1863 Cherokee Dr Unit 1 Salinas, CA 93906

Northridge NeighborhoodEstimated Value: $350,294 - $474,000

2

Beds

2

Baths

875

Sq Ft

$455/Sq Ft

Est. Value

About This Home

This home is located at 1863 Cherokee Dr Unit 1, Salinas, CA 93906 and is currently estimated at $397,824, approximately $454 per square foot. 1863 Cherokee Dr Unit 1 is a home located in Monterey County with nearby schools including Henry F. Kammann Elementary School, Boronda Meadows Elementary School, and Harden Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2013

Sold by

Arias Elizabeth

Bought by

Arias Elizabeth

Current Estimated Value

Purchase Details

Closed on

Oct 15, 2013

Sold by

Arias Edward D and Leach Beatrice

Bought by

Arias Elizabeth

Purchase Details

Closed on

Feb 1, 2010

Sold by

Arias Edward S and Arias Sophie O

Bought by

Arias Edward S and Arias Sophie O

Purchase Details

Closed on

Sep 11, 1998

Sold by

Russell Richard M

Bought by

Arias Eddie S and Arias Sophie O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Outstanding Balance

$15,367

Interest Rate

6.89%

Estimated Equity

$382,457

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Arias Elizabeth | -- | None Available | |

| Arias Elizabeth | -- | None Available | |

| Arias Edward D | -- | None Available | |

| Arias Edward S | -- | None Available | |

| Arias Eddie S | $90,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Arias Eddie S | $72,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,155 | $104,659 | $49,250 | $55,409 |

| 2024 | $1,155 | $102,608 | $48,285 | $54,323 |

| 2023 | $1,116 | $100,597 | $47,339 | $53,258 |

| 2022 | $1,073 | $98,625 | $46,411 | $52,214 |

| 2021 | $1,030 | $96,692 | $45,501 | $51,191 |

| 2020 | $1,001 | $95,702 | $45,035 | $50,667 |

| 2019 | $991 | $93,826 | $44,152 | $49,674 |

| 2018 | $976 | $91,987 | $43,287 | $48,700 |

| 2017 | $976 | $90,185 | $42,439 | $47,746 |

| 2016 | $974 | $88,417 | $41,607 | $46,810 |

| 2015 | $981 | $87,090 | $40,983 | $46,107 |

| 2014 | $916 | $85,385 | $40,181 | $45,204 |

Source: Public Records

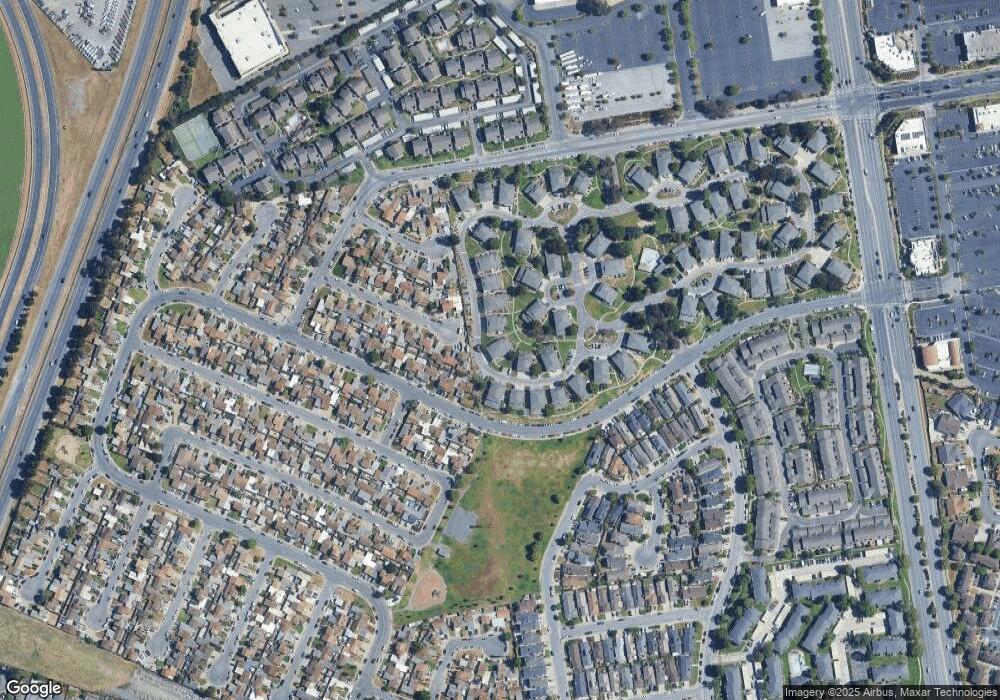

Map

Nearby Homes

- 1861 Cherokee Dr Unit 1

- 1575 Sepulveda Dr

- 1840 Cherokee Dr Unit 2

- 1634 Cuevas Cir Unit 5

- 1690 Cherokee Dr

- 1588 Cherokee Dr

- 1518 Duran Cir

- 730 N Main St

- 216 Crescent Way

- 129 Rodeo Ave

- 1823 Broadway Dr

- 1865 Delancey Dr

- 55 San Juan Grade Rd Unit 96

- 55 San Juan Grade Rd Unit 85

- 213 Montclair Ln

- 336 Rainier Dr

- 1880 Gamay Way

- 417 Tyler Place Unit I

- 225 Loma Dr

- 1117 Baldwin St Unit 6

- 1863 Cherokee Dr Unit 3

- 1863 Cherokee Dr Unit 4

- 1863 Cherokee Dr Unit 3

- 1863 Cherokee Dr Unit 2

- 1861 Cherokee Dr Unit 4

- 1861 Cherokee Dr Unit 2

- 1861 Cherokee Dr Unit 4

- 1861 Cherokee Dr Unit 3

- 1857 Cherokee Dr Unit 3

- 1857 Cherokee Dr Unit 4

- 1857 Cherokee Dr Unit 3

- 1857 Cherokee Dr Unit 2

- 1857 Cherokee Dr Unit 1

- 1869 Cherokee Dr Unit 3

- 1869 Cherokee Dr Unit 2

- 1869 Cherokee Dr Unit 4

- 1869 Cherokee Dr Unit 3

- 1869 Cherokee Dr Unit 1

- 1748 Madrid Cir

- 1887 Cherokee Dr Unit 4