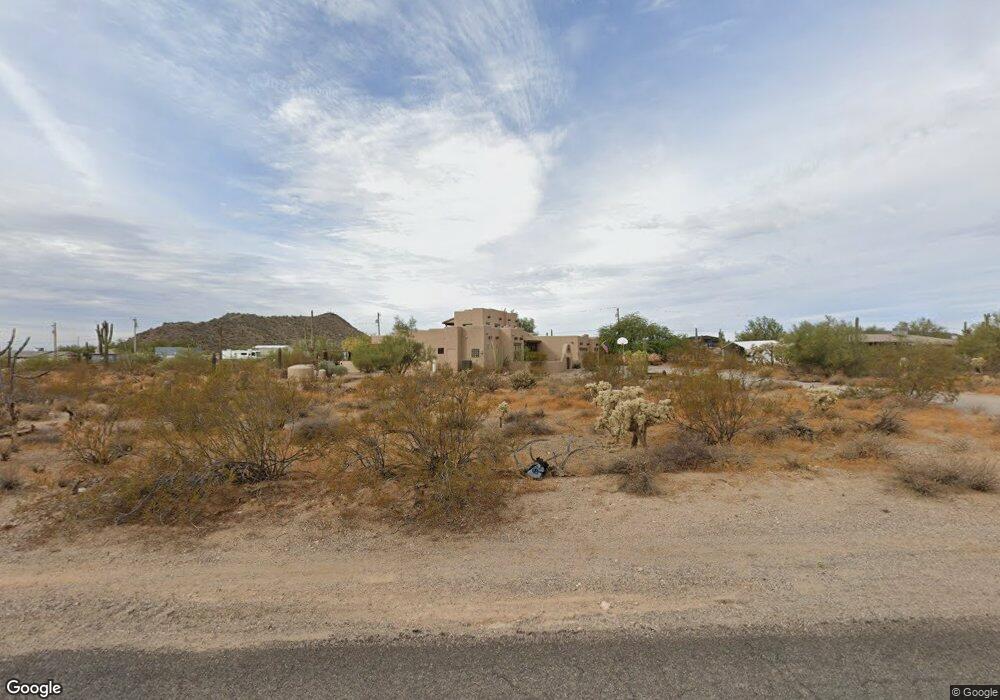

This home is located at 1858 N 103rd St, Mesa, AZ 85207 and is currently estimated at $932,581, approximately $331 per square foot. 1858 N 103rd St is a home located in Maricopa County with nearby schools including Franklin at Brimhall Elementary School, Zaharis Elementary School, and Franklin West Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2022

Sold by

Kosisky Daniel E

Bought by

Dan And Nancy Kosisky Trust

Current Estimated Value

Purchase Details

Closed on

Feb 25, 2021

Sold by

Kosisky Daniel E and Kosisky Nancy A

Bought by

Kosisky Daniel E and Kosisky Nancy A

Purchase Details

Closed on

Feb 5, 2021

Sold by

Kosisky Daniel E and Kosisky Nancy A

Bought by

Kosisky Kevin D and Kosisky Annie M

Purchase Details

Closed on

Nov 30, 1998

Sold by

Cork Marcella Shemer and Barry Shemer W

Bought by

Cork Marcella Shemer and Barry Shemer W

Purchase Details

Closed on

Sep 30, 1998

Sold by

Shemer W Barry and Shemer Marcella A

Bought by

Cork Marcella A Shemer

Purchase Details

Closed on

Jan 4, 1998

Sold by

Cork Marcella Shemer and Barry Shemer W

Bought by

Kosisky Daniel E and Kosisky Nancy A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dan And Nancy Kosisky Trust | -- | Winsor Law Firm Plc | |

| Kosisky Daniel E | -- | None Listed On Document | |

| Kosisky Kevin D | -- | None Available | |

| Cork Marcella Shemer | -- | -- | |

| Cork Marcella A Shemer | -- | -- | |

| Kosisky Daniel E | $36,500 | Stewart Title & Trust |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,719 | $36,518 | -- | -- |

| 2024 | $2,781 | $34,779 | -- | -- |

| 2023 | $2,781 | $63,620 | $12,720 | $50,900 |

| 2022 | $2,710 | $47,380 | $9,470 | $37,910 |

| 2021 | $2,740 | $44,070 | $8,810 | $35,260 |

| 2020 | $2,720 | $39,520 | $7,900 | $31,620 |

| 2019 | $2,492 | $36,920 | $7,380 | $29,540 |

| 2018 | $2,424 | $34,970 | $6,990 | $27,980 |

| 2017 | $2,333 | $33,630 | $6,720 | $26,910 |

| 2016 | $2,284 | $34,580 | $6,910 | $27,670 |

Source: Public Records

Map

Nearby Homes

- 1911 N 103rd St

- 1721 N Berrett

- 9915 E Jensen St

- 9762 E Inglewood Cir

- 1241 N 102nd St

- 9545 E Kenwood Cir

- 415 N Crismon Rd

- 9747 E Greenway St

- 9661 E Glencove Cir

- 2223 N Azurite

- 1428 N Leandro Cir

- 2453 N Travis

- 9310 E Mclellan Rd

- 10517 E Evergreen St

- 10662 E Ensenada St

- 9326 E Princess Dr

- 1105 N 110th St

- 950 N 97th St

- 2441 N Cabot Cir

- 9155 E Leonora St

- 1910 N 103rd St

- 0 E 103rd St

- 1824 N 103rd St

- 1846 N 102nd Place

- 0 N 103rd St --

- 1858 N 102nd Place

- 1926 N 102nd Place

- 10212 E Jensen Rd

- 10336 E Jensen Rd

- 1942 N 103rd St

- 1919 N 103rd St

- 1909 N 103rd St

- 1909 N 103rd St

- 0 E Jensen St Unit 220-02-010-C 6407083

- 10130 E Jensen Rd

- 10130 E Jensen St

- 10204 E Jensen St

- 10344 E Jensen St

- 10331 E Mckellips Rd

- 1933 N 103rd St