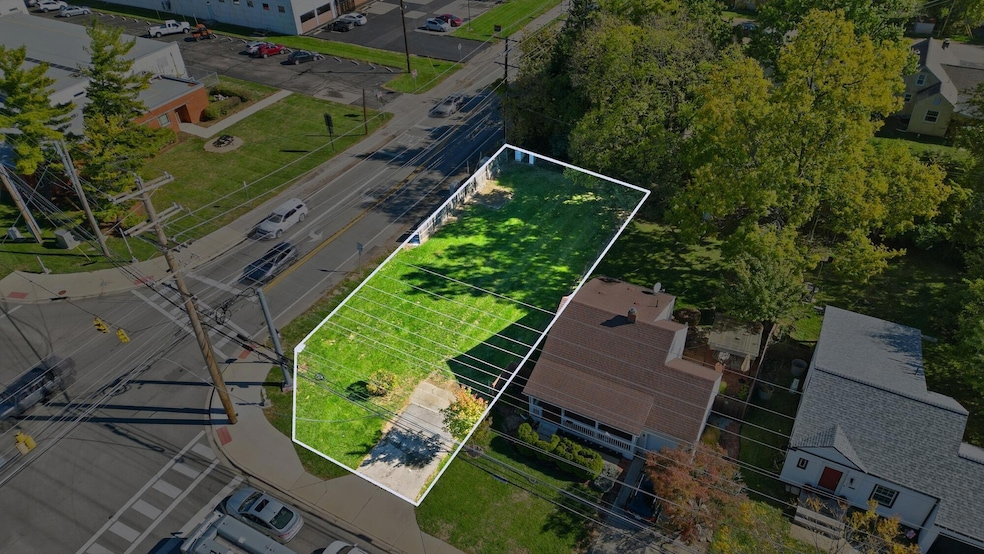

1878 Kenny Rd Columbus, OH 43212

Tri-Village NeighborhoodEstimated payment $1,048/month

About This Lot

Prime investment opportunity in the highly desirable University View neighborhood to build a new house! Zoned R8 with potential conditional approval for two townhouse apartments.

The location provides unbeatable proximity to OSU, UA, Grandview and the upcoming Carmenton District- a hub for innovation, healthcare and research that is poised to further demand in the area. For a possible rental property, the proximity to OSU ensures year-round rental strength, with demand driven professionals, graduate students, and medical staff. Community offers a park, inc a playground, tennis courts, baseketball court, and shelter house. This idyllic Post War community was built through a joint venture between HUD and the OSU School of Architecture to house veterans and their families as they attended OSU through the GI bills.

Property Details

Property Type

- Land

Est. Annual Taxes

- $2,138

Lot Details

- 6,970 Sq Ft Lot

Listing and Financial Details

- Assessor Parcel Number 130-001681

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,138 | $36,300 | $36,300 | -- |

| 2023 | $2,115 | $36,295 | $36,295 | $0 |

| 2022 | $2,428 | $32,620 | $32,620 | $0 |

| 2021 | $2,431 | $32,620 | $32,620 | $0 |

| 2020 | $2,457 | $32,620 | $32,620 | $0 |

| 2019 | $4,967 | $61,460 | $32,620 | $28,840 |

| 2018 | $4,422 | $61,460 | $32,620 | $28,840 |

| 2017 | $4,697 | $61,460 | $32,620 | $28,840 |

| 2016 | $4,433 | $49,600 | $21,070 | $28,530 |

| 2015 | $3,882 | $49,600 | $21,070 | $28,530 |

| 2014 | $3,888 | $49,600 | $21,070 | $28,530 |

| 2013 | $1,817 | $47,215 | $20,055 | $27,160 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 10/27/2025 10/27/25 | For Sale | $165,000 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Corporate Deed | -- | Principle T | |

| Survivorship Deed | $95,000 | Chicago Title | |

| Warranty Deed | $85,000 | Esquire Title | |

| Deed | -- | -- | |

| Deed | $36,000 | -- |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $72,250 | Purchase Money Mortgage |

Source: Columbus and Central Ohio Regional MLS

MLS Number: 225040729

APN: 130-001681

- 1060 Sells Ave Unit 104

- 945 Chambers Rd

- 1126 King Ave Unit 128

- 1395 Upper Green Cir Unit 1395

- 1398 Lower Green Cir Unit 1398

- 00 W 7th Ave

- 1364 W 7th Ave

- 1825 Northwest Ct Unit D

- 1488 Essex Rd

- 1481 Doone Rd

- 1470 Cardiff Rd

- 1297 Doten Ave

- 1095 W 3rd Ave

- 1093 W 3rd Ave

- 1242 Oxley Rd

- 1083 W 3rd Ave

- 1240 Oxley Rd

- 1535 Doone Rd

- 1661 Ashland Ave Unit 663

- 1655-1657 Ashland Ave

- 1858 Kenny Rd

- 1813 Kenny Rd Unit 1809

- 1809-1813 Kenny Rd

- 858 Kinnear Rd

- 878 W 10th Ave

- 1751 Kenny Rd

- 887 W 10th Ave

- 1150 Kinnear Rd

- 1134 Chambers Rd

- 1648 Kenny Rd

- 1234 Steelwood Rd

- 1190 Chambers Rd

- 1211 Chambers Rd

- 1656-1662 Northwest Blvd

- 1550 Kenny Rd

- 1361 Presidential Dr

- 1295 Chesapeake Ave

- 900 Nettle Dr

- 1303-1307 King Ave

- 1350 King Ave Unit 105