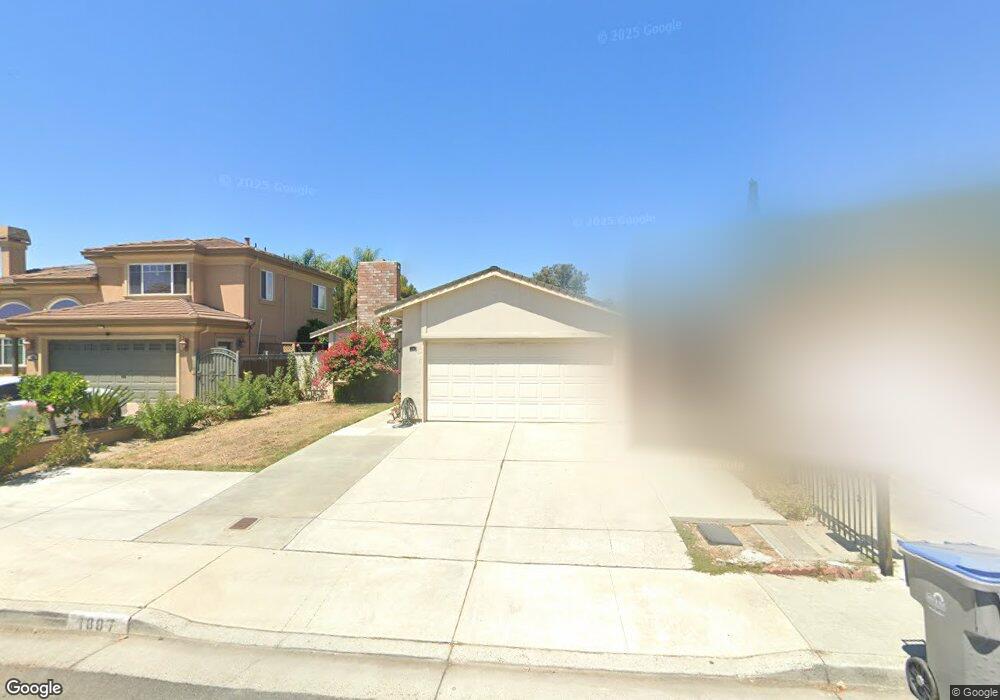

1887 Diamente Ct San Jose, CA 95116

Checkers NeighborhoodEstimated Value: $1,121,000 - $1,234,000

5

Beds

3

Baths

1,005

Sq Ft

$1,175/Sq Ft

Est. Value

About This Home

This home is located at 1887 Diamente Ct, San Jose, CA 95116 and is currently estimated at $1,180,808, approximately $1,174 per square foot. 1887 Diamente Ct is a home located in Santa Clara County with nearby schools including San Antonio Elementary School, Independence High School, and Rocketship Fuerza Community Prep.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 1, 2024

Sold by

Gorgonio Laodicea A

Bought by

2023 Laodicea A Gorgonio Irrevocable Trust and Gorgonio

Current Estimated Value

Purchase Details

Closed on

Dec 6, 2004

Sold by

Gorgonio Mary Jane G and Gorgonio Abemael A

Bought by

Gorgonio Laodicea A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

5.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 4, 2002

Sold by

Gorgonio Laodicea A and Gorgonio Dan A

Bought by

Gorgonio Laodicea A and Gorgonio Abemael A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Interest Rate

6.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 2023 Laodicea A Gorgonio Irrevocable Trust | -- | None Listed On Document | |

| Gorgonio Laodicea A | -- | Alliance Title Company | |

| Gorgonio Laodicea A | -- | Alliance Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gorgonio Laodicea A | $300,000 | |

| Previous Owner | Gorgonio Laodicea A | $235,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,246 | $682,754 | $408,566 | $274,188 |

| 2024 | $10,246 | $669,367 | $400,555 | $268,812 |

| 2023 | $10,047 | $656,243 | $392,701 | $263,542 |

| 2022 | $9,853 | $643,376 | $385,001 | $258,375 |

| 2021 | $9,519 | $630,761 | $377,452 | $253,309 |

| 2020 | $9,342 | $624,294 | $373,582 | $250,712 |

| 2019 | $9,088 | $612,054 | $366,257 | $245,797 |

| 2018 | $8,972 | $600,054 | $359,076 | $240,978 |

| 2017 | $9,009 | $588,289 | $352,036 | $236,253 |

| 2016 | $8,499 | $576,755 | $345,134 | $231,621 |

| 2015 | $8,498 | $568,092 | $339,950 | $228,142 |

| 2014 | $7,081 | $489,500 | $292,900 | $196,600 |

Source: Public Records

Map

Nearby Homes

- 295 Esmeralda Ct

- 1715 Calle de Plata

- 1826 Perrone Cir

- 125 Magellan Ave

- 67 Silcreek Dr

- 1816 Luby Dr Unit 46

- 264 N 34th St

- 88 N Jackson Ave Unit 322

- 88 N Jackson Ave Unit 105

- 86 Eastwood Ct

- 2177 Alum Rock Ave Unit 112

- 210 Damsen Dr Unit 22

- 230 Montclair Ave

- 76 Sunset Ct

- 127 Schott St

- 1622 Perry Ct

- 1565 E Saint James St

- 64 Via de Guadalupe

- 171 S Sunset Ave

- 1889 Sable Place

- 1893 Diamente Ct

- 1881 Diamente Ct

- 1875 Diamente Ct

- 286 Esmeralda Ct

- 1888 Diamente Ct

- 1894 Diamente Ct

- 292 Esmeralda Ct

- 1882 Diamente Ct

- 280 Esmeralda Ct

- 274 Esmeralda Ct

- 1876 Diamente Ct

- 268 Esmeralda Ct

- 296 Esmeralda Ct

- 262 Esmeralda Ct

- 1885 Avenida de Cobre

- 1891 Avenida de Cobre

- 256 Esmeralda Ct

- 1879 Avenida de Cobre

- 1873 Avenida de Cobre

- 250 Esmeralda Ct